Lamb Weston (LW) Q1 Earnings & Sales Top Estimates, FY24 View Up

Lamb Weston Holdings, Inc. LW posted solid first-quarter fiscal 2024 results, with the top and the bottom line beating the Zacks Consensus Estimate. Net sales and earnings increased year over year. Results gained from improved pricing in every segment and favorable customer and product mix.

A solid start to the year and the ongoing demand and pricing scenario prompted management to raise its fiscal 2024 outlook.

Quarter in Detail

LW’s bottom line came in at $1.63 per share, surpassing the Zacks Consensus Estimate of $1.09. Adjusted earnings jumped 109% from 78 cents per share reported in the year-ago quarter.

Net sales amounted to $1,665.3 million, up 48% year over year. The top line surpassed the Zacks Consensus Estimate of $1,594.3 million. Net sales (excluding the incremental sales attributable to buyouts) increased 15%.

Price/mix rose 23%, which reflects gains from pricing actions in both business units undertaken to counter input and manufacturing cost inflation. Also, the favorable mix and the timing of trade spending in North America contributed to the upside. Reduced customer transportation charges somewhat offset these factors. We had expected price/mix to grow 28.5% during the reported quarter. Volume fell 8%, mainly reflecting LW’s efforts to exit some lower-priced and lower-margin businesses. Inventory destocking by some customers across a few markets also pressured volumes to a lesser extent.

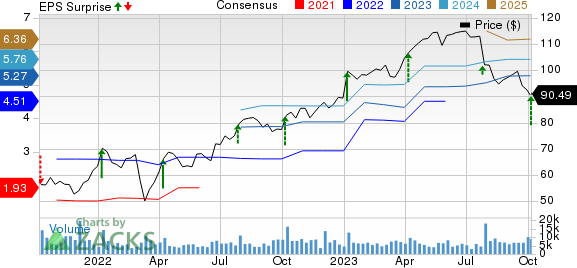

Lamb Weston Price, Consensus and EPS Surprise

Lamb Weston price-consensus-eps-surprise-chart | Lamb Weston Quote

Gross profit came in at $499.5 million, up $226.2 million from the year-ago quarter’s levels. Gross profit, excluding unrealized mark-to-market gains and losses related to commodity derivatives and items impacting comparability, grew by $213 million year over year. The upside can mainly be attributed to gains from pricing actions. However, increased costs on a per pound basis and lesser sales volumes, among others, were a concern. Increased costs per pound reflect mid-to-high-single-digit cost inflation for key inputs like raw potatoes, labor, ingredients including grains and starches, and energy.

Selling, general and administrative (SG&A) expenses escalated by $59.9 million to $176.2 million. Adjusted EBITDA jumped 76% to $412.8 million, courtesy of increased income from operations. We had expected the metric to increase 42.6% to $293.2 million in the quarter.

Segment Analysis

Sales in the North America segment increased 19% to $1,135.4 million. Price/mix grew 24% on the carryover benefit of pricing actions undertaken during fiscal 2023, favorable mix and the timing of trade spending. Reduced customer transportation charges somewhat offset these. Volume fell 5%, mainly due to management’s efforts to exit some businesses. Reduced shipments owing to inventory destocking by a few customers was also a concern. Adjusted EBITDA in the segment came in at $379.4 million, which jumped 64%.

In the International segment, sales increased 212% to $529.9 million. The price/mix advanced 18% and volumes jumped 194%. Adjusted EBITDA in the segment came in at $89.6 million, which jumped 171%.

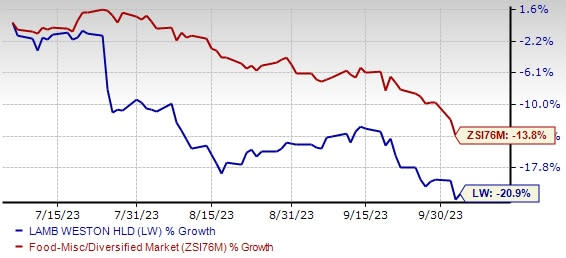

Image Source: Zacks Investment Research

Other Financial Details

The Zacks Rank #3 (Hold) company ended the quarter with cash and cash equivalents of $163.3 million, long-term debt and financing obligations (excluding the current portion) of $3,248.5 million and total shareholders’ equity of $1,503 million. The company generated $334.6 million as net cash from operating activities for the 13 weeks ended Aug 27, 2023.

Capital expenditures amounted to $304.7 million during the quarter. For fiscal 2024, the company expects cash to be used for capital expenditures in the band of $800-$900 million.

During this time, management paid out dividends worth $41 million. The company repurchased 992,365 shares for $100 million.

Guidance

For fiscal 2024, management now expects net sales in the range of $6.8-$7.0 billion. The guidance includes $1.1-$1.2 billion of sales attributed to the consolidation of LW EMEA. Earlier, the metric was envisioned in the range of $6.7-$6.9 billion, including $1-$1.1 billion of sales attributed to the consolidation of LW EMEA.

Net sales, excluding buyouts, are likely to grow 6.5-8.5%, mainly driven by pricing actions. Sales volumes are likely to come under pressure due to the company’s efforts to exit some lower-priced and lower-margin businesses. Due to macroeconomic headwinds, soft restaurant traffic trends in the U.S. and other key markets might be a headwind.

Lamb Weston expects SG&A expenses in the band of $765-$775 million. The company now expects net income in the range of $800-$870 million, compared with $725-$790 million expected earlier. Diluted earnings per share (EPS) are now envisioned in the range of $5.47-$5.92. Earlier, the metric was likely to come in the range of $4.95-$5.40.

Adjusted EBITDA is likely to come in the $1,540-$1,620 million range compared with $1,450-$1,525 million expected earlier. Management expects adjusted net income between $805 and $875 million. The company anticipated adjusted EPS of $5.50 to $5.95 during fiscal 2024.

Management expects interest expenses, net of approximately $155 million for fiscal 2024 and an effective tax rate of 23-24%. Further, it anticipates depreciation and amortization expenses of nearly $325 million.

Shares of the company have dropped 20.9% in the past three months compared with the industry’s 13.8% decline.

Top 3 Picks

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently flaunts a Zacks Rank #1 (Strong Buy). CELH delivered an earnings surprise of 100% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 170.3%, respectively, from the year-ago reported numbers.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Flowers Foods’ current financial year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2. KHC has a trailing four-quarter earnings surprise of 11.3%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 2.2% from the corresponding year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report