Lamar (LAMR) Stock Declines 2.4% Despite Q4 AFFO & Revenues Beat

Lamar Advertising Company LAMR reported fourth-quarter 2023 adjusted funds from operations (AFFO) per share of $2.10, beating the Zacks Consensus Estimate of $1.95. The figure also compared favorably with the prior-year quarter's tally of $1.91.

Results reflect year-over-year growth in the top line. However, higher interest expenses during the quarter acted as a dampener. Probably because of negative sentiments, shares of the company lost 2.44% on the Feb 23 normal trading session on the NYSE despite better-than-expected results.

Quarterly net revenues of $555.9 million increased 3.8% on a year-over-year basis and beat the consensus mark of $549.8 million.

Per the company’s chief executive, Sean Reilly, “Revenue growth accelerated as we moved through the fourth quarter, primarily because of strength in local sales. The result is that we achieved $7.47 in full-year AFFO per diluted share, easily beating our revised guidance range for 2023. For 2024, we are projecting further growth in AFFO, with a range of $7.67 to $7.82 per diluted share.”

For the full-year 2023, the AFFO per share came in at $7.47, higher than the prior-year tally of $7.38. This was backed by 3.9% growth in net revenues to $2.11 billion.

Quarter in Detail

Operating income of $191.7 million climbed 74.2% from the year-ago period’s $110.1 million, while the adjusted EBITDA increased 6.3% to $268.2 million.

Acquisition-adjusted net revenues for the fourth quarter climbed 2.5% year over year. Also, acquisition-adjusted EBITDA rose 5.1%.

Interest expenses increased 17.7% year over year to $44.3 million during the reported quarter.

The company’s free cash flow of $180.3 million increased 13.2% year over year in the quarter.

Balance Sheet

The cash flow provided by operating activities in the three months ended Dec 31, 2023, was $254.2 million compared with $244.5 million recorded in the year-ago period.

As of Dec 31, 2023, Lamar Advertising had a total liquidity of $715.8 million. This comprised $671.2 million available for borrowing under its revolving senior credit facility and $44.6 million in cash and cash equivalents. As of the same date, the outstanding balance under the company’s revolving credit facility totaled $70 million and $249.6 million under the Accounts Receivable Securitization Program.

Lamar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

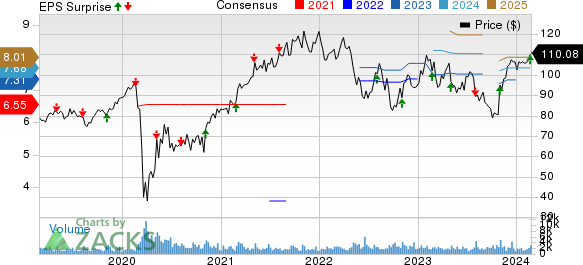

Lamar Advertising Company Price, Consensus and EPS Surprise

Lamar Advertising Company price-consensus-eps-surprise-chart | Lamar Advertising Company Quote

Performance of Other REITs

OUTFRONT Media Inc. OUT reported fourth-quarter 2023 AFFO per share of 62 cents, missing the Zacks Consensus Estimate of 64 cents.

OUT’s results were affected by a rise in interest expenses. However, higher billboard revenues in the quarter aided year-over-year top-line growth.

Healthpeak Properties, Inc. PEAK reported fourth-quarter 2023 funds from operations (FFO) as adjusted per share of 46 cents, beating the Zacks Consensus Estimate by a whisker. The reported figure rose 4.5% from the prior-year quarter.

Results reflect better-than-anticipated revenues. Moreover, growth in same-store portfolio cash (adjusted) NOI was witnessed across the portfolio. PEAK also issued its 2024 outlook.

Highwoods Properties Inc. HIW reported fourth-quarter 2023 FFO per share of 99 cents, outpacing the Zacks Consensus Estimate of 91 cents. The figure was also above the prior-year quarter’s 96 cents.

HIW’s quarterly results reflect rent growth. However, a fall in occupancy and higher operating expenses acted as dampeners. It also issued its outlook for 2024.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Highwoods Properties, Inc. (HIW) : Free Stock Analysis Report

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report