L.B. Foster Co (FSTR) Surpasses 2023 Guidance with Strong Cash Flow and Reduced Leverage

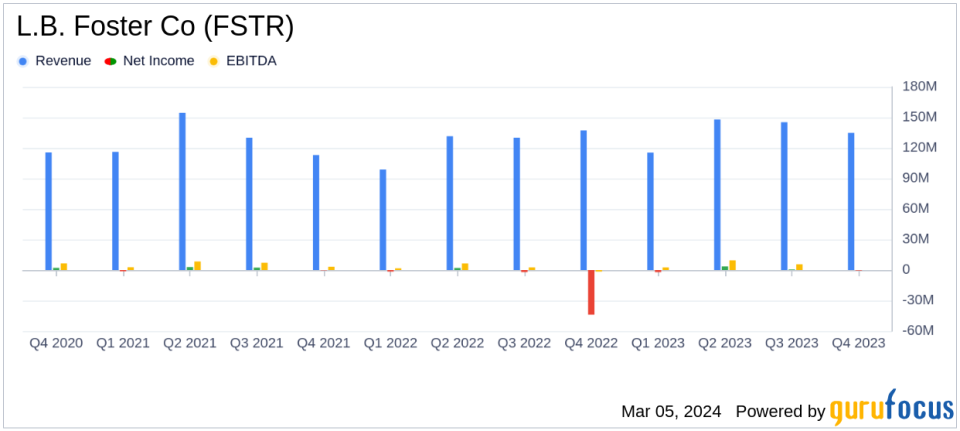

Net Sales: Full year 2023 net sales increased by 9.3% to $543.7 million, exceeding guidance.

Gross Margin Expansion: Gross margins expanded 270 basis points to 20.7% for the full year.

Net Income: Full year 2023 net income stood at $1.3 million, a significant improvement over the prior year.

Adjusted EBITDA: Reached $31.8 million for the full year, surpassing the upper end of guidance by $0.8 million.

Free Cash Flow: Reported strong free cash flow of $33.0 million for the full year.

Debt Reduction: Net debt declined by $36.3 million in 2023, with gross leverage ratio improving from 2.8x to 1.7x.

2024 Guidance: Projects net sales between $525.0 million to $560.0 million and adjusted EBITDA from $34.0 million to $39.0 million.

On March 5, 2024, L.B. Foster Co (NASDAQ:FSTR), a prominent provider of products and services for the rail and infrastructure markets, announced its financial results for the fourth quarter and full year of 2023. The company released its 8-K filing, revealing a year of substantial financial achievements and setting the stage for continued growth in 2024.

Company Overview

L.B. Foster Co operates through two segments: Rail Technologies and Services, and Infrastructure Solutions. The company's offerings include a variety of products and services for the rail, construction, energy, and utility industries. With a focus on providing new and used rail, trackwork, accessories, concrete railroad ties, insulated rail joints, power rail, track fasteners, and steel sheet piling, L.B. Foster Co is a key player in the transportation industry, generating the majority of its revenue from the Rail Products and Services segment.

Financial Performance and Challenges

The company's financial performance in 2023 was marked by a 9.3% increase in net sales over the previous year, reaching $543.7 million, which was $3.7 million above the upper end of the guidance range. This growth was driven by an 11.7% organic increase. Despite a slight decrease in fourth-quarter net sales, the full year saw gross margin expansion and a net income of $1.3 million, a notable improvement from the previous year's performance.

However, L.B. Foster Co faced challenges, particularly in its UK Technology Services business, which experienced commercial weakness leading to a decline in organic sales and gross margins. The company also reported a fourth-quarter net loss of $0.5 million, although this was a significant improvement over the prior year quarter.

Financial Achievements and Importance

The company's financial achievements in 2023 are critical indicators of its operational efficiency and strategic positioning within the transportation industry. The expansion of gross margins and the robust free cash flow demonstrate L.B. Foster Co's ability to manage costs effectively and generate liquidity. The reduction in net debt and improvement in the gross leverage ratio highlight the company's commitment to financial stability and its capacity to service and reduce debt.

Key Financial Metrics

Key financial metrics from the earnings report include:

"Full year 2023 net cash flow from operations of $37.4 million was favorable $48.0 million over 2022, with free cash flow totaling $33.0 million and $2.3 million in stock repurchases representing approximately 1.2% of its outstanding common stock."

This cash flow performance underscores the company's solid operational execution and disciplined capital management. The adjusted EBITDA of $31.8 million for the full year, which was $0.8 million above guidance, is another important metric that reflects the company's profitability and operational effectiveness.

Looking Ahead

For 2024, L.B. Foster Co has established guidance with net sales expected to range from $525.0 million to $560.0 million, representing organic growth of approximately 0.0% to 6.0%. The company also anticipates adjusted EBITDA to range from $34.0 million to $39.0 million and free cash flow to be between $12.0 million to $18.0 million. Capital expenditures are expected to represent approximately 2.0% to 2.5% of sales.

As L.B. Foster Co continues its strategic transformation, the company remains focused on pursuing growth opportunities and improving its financial and operational performance. With favorable end market conditions and a clear strategic direction, L.B. Foster Co is poised for continued success in the years ahead.

For detailed financial tables and further information, please refer to the full 8-K filing.

Investors and value seekers are encouraged to visit GuruFocus.com for comprehensive analysis and insights into L.B. Foster Co's financial health and future prospects.

Explore the complete 8-K earnings release (here) from L.B. Foster Co for further details.

This article first appeared on GuruFocus.