L3Harris Technologies Inc (LHX) Reports Strong Fiscal Year 2023 Results and Sets 2024 Guidance

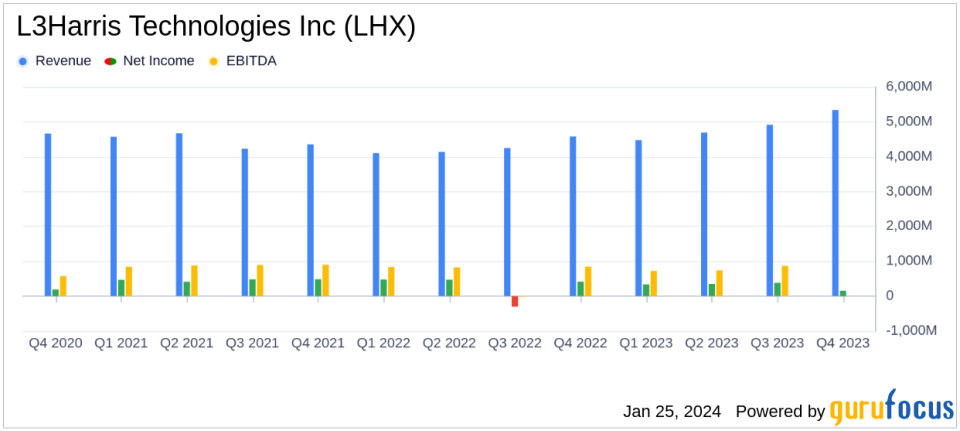

Revenue: FY23 revenue increased by 14% to $19.4 billion, with a 17% increase in Q4.

Operating Margin: FY23 operating margin improved to 7.3%, despite a Q4 dip due to goodwill impairment.

Earnings Per Share (EPS): FY23 EPS grew by 17% to $6.44, with non-GAAP EPS at $12.36.

Cash Flow: FY23 cash from operations totaled $2.1 billion, with free cash flow at $2.0 billion.

2024 Guidance: LHX sets revenue guidance between $20.7 billion and $21.3 billion, with non-GAAP EPS between $12.40 and $12.80.

On January 25, 2024, L3Harris Technologies Inc (NYSE:LHX) released its 8-K filing, detailing its financial performance for the fourth quarter and full fiscal year of 2023, and providing guidance for the fiscal year 2024. L3Harris Technologies, a leader in the C4ISR market, has recently expanded its portfolio with the acquisition of Aerojet Rocketdyne, a major player in the rocket motor industry.

Financial Performance Highlights

L3Harris Technologies Inc (NYSE:LHX) reported a robust increase in annual revenue, rising 14% to $19.4 billion in FY23, with a notable 17% increase in the fourth quarter alone. The company's operating margin for the full year improved to 7.3%, despite a decrease in the fourth quarter to 2.9%, largely due to a goodwill impairment related to a pending business sale. The segment operating margin for the year was 14.8%, reflecting a mix of improved efficiencies and product mix.

The company's earnings per share (EPS) for FY23 increased by 17% to $6.44, with non-GAAP EPS at $12.36. The fourth quarter saw a decrease in EPS to $0.83, primarily due to the aforementioned impairment, increased amortization of acquisition-related intangibles, and higher interest expenses. However, non-GAAP EPS for Q4 rose by 2% to $3.35.

Cash Flow and 2024 Outlook

L3Harris generated $2.1 billion in cash from operations and $2.0 billion in free cash flow for the fiscal year. Looking ahead to 2024, the company has set a revenue guidance range of $20.7 billion to $21.3 billion, with non-GAAP EPS expected to be between $12.40 and $12.80. These projections are underpinned by the company's strategic acquisitions and its focus on aligning its portfolio with the priorities of the Department of Defense and U.S. allied partners.

Strategic Acquisitions and Portfolio Realignment

Christopher E. Kubasik, Chair and CEO of L3Harris, highlighted the company's strategic moves, including the integration of two acquisitions and the divestiture of a non-core business, as key drivers of the company's strong performance. Kubasik also emphasized the company's commitment to achieving cost savings through the LHX NeXt program, which aims to drive operational improvements, margin expansion, and free cash flow growth.

The company's confidence in its financial framework and capital allocation priorities for 2024-2026, including reducing leverage and returning excess cash to shareholders, positions L3Harris Technologies Inc (NYSE:LHX) as a formidable player in the aerospace and defense industry, poised for continued growth and shareholder value creation.

For a more detailed analysis of L3Harris Technologies Inc (NYSE:LHX)'s financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from L3Harris Technologies Inc for further details.

This article first appeared on GuruFocus.