Kulicke & Soffa Industries Inc (KLIC) Reports Decline in Q1 2024 Earnings Amid Market Weakness

Net Revenue: $171.2 million, a decrease of 2.9% from Q1 2023.

Gross Margin: Down to 46.7%, a decrease of 360 basis points year-over-year.

Net Income: Reported at $9.3 million, down 36.3% from the same quarter last year.

Earnings Per Share (EPS): GAAP EPS at $0.16, a decrease of 36% year-over-year; non-GAAP EPS at $0.30.

Free Cash Flow: Adjusted free cash flow was negative $(11.8) million.

Share Repurchase: Repurchased 0.6 million shares at a cost of $26.8 million.

Q2 Outlook: Expects net revenue around $170 million and EPS approximately $0.13 on a GAAP basis.

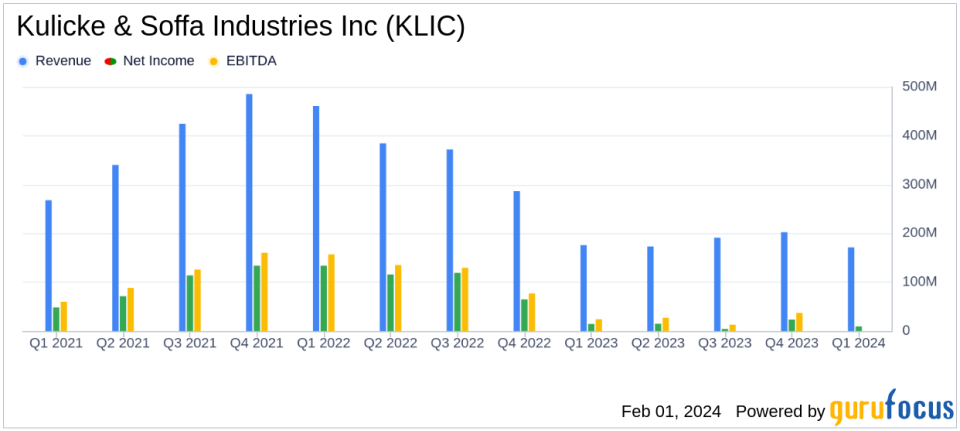

Kulicke & Soffa Industries Inc (NASDAQ:KLIC) released its 8-K filing on January 31, 2024, detailing its financial performance for the first fiscal quarter ended December 30, 2023. The company, a leader in semiconductor assembly equipment, reported a slight decline in net revenue to $171.2 million, a 2.9% decrease from the first quarter of the previous fiscal year. This downturn reflects broader industry challenges, including weakness in the Automotive and Power Semiconductor sectors.

Financial Performance and Market Challenges

Kulicke & Soffa's gross margin also experienced a decline, dropping to 46.7%, which is a 360 basis point decrease compared to the same quarter last year. The company's income from operations plummeted by 85.7% year-over-year to $1.7 million, with operating margin at a mere 1.0%. Net income fell to $9.3 million, a 36.3% decrease from Q1 2023, resulting in a diluted EPS of $0.16. The non-GAAP net income stood at $17.0 million, with a non-GAAP EPS of $0.30.

Despite these challenges, Kulicke & Soffa emphasized its ongoing progress in company-specific growth opportunities, particularly in Advanced Packaging, Advanced Display, and Advanced Dispense. Fusen Chen, the company's President and CEO, commented on the outlook, stating:

"While Automotive and Power Semiconductor weakness has impacted the industry, as well as our fiscal Q2 outlook, we anticipate semiconductor unit growth will return to a more normal growth rate later this fiscal year. As the market growth returns, we anticipate reaching new milestones across our specific K&S opportunities within Advanced Packaging, Advanced Display and Advanced Dispense."

Strategic Financial Moves

The company's strategic financial activities included an increase in share repurchase activity, with 0.6 million shares bought back at a cost of $26.8 million. This move reflects the company's confidence in its long-term value despite the current market downturn. Kulicke & Soffa's balance sheet remains robust, with cash, cash equivalents, and short-term investments totaling $709.7 million as of December 30, 2023.

Looking ahead to the second quarter of fiscal 2024, Kulicke & Soffa expects net revenue to be approximately $170 million, with GAAP diluted EPS at about $0.13 and non-GAAP diluted EPS around $0.25. These projections take into account the current market conditions and the company's strategic initiatives.

For value investors, the company's strong balance sheet, ongoing share repurchases, and focus on growth opportunities in emerging technology areas may present a compelling case for long-term investment, despite short-term industry headwinds.

For more detailed information and to access the earnings conference webcast, investors are encouraged to visit investor.kns.com.

Kulicke & Soffa's financial results highlight the cyclical nature of the semiconductor industry and the importance of strategic planning and innovation in navigating market fluctuations. The company's commitment to capital return programs and investment in growth areas may position it well for the anticipated market recovery.

Explore the complete 8-K earnings release (here) from Kulicke & Soffa Industries Inc for further details.

This article first appeared on GuruFocus.