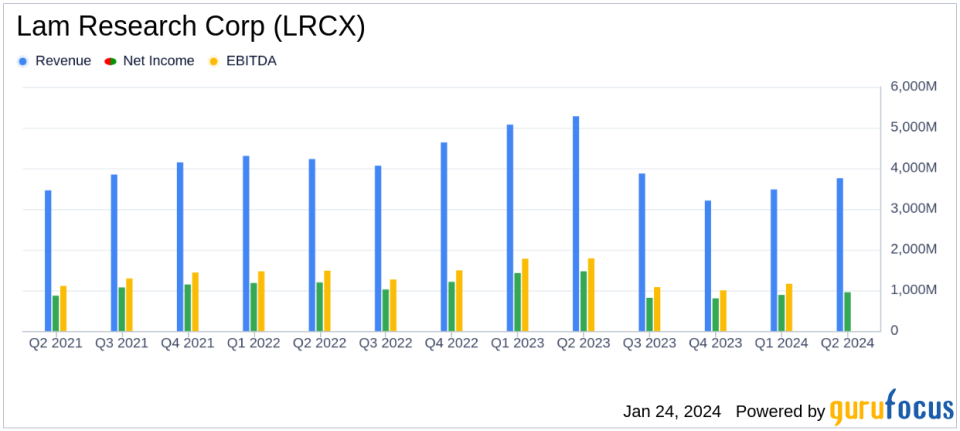

Lam Research Corp (LRCX) Reports Growth in Quarterly Revenue and Earnings Per Share

Revenue: Increased by 7.9% quarter-over-quarter to $3.76 billion.

Gross Margin: U.S. GAAP gross margin decreased slightly to 46.8%.

Operating Income: U.S. GAAP operating income was 28.1% of revenue.

Diluted EPS: U.S. GAAP diluted EPS rose by 8.4% to $7.22.

Cash Flow: Operating activities generated $1.454 billion in cash.

Balance Sheet: Cash and equivalents increased to $5.6 billion.

Outlook: Guidance for the next quarter includes expected revenue of approximately $3.7 billion.

On January 24, 2024, Lam Research Corp (NASDAQ:LRCX) released its 8-K filing, detailing the financial results for the quarter ended December 24, 2023. As a leading semiconductor wafer fabrication equipment manufacturer, Lam Research specializes in deposition and etch market segments, holding significant market share and serving top global chipmakers.

Financial Highlights and Challenges

Lam Research reported a revenue of $3.76 billion for the December 2023 quarter, marking a 7.9% increase from the previous quarter. The company's U.S. GAAP gross margin slightly decreased to 46.8%, and operating income as a percentage of revenue was 28.1%. The diluted earnings per share (EPS) on a U.S. GAAP basis increased by 8.4% to $7.22. Non-GAAP figures also showed positive trends, with a non-GAAP diluted EPS of $7.52, up 9.8% from the previous quarter.

Despite these achievements, challenges such as supply chain cost increases, geopolitical tensions, and potential market volatility remain. These factors could impact Lam Research's ability to maintain its growth trajectory and profitability.

Operational Efficiency and Market Position

The company's financial achievements are significant given the competitive nature of the semiconductor industry. Lam Research's ability to increase revenue and EPS demonstrates operational efficiency and a strong market position. The company's focus on product differentiation and a flexible global infrastructure positions it well to capitalize on industry growth driven by innovations in areas like artificial intelligence (AI).

Income Statement and Balance Sheet Analysis

Key details from the income statement show that operating expenses for the quarter were $700 million, with net income reaching $954 million. The balance sheet reflects a robust financial position, with cash and cash equivalents, short-term investments, and restricted cash and investments totaling $5.6 billion, an increase from the previous quarter's $5.2 billion. Deferred revenue also increased, indicating a healthy backlog of orders.

"Lam delivered solid results to close out 2023," said Tim Archer, Lam Researchs President and Chief Executive Officer. "With our investments in extending product differentiation and building a flexible and efficient global infrastructure, we are in a strong position to benefit as innovations such as AI power robust semiconductor industry growth in the years to come."

Outlook and Forward Guidance

Looking ahead, Lam Research provided guidance for the March 31, 2024 quarter, expecting revenue to be around $3.7 billion. The company anticipates a U.S. GAAP gross margin of approximately 47.2% and a non-GAAP gross margin of around 48.0%. Operating income is projected to be 28.1% of revenue on a U.S. GAAP basis and 29.5% on a non-GAAP basis, with net income per diluted share estimated at $6.90 and $7.25, respectively.

Lam Research's financial performance in the December 2023 quarter reflects the company's resilience and strategic positioning in the semiconductor industry. With a strong balance sheet and positive outlook, Lam Research is poised to continue its growth and meet the demands of an evolving market.

For a detailed analysis of Lam Research Corp's financial results and future expectations, investors and interested parties can access the full earnings report on the SEC website or visit GuruFocus.com for comprehensive investment analysis and commentary.

Explore the complete 8-K earnings release (here) from Lam Research Corp for further details.

This article first appeared on GuruFocus.