Lam Research (LRCX) Q4 Earnings Beat, Revenues Rise Y/Y

Lam Research Corporation LRCX reported fourth-quarter fiscal 2022 non-GAAP earnings of $8.83 per share, which surpassed the Zacks Consensus Estimate by 20.7%. The figure increased 9.1% year over year.

Revenues improved 11.8% year over year to $4.64 billion. Further, the figure surpassed the Zacks Consensus Estimate of $4.21 billion.

Top-line growth was driven by strong momentum in both systems and customer support businesses.

Notably, the company’s system revenues were $3.01 billion (64.9% of the total revenues), up 8.8% from the year-ago quarter.

In the Customer Support Business Group, revenues for the reported quarter were $1.63 billion (35.1%), up 17.9% year over year.

The company remains optimistic about the opportunities in advanced packaging, owing to robust etch and deposition product lines.

For 2022, the wafer fabrication equipment (WFE) spending is estimated to be within the low to mid-$90-billion range. Global supply challenges and macro headwinds in consumer-focused markets are expected to prevail.

Nevertheless, increasing semiconductor demand, strengthening foundry-logic spending, expanding semiconductor content in end devices and rising device complexity are likely to continue acting as tailwinds.

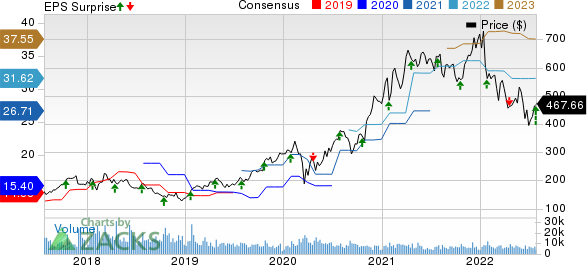

Lam Research Corporation Price, Consensus and EPS Surprise

Lam Research Corporation price-consensus-eps-surprise-chart | Lam Research Corporation Quote

Regions in Detail

China, Korea and Taiwan accounted for 31%, 24% and 19% of the company’s total fiscal fourth-quarter revenues, respectively. Then again, Japan, Southeast Asia, the United States and Europe accounted for 6%, 5%, 8% and 7%, respectively.

Operating Details

The non-GAAP gross margin was 45.2%, which contracted 130 basis points (bps) year over year.

Non-GAAP operating expenses were $634.6 million, reflecting an increase of 10.6% from the prior-year quarter. As a percentage of revenues, the figure contracted 10 bps year over year to 13.7%.

The non-GAAP operating margin was 31.5%, contracting 110 bps from the year-ago quarter.

Balance Sheet & Cash Flow

As of Jun 26, 2022, cash and cash equivalents, and short-term investments decreased to $3.65 billion from $4.35 billion as of Mar 27, 2022.

Cash flow from operating activities was $443.9 million for the reported quarter, down from $757.7 million in the previous quarter. Capital expenditure was $125.7 million in fourth-quarter fiscal 2022 compared with $145 million in third-quarter fiscal 2022.

In the reported quarter, Lam Research paid out dividends of $208.1 million and repurchased shares worth $876.1 million.

Guidance

For first-quarter fiscal 2023, the company expects revenues of $4.9 billion (+/- $300 million). The Zacks Consensus Estimate for the same is pegged at $4.66 billion.

The non-GAAP gross margin is projected to be 45% (+/-1%), and the non-GAAP operating margin is expected to be 31.5% (+/-1%).

Non-GAAP earnings are projected to be $9.50 (+/- 75 cents) per share on a diluted share count of 139 million. The Zacks Consensus Estimate for non-GAAP earnings per share is pegged at $8.90.

Zacks Rank and Stocks to Consider

Currently, Lam Research carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Aspen Technology AZPN, Keysight Technologies KEYS and Asure Software ASUR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aspen technology has returned 18.9% in the year-to-date period. The long-term earnings growth rate for AZPN is currently projected at 16.3%.

Keysight Technologies has lost 26.8% in the year-to-date period. KEYS’ long-term earnings growth rate is currently projected at 9.1%.

Asure Software has lost 27.2% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 14%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research