LabCorp (LH) Debuts NfL Test for Neuronal Damage Diagnosis

Laboratory Corporation of America Holdings LH, popularly known as LabCorp, recently launched the Neurofilament Light Chain (NfL) blood test to facilitate the detection and verification of the signs of neurodegenerative disease. This widely-accessible test provides direct evidence of neurodegeneration and neuronal injury. It will allow physicians to offer patients a more effective and efficient path to diagnosis and treatment.

The new NfL test aids in diagnosing neuronal injury resulting from brain injury, such as concussion or from diseases like multiple sclerosis, Alzheimer’s and Parkinson’s. It is currently available for health care providers to order.

The serial use of NfL testing assists doctors in following trends that suggest the efficacy of medicines or therapies. It can also indicate if an injury or disease is still in progression.

More on the News

Neurofilaments are proteins released upon neuronal damage and are detectable in blood. Although NfL is one of the three primary neurofilament types most widely studied in research settings, a reliable NfL test has not been widely accessible for patient care.

Given this, management believes the wide availability of LabCorp’s new NfL test will support neurologists with a tool that allows for rapid diagnoses, enhanced treatment decisions and improved patient care. It also marks a significant step forward in the monitoring and identifying patients with neuronal injury due to disease or trauma.

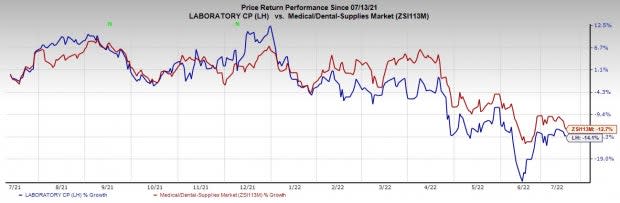

Image Source: Zacks Investment Research

The NfL test can be carried out using a standard blood collection at any hospital, physician’s office or at one of LabCorp’s almost 2,000 patient service centers. The test’s introduction and availability underscore the company’s commitment to neurology and improving the health and lives of the millions suffering from neurodegenerative and related diseases.

Industry Prospects

Per a report published in Research and Markets, the neurodegenerative disease market is expected to see a CAGR of 3.24% during 2022-2027. Factors such as the growing incidence of neurological disorders, growing public awareness, and a robust product pipeline for neurodegenerative disease treatment can be attributed to market growth.

Given the market prospects, LabCorp’s latest launch seems opportune.

Other Notable Developments

This month, LabCorp announced its plans to initiate monkeypox testing. This test will be done using the U.S. Centers for Disease Control and Prevention’s (CDC) orthopoxvirus test. The test detects all non-smallpox-related orthopoxviruses, including monkeypox. According to LabCorp, this effort is part of the CDC’s commitment to quickly increase monkeypox testing access and capacity in every community during the ongoing outbreak.

In June 2022, the company enhanced its central laboratory presence and drug development capabilities in Japan by expanding CB Trial Laboratory. This central laboratory is co-managed by LabCorp Drug Development and a renowned Japan-based clinical laboratory testing services provider, BML. Under the collaboration, LabCorp and BML will start working on a new laboratory facility in Kawagoe, Saitama, extending capacity and services for pharmaceutical and biotechnology clients.

Price Performance

The stock has underperformed its industry in the past year. It has declined 14.1% compared with the industry’s 12.7% fall.

Zacks Rank and Key Picks

Currently, LabCorp carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, Merck & Co., Inc. MRK and Patterson Companies, Inc. PDCO.

AMN Healthcare has a long-term earnings growth rate of 1.1%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.6%, on average. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has gained 13.1% against the industry’s 34.8% fall.

Merck has a long-term earnings growth rate of 10.1%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13.4%, on average. It currently carries a Zacks Rank #2 (Buy).

Merck has outperformed its industry in the past year. MRK has gained 20.8% against the industry’s 14.4% growth.

Patterson Companies has an estimated long-term growth rate of 9.6%. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 16.5%. It currently flaunts a Zacks Rank #2.

Patterson Companies has outperformed its industry in the past year. PDCO has lost 0.3% compared with the industry’s 12.8% fall in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research