Labcorp (LH) Expands Strategic Alliances, Test Sales Fall

Laboratory Corporation of America Holdings or Labcorp LH has been benefiting from the solid execution of its strategic priorities. Investment in targeted high-growth areas should continue the momentum. Yet, severely declining COVID-19 testing revenues dent growth. The stock carries a Zacks Rank #3 (Hold) currently.

In its efforts to expand, Labcorp is focusing more on key growth areas such as oncology, women’s health, autoimmune disease and neurology. The company’s ability to develop, license and ultimately scale specialty testing, including companion diagnostics, can be pivotal in significantly driving near-term growth.

Developing specialty tests and companion diagnostics establishes Labcorp as an attractive partner to health systems and biopharma, as they continue to develop more therapies in the highest specialty areas. In addition, the company is well-positioned for long-term success in Cell & Gene Therapy, expanding into the consumer market and international growth through the specialty testing and biopharma business.

In addition, the company is investing in innovation and technology that supports diagnostic and drug development testing for various diseases such as cancer and Alzheimer’s. Labcorp is the first company to nationally avail of an ATN profile — a blood-based test that combines three well-researched blood biomarkers to identify and assess biological changes associated with Alzheimer's disease, Amyloid-Tau Alzheimer's and neurodegeneration targeted for patients being evaluated for mild dementia.

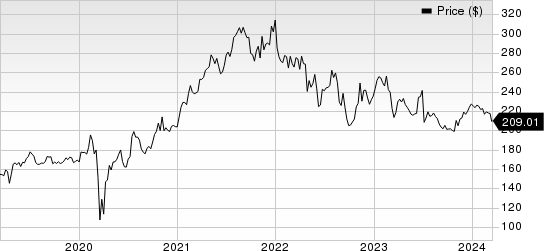

Labcorp Price

Labcorp price | Labcorp Quote

Further, Labcorp boasts a robust pipeline of potential hospital and local laboratory acquisitions, which present ample opportunities for growth. The company also continues to progress in terms of integrating hospital partnerships and acquisitions.

In the fourth quarter of 2023, the momentum from the health systems and regional local lab partnership strategy remained strong. Labcorp announced a strategic partnership with Baystate Health in Western Massachusetts to acquire its outreach laboratory business and select operating assets. It also completed the acquisition of select assets from Legacy Health and currently manages Legacy's inpatient hospital laboratories, serving patients throughout Oregon and Southwest Washington.

On the flip side, with the end of the pandemic, Labcorp witnessed a significant decline in COVID-19 PCR testing volumes. In the fourth quarter of 2023, testing revenues were down 73% and affected some of the company’s key metrics.

Besides, Labcorp’s operations are also subject to the effects of macroeconomic factors in the United States and globally. These include significant economic fluctuations as a result of the disturbed geopolitical situation and inflation, all leading to an increase in the costs of goods and services. Throughout most of the months of 2023, Labcorp.’s Early Development Research Laboratories business grappled with non-human primate (NHP)-related supply chain issues. The company experienced higher-than-normal cancellations and lower orders, primarily due to small biotech funding.

Meanwhile, Labcorp faces intense competition from its major competitor, Quest Diagnostics, and other commercial laboratories and hospitals. In a $55 billion U.S. lab market, hospitals control an estimated 55% of the diagnostic test market, compared to Labcorp’s 10% share. While pricing is an important factor in choosing a testing lab, hospital-affiliated physicians expect a high level of service, including accurate and rapid turnaround of testing results. As a result, Labcorp and other commercial labs compete with hospital-affiliated labs, primarily on the basis of quality of service.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita DVA, Cardinal Health CAH and Stryker SYK. While DaVita sports a Zacks Rank #1 (Strong Buy), Cardinal Health and Stryker carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for DaVita’s 2024 earnings per share have moved up from $8.46 to $8.97 in the past 30 days. Shares of the company have surged 81.9% in the past year compared with the industry’s 26.9% rise.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.57%. In the last reported quarter, it delivered an earnings surprise of 22.22%.

Cardinal Health’s stock has surged 59.1% in the past year. Earnings estimates for Cardinal Health have risen from $7.17 to $7.28 for fiscal 2024 and from $7.94 to $8.03 for fiscal 2025 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 15.6%. In the last reported quarter, it posted an earnings surprise of 16.67%.

Estimates for Stryker’s 2024 earnings per share have increased from $11.84 to $11.86 in the past 30 days. Shares of the company have moved 30.7% upward in the past year compared with the industry’s rise of 10.8%.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.09%. In the last reported quarter, it delivered an earnings surprise of 5.81%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Labcorp (LH) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report