Lamar (LAMR) Stock Up 3.1% as Q3 AFFO Beats, Revenues Rise Y/Y

Shares of Lamar Advertising Company LAMR gained 3.07% on the Nov 3 normal trading session on the NYSE after it reported third-quarter 2023 adjusted funds from operations (AFFO) per share of $2.04, beating the Zacks Consensus Estimate of $1.91. The figure also compared favorably with the prior-year quarter tally of $2.03.

Results reflect year-over-year growth in the top line. However, higher interest expenses during the quarter acted as a dampener.

Quarterly net revenues of $542.6 million increased 2.9% on a year-over-year basis but missed the consensus mark of $543.5 million.

Per the company’s chief executive, Sean Reilly, “In the third quarter, we demonstrated impressive operating leverage, increasing revenue while decreasing expenses on a year-over-year, acquisition-adjusted basis. The broader advertising environment remains challenging. Nevertheless, based on current bookings, we are pacing to reach or even slightly exceed the upper end of our revised guidance for full-year diluted AFFO per share.”

Quarter in Detail

Operating income of $188.1 million climbed 3.9% from the year-ago period’s $180.9 million, while the adjusted EBITDA increased 5.8% to $265.7 million.

Acquisition-adjusted net revenues for the third quarter climbed 1.6% year over year. Also, acquisition-adjusted EBITDA rose 4.5%.

Interest expenses flared up 34.3% year over year to $45.1 million during the reported quarter.

The company’s free cash flow of $181.04 million increased 2.9% year over year in the quarter.

Balance Sheet

The cash flow provided by operating activities in the three months ended Sep 30, 2023, was $222.5 million compared with $224.5 million recorded in the year-ago period.

As of Sep 30, 2023, Lamar Advertising had a total liquidity of $645.7 million. This comprised $606.3 million available for borrowing under its revolving senior credit facility and $39.4 million in cash and cash equivalents. As of the same date, the outstanding balance under the company’s revolving credit facility totaled $135 million and $247.1 million under the Accounts Receivable Securitization Program.

Lamar currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

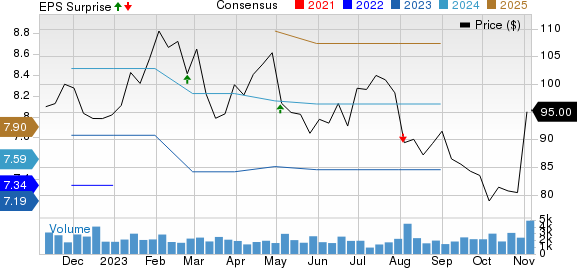

Lamar Advertising Company Price, Consensus and EPS Surprise

Lamar Advertising Company price-consensus-eps-surprise-chart | Lamar Advertising Company Quote

Performance of Other REITs

OUTFRONT Media Inc. OUT reported AFFO per share of 46 cents, surpassing the Zacks Consensus Estimate of 42 cents. The figure, however, declined 13.2% year over year.

OUT’s results reflect higher billboard revenues in the quarter, which aided decent year-over-year top-line growth. However, higher interest expenses acted as a dampener.

Public Storage PSA reported a third-quarter 2023 core FFO per share of $4.33, which increased 4.8% year over year and topped the Zacks Consensus Estimate of $4.21.

Results showed a better-than-anticipated top line, aided by an improvement in the realized annual rent per available square foot in the reported quarter. The company also benefited from its expansion efforts through acquisitions, developments and extensions. PSA also raised its 2023 outlook.

Healthpeak Properties, Inc. PEAK reported third-quarter 2023 FFO as adjusted per share of 45 cents, beating the Zacks Consensus Estimate by a whisker. The reported figure rose 4.6% from the prior-year quarter.

Results reflected better-than-anticipated revenues. Moreover, growth in same-store portfolio cash (adjusted) net operating income was witnessed across the portfolio. PEAK raised its outlook for the current year.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report