Lamb Weston (LW) Gains on Solid Pricing & Expansion Efforts

Lamb Weston Holdings, Inc. LW is focused on undertaking effective pricing actions, which are yielding. The provider of value-added frozen potato products is on track with strategic growth efforts, like expanding capacity.

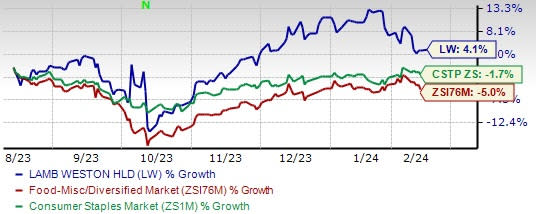

This currently Zacks Rank #2 (Buy) company’s shares have risen 4.1% in the past six months against the industry’s 5% decline. The stock has outperformed the Zacks Consumer Staples sector’s 1.7% decline. Let’s discuss the factors driving Lamb Weston’s growth.

Pricing

Net sales are benefiting from robust price/mix, as witnessed during the second quarter of fiscal 2024. The price/mix rose 12%, which reflects gains from inflation-induced pricing actions in business units and a positive mix. In the North America segment, price/mix increased 14% on the carryover benefit of pricing actions undertaken during fiscal 2023 and positive mix, stemming from continued gains from revenue growth management and other mix improvement efforts. In the International segment, price/mix advanced 10%.

Strategic pricing actions drove the company’s quarterly net sales, which amounted to $1,732.1 million, up 36% year over year. Net sales, excluding buyouts, are projected to increase 6.5-8.5% in fiscal 2024, on a low double-digit percentage points increase in price/mix.

Image Source: Zacks Investment Research

Expansions on Track

Lamb Weston’s sturdy balance sheet and capacity to generate cash keep it well-placed to boost production capacity and fuel long-term growth. The company’s efforts to boost offerings and expand capacity enable it to meet the rising demand conditions for snacks and fries effectively.

Capital expenditures amounted to $566.5 million during the first half of fiscal 2024, owing to construction and equipment purchases as LW continues to expand its processing capacity in Idaho, Argentina and the Netherlands. In its last earnings call, management highlighted that its new greenfield processing facility in China is now operational. For fiscal 2024, the company expects cash to be used for capital expenditures in the band of $900-$950 million.

Bright Prospects

Lamb Weston continues to reap benefits from an effective pricing scenario and a solid operating momentum. Its focus on improving supply-chain productivity, global expansion efforts, bettering manufacturing and system capabilities and strengthening product, customer and channel mix continues to drive growth.

Management anticipates fiscal 2024 adjusted earnings per share to be in the range of $5.70-$6.15, indicating year-over-year growth. Net sales are anticipated to be in the band of $6.8-$7.0 billion during the year. Net sales, excluding buyouts, are projected to rise 6.5-8.5%.

Other Promising Stocks

Post Holdings POST, operating as a cosmetic and skin care product provider, currently sports a Zacks Rank of 1 (Strong Buy). POST has a trailing four-quarter earnings surprise of 52.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current financial-year sales indicates growth of 15.2% from the prior-year reported number.

Mondelez International MDLZ has a trailing four-quarter earnings surprise of 8.6%, on average. MDLZ currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Mondelez’s current financial-year sales and earnings indicates growth of 2.9% and 10%, respectively, from the year-ago period's reported figures.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 145%.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales indicates growth of 29% from the year-ago reported actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report