LabCorp (LH) to Expand Diagnostics Services With New Deal

Laboratory Corporation of America, Inc. or LabCorp LH entered into an agreement with Baystate Health to acquire outreach laboratory business and select operating assets, including laboratory service centers operated by Baystate Health throughout Massachusetts. The transaction is expected to close in early 2024 and is subject to customary closing conditions and applicable regulatory approvals.

This strategic partnership will expand on LabCorp and Baystate Health's existing reference laboratory connection to increase the efficiency of routine and specialty lab testing.

More on the News

Baystate Health and Labcorp will improve access to high-quality, reasonably priced healthcare for underserved populations across the region. This partnership aims to standardize laboratory testing across Baystate Health, increase the capacity for rapid results delivery, and enhance patient and provider access to testing.

Additionally, Baystate Health will continue to offer expert support services for anatomic pathology and a few specialized tests at its current laboratory. At the same time, Labcorp established a regional laboratory at its Holyoke, MA, site.

Strategic Implications

Through this strategic relationship, LabCorp supports Baystate Health's mission to improve people's health in communities daily with quality and compassion. Together, the companies will continue to deliver a high level of service with plans to make capital investments in structure and process to deliver laboratory services to our patient population in more innovative and efficient ways.

The acquisition will bring together critical expertise, experience, and technology from both organizations to improve the delivery of high-quality patient care. Baystate Health will leverage LabCorp's leading clinical laboratory services, robust data, and digital tools to provide continued, convenient patient access.

Image Source: Zacks Investment Research

LabCorp's mission is to provide high-quality, cost-effective laboratory testing to the health systems, clinicians, patients, health plans, and communities we serve. The organization is excited to expand its strategic relationship with Baystate Health and realize the shared ambition of improving the patient and provider experience in the communities served by Baystate.

Industry Prospects

Per a report by Grand View Research, the global clinical laboratory service market size was estimated at $217.53 billion in 2022 and is expected to expand at a CAGR of 3.2% by 2030. The industry is witnessing growth due to factors such as the increasing burden of chronic diseases and the growing demand for early diagnostic tests.

Strategic Deals Driving Growth

In July 2023, LabCorp entered into an agreement with Legacy Health to acquire select assets of its outreach laboratory business, including laboratory facilities and equipment. Legacy Health will maintain ownership and licensure of its hospital laboratories and retain ownership of its central lab building at Holladay Park in Northeast Portland. The comprehensive laboratory relationship will allow LabCorp to bring its leading diagnostics capabilities and related support services to patients across Legacy Health's service area.

LH completed a strategic partnership agreement with the Philadelphia-based health system, Jefferson Health (Jefferson), the same month. Per the terms of the deal, with the formation of this strategic laboratory relationship, LabCorp will acquire the select assets of Jefferson's outreach laboratory services, while the latter will continue to own and operate existing hospital labs for outpatient and inpatient services.

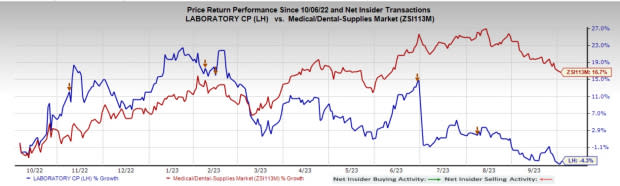

Price Performance

In the past six months, shares of LabCorp have declined 4.3% against the industry’s 16.7% growth.

Zacks Rank and Other Key Picks

LH currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Quanterix QTRX and Align Technology ALGN, each carrying a Zacks Rank #2 (Buy).

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 25.5% against the industry’s 8.9% decline in the past year.

Estimates for Quanterix’s 2023 loss per share have remained constant at 97 cents in the past 30 days. Shares of the company have surged 141.5% in the past year compared with the industry’s fall of 5.6%.

QTRX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Estimates for Align Technology’s 2023 earnings have increased from $8.77 to $8.78 per share in the past 30 days. Shares of the company have increased 27% in the past year compared with the industry’s rise of 14.3%.

ALGN’s earnings beat estimates in three of the trailing four quarters and missed in one. In the last reported quarter, it posted an earnings surprise of 9.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Labcorp (LH) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report