Lamar Advertising Co (LAMR) Reports Solid Growth in Q4 and Full-Year 2023 Earnings

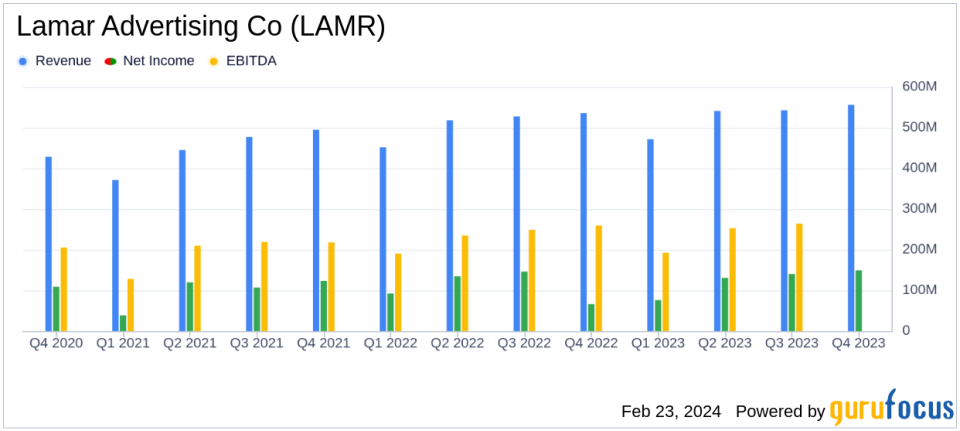

Q4 Revenue: Increased by 3.8% to $555.9 million from the previous year.

Q4 Net Income: Rose significantly to $149.3 million, marking an increase of $83.2 million year-over-year.

Full-Year Revenue: Grew by 3.9% to $2.11 billion compared to the previous year.

Full-Year Net Income: Improved to $496.8 million, up $58.2 million from the prior year.

Diluted AFFO Per Share: Increased by 9.9% in Q4 and 1.2% for the full year, surpassing the company's revised guidance.

Liquidity: As of December 31, 2023, Lamar had $715.8 million in total liquidity.

2024 Guidance: Net income per diluted share projected to be between $5.02 and $5.07, with diluted AFFO per share between $7.67 and $7.82.

Lamar Advertising Co (NASDAQ:LAMR) released its 8-K filing on February 23, 2024, detailing a year of robust financial performance. The company, a leading owner and operator of outdoor advertising and logo sign displays, demonstrated resilience and growth in both the fourth quarter and the full year ended December 31, 2023.

Company Overview

Lamar Advertising Co is an outdoor advertising company that operates as a real estate investment trust (REIT). The company specializes in leasing space for advertising across various platforms, including billboards, buses, shelters, benches, logo plates, and airport terminals. With a significant presence in Pennsylvania and Texas, Lamar generates most of its revenue from its extensive portfolio of static and digital roadside billboard displays in the U.S. Its customer base primarily consists of businesses in the restaurant, service, healthcare, and retail sectors.

Financial Performance and Challenges

Lamar's fourth-quarter results showed a 3.8% increase in net revenue to $555.9 million, while net income soared to $149.3 million, an impressive jump from the $66.1 million reported in the same period of the previous year. Adjusted EBITDA also saw a healthy increase of 6.3% to $268.2 million. For the full year, net revenue climbed by 3.9% to $2.11 billion, and net income increased by $58.2 million to $496.8 million. These results underscore the company's ability to grow its top and bottom lines, despite the challenges posed by a competitive advertising market and the ongoing need to innovate in the digital space.

Financial Achievements

The company's financial achievements are particularly noteworthy for a REIT, as they reflect the successful management of its advertising assets and the ability to generate consistent rental income. The increase in diluted AFFO per share by 9.9% in Q4 and 1.2% for the full year to $7.47, beating the company's revised guidance, is a critical metric for investors as it indicates the company's ability to generate cash flow from its operations.

Key Financial Metrics

Free cash flow for Q4 increased by 13.2% to $180.3 million, although there was a slight decrease of 0.4% for the full year. The company's liquidity remained strong, with $715.8 million available, including cash and available borrowing under its credit facilities. These metrics are essential for Lamar as they provide the financial flexibility to invest in new opportunities and maintain its dividend payments to shareholders.

"Revenue growth accelerated as we moved through the fourth quarter, primarily because of strength in local sales. In addition, our team continued to do an outstanding job controlling expenses," said Lamar chief executive Sean Reilly. "The result is that we achieved $7.47 in full year AFFO per diluted share, easily beating our revised guidance range for 2023. For 2024, we are projecting further growth in AFFO, with a range of $7.67 to $7.82 per diluted share."

Analysis of Performance

Lamar's performance in 2023 reflects a strong operational strategy, with an emphasis on local sales and expense control contributing to its financial success. The company's guidance for 2024 suggests confidence in its ability to continue this positive trajectory. However, as a REIT, Lamar must navigate the complexities of the real estate market and the evolving landscape of outdoor advertising to sustain growth.

For detailed financial tables and a complete analysis of Lamar's performance, including reconciliations of non-GAAP measures, please refer to the full 8-K filing.

Investors and potential GuruFocus.com members interested in Lamar Advertising Co's value proposition can find more in-depth analysis and up-to-date information on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Lamar Advertising Co for further details.

This article first appeared on GuruFocus.