Labcorp (LH) Q4 Earnings and Revenues Beat, Margins Fall

Laboratory Corporation of America Holdings LH, or Labcorp, reported adjusted earnings per share (EPS) of $3.30 in fourth-quarter 2023, up 8.2% from the year-ago quarter’s figure. The adjusted figure excludes the impact of certain amortization expenses and restructuring charges, among others. The bottom line beat the Zacks Consensus Estimate by 0.3%.

On a GAAP basis, net loss in the fourth quarter was $1.95 per share compared with the year-ago EPS of 42 cents.

For the full year, adjusted earnings were $13.56 per share, reflecting an 18.6% fall from the year-ago period. It beats the Zacks Consensus Estimate by 0.07%.

Revenues

Revenues in the quarter under review rose 3.4% year over year to $3.03 billion. The metric surpassed the Zacks Consensus Estimate by 0.9%.

The increase was due to organic revenue of 1.5%, acquisitions, net of divestitures of 1.4% and foreign currency translation of 0.7%. The 1.5% increase in organic revenue was driven by a 5.0% increase in the company's organic Base Business, partially offset by a 3.5% decline in COVID-19 PCR and antibody testing (COVID-19 Testing).

Total revenues for 2023 were $12.16 billion, up 2.5% from the year-ago period’s levels. The figure beat the Zacks Consensus Estimate by 0.2%.

Segments in Detail

The company currently operates under two segments — Labcorp Diagnostics Laboratories and Labcorp Biopharma Laboratory Services (comprised of its Central Laboratories and Early Development Research Laboratories).

For the fourth quarter, Diagnostics Laboratories reported revenues of $2.35 billion, reflecting a 2.6% rise year over year.

On an organic basis, revenues were up 0.8%, driven by a 5.3% increase in the Base Business, partially offset by a (4.5%) decline in COVID-19 Testing.

The company’s Total volumes (measured by requisitions) increased by 2.4% as acquisition volumes contributed 2.1% and organic volumes rose 0.3%.

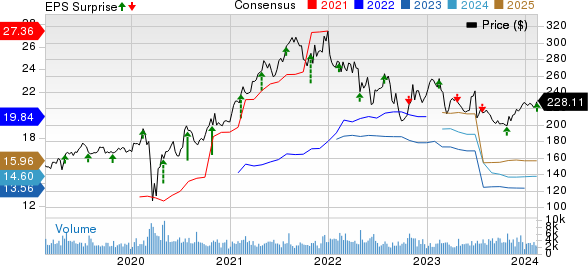

Labcorp Price, Consensus and EPS Surprise

Labcorp price-consensus-eps-surprise-chart | Labcorp Quote

Biopharma Laboratory Services revenues rose 7.1% to $694.8 million in the fourth quarter. The year-over-year increase was primarily driven by organic growth of 4% and foreign currency translation of 3.1%.

Margins

The gross margin contracted 16 basis points (bps) to 27.1% in the fourth quarter.

The adjusted operating income declined 15.8% year over year to $288.5 million. The adjusted operating margin contracted 219 bps from the year-ago quarter’s levels to 9.5%.

Cash Position

Labcorp exited 2023 with cash and cash equivalents of $536.8 million compared with $320.6 million at the end of 2022. Long-term debt (excluding the current portion) at the end of 2023 was $4.05 billion, down from $5.04 billion at the end of 2022.

Cumulative cash flow provided by operating activities at the end of 2023 was $1.33 billion compared to $1.96 billion in the prior year’s comparable period.

2024 View

The company provided its 2024 guidance.

Total Labcorp Enterprise revenues for 2024 are expected to grow in the range of 4.7-6.5%.

Diagnostics Laboratories revenues are expected to grow in the range of 3.2-4.8%.

Total Biopharma Laboratory Services revenues are expected to rise in the range of 5.5-7.5% in 2024.

The Zacks Consensus Estimate for full-year revenues is pegged at $12.51 billion.

The company expects full-year adjusted EPS in the band of $14.30-$15.40. The Zacks Consensus Estimate for the metric is pegged at $14.60.

The company projects 2024 free cash flow from continued operation in the range of $1.00-$1.15 billion.

Our Take

Labcorp ended the fourth quarter of 2023 with earnings and revenues beating estimates. Diagnostics Laboratories and Biopharma Laboratory Services businesses demonstrated strong performance in the reported quarter.

In the fourth quarter and throughout the year, Labcorp executed its enterprise strategy. The company closed its previously announced transaction with Legacy Health to acquire select assets of Legacy's outreach laboratory business, which looks encouraging. During the reported quarter, the company announced six new laboratory partnerships and launched new advanced tests in its focused specialty areas across the business, reflecting strong momentum. The company also became the first laboratory to launch a new, FDA-cleared blood test for risk assessment and clinical management of severe preeclampsia, raising investors' optimism.

Meanwhile, the reduction in COVID-19 testing revenues negatively impacted the company’s performance in the reported quarter. Further, the contraction of both margins looks discouraging.

Zacks Rank and Key Picks

Labcorp currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Stryker Corporation SYK, Cencora, Inc. COR and Cardinal Health CAH.

Stryker, carrying a Zacks Rank #2 (Buy), reported a fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Cencora, carrying a Zacks Rank #2, reported a first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 6.7%.

Cardinal Health, carrying a Zacks Rank #2, reported second-quarter fiscal 2024 adjusted earnings of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion increased 11.6% on a year-over-year basis and topped the Zacks Consensus Estimate by 1.1%.

CAH has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Labcorp (LH) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report