Lacklustre Performance Is Driving MEI Pharma, Inc.'s (NASDAQ:MEIP) Low P/S

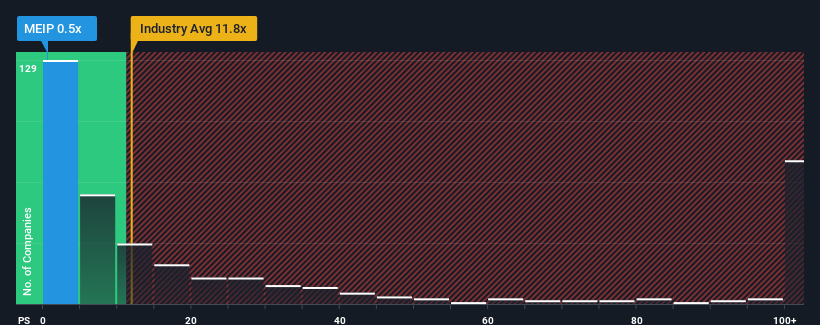

MEI Pharma, Inc.'s (NASDAQ:MEIP) price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.8x and even P/S above 53x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for MEI Pharma

How MEI Pharma Has Been Performing

MEI Pharma certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MEI Pharma.

Is There Any Revenue Growth Forecasted For MEI Pharma?

The only time you'd be truly comfortable seeing a P/S as depressed as MEI Pharma's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 78%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 38% per year as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to expand by 95% per annum, which paints a poor picture.

With this information, we are not surprised that MEI Pharma is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that MEI Pharma maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, MEI Pharma's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for MEI Pharma you should be aware of, and 1 of them is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here