Krystal Biotech Inc (KRYS) Reports Strong Q4 and Full Year 2023 Financial Results

Net Product Revenue: $42.1M in Q4 and $50.7M for the full year 2023.

Balance Sheet Strength: Closed the year with $594.1M in cash and investments.

Commercial Success: VYJUVEK U.S. launch mirrors trajectories of top rare disease launches.

Regulatory Milestones: Received permanent J-code for VYJUVEK and Orphan Drug Designation in Japan for B-VEC.

Research and Development: R&D expenses at $11.4M in Q4; $46.4M for the full year.

Profitability: Net income of $8.7M in Q4; $10.9M for the full year 2023.

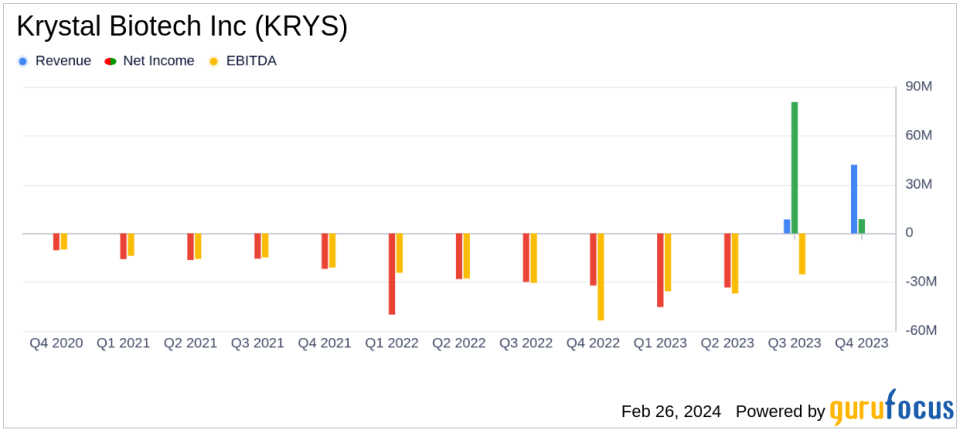

On February 26, 2024, Krystal Biotech Inc (NASDAQ:KRYS), a leader in redosable gene therapies for treating rare diseases, announced its financial results for the fourth quarter and full year of 2023. The company's 8-K filing reveals significant revenue growth, driven by the successful commercial launch of VYJUVEK, the first FDA-approved therapy for dystrophic epidermolysis bullosa (DEB).

Company Overview

Krystal Biotech Inc is at the forefront of the healthcare sector in the United States, dedicated to developing innovative gene therapies for patients with debilitating diseases. Utilizing its proprietary STAR-D gene therapy platform, Krystal Biotech has developed treatments for rare dermatological conditions and plans to expand its pipeline to address additional dermatological indications.

Financial Performance and Challenges

The company's financial achievements in 2023 include a net product revenue of $42.1 million in the fourth quarter and $50.7 million for the full year. This performance is particularly noteworthy for a biotechnology company like Krystal Biotech, where product revenue is critical for sustaining research and development efforts. The high gross margin of 93% in the fourth quarter underscores the company's ability to manage production costs effectively.

However, challenges remain as the company continues to invest in research and development, with expenses totaling $11.4 million in Q4 and $46.4 million for the full year. These investments are essential for advancing Krystal Biotech's clinical pipeline and maintaining its leadership in redosable gene therapy.

Key Financial Metrics

Important metrics from the financial statements include:

"The Company recorded net product revenue of $42.1 million from sales of VYJUVEK during the quarter ended December 31, 2023."

"Cash, cash equivalents, and investments totaled $594.1 million on December 31, 2023."

"Net income (loss) for the quarters ended December 31, 2023 and 2022 was $8.7 million and $(32.1) million, respectively."

These metrics are crucial as they reflect the company's ability to generate revenue from its flagship product, maintain a strong cash position to fund operations, and achieve profitability, which is significant for a biotechnology firm in its commercial stage.

Financial Tables Summary

Financial Aspect | Q4 2023 | Full Year 2023 |

|---|---|---|

Net Product Revenue | $42.1M | $50.7M |

Cash and Investments | $594.1M | |

Net Income | $8.7M | $10.9M |

Company's Performance Analysis

Krystal Biotech's performance in 2023 demonstrates a significant turnaround, with a net income of $10.9 million for the year, compared to a net loss of $140.0 million in 2022. The company's strategic focus on commercializing VYJUVEK and advancing its clinical pipeline has yielded positive results, positioning it for continued growth and expansion into new markets.

The company's strong balance sheet, with $594.1 million in cash and investments, provides the financial flexibility to support ongoing research and development initiatives and potential commercial expansion. The successful commercial trajectory of VYJUVEK, reflected in the high patient and physician demand, broad access, and high compliance rates, underscores the product's market potential and the company's commercial capabilities.

Looking ahead, Krystal Biotech's alignment with the FDA on the approval of B-VEC eyedrop formulation and the anticipated decisions on B-VEC in the EU and Japan in the second half of 2024 and 2025, respectively, signal further growth opportunities. The company's commitment to advancing its clinical pipeline, as evidenced by the initiation of five active clinical trials in 2024, positions it well for future success.

For a more detailed analysis of Krystal Biotech Inc (NASDAQ:KRYS)'s financial results and business updates, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Krystal Biotech Inc for further details.

This article first appeared on GuruFocus.