Lamb Weston (LW) Q2 Earnings Coming Up: Factors to Note

Lamb Weston Holdings, Inc. LW is likely to register top- and bottom-line growth when it reports second-quarter fiscal 2024 earnings on Jan 4. The Zacks Consensus Estimate for revenues is pegged at $1.7 billion, suggesting an increase of 32.8% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for the fiscal second-quarter bottom line has remained unchanged in the last 30 days at $1.40 per share. The projection indicates growth of 9.4% from the year-ago quarter’s reported figure.

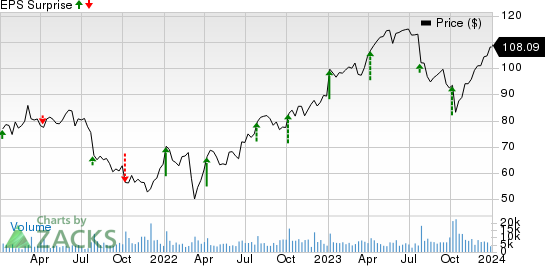

Lamb Weston has a trailing four-quarter earnings surprise of 46.2% on average. This frozen potato product company delivered an earnings surprise of 49.5% in the last reported quarter.

Lamb Weston Price and EPS Surprise

Lamb Weston price-eps-surprise | Lamb Weston Quote

Things To Note

Lamb Weston continues to reap benefits from an effective pricing scenario and a solid operating momentum. The company’s focus on improving supply chain productivity has been a primary growth driver. We expect price/mix to grow 10% in the second quarter of fiscal 2024.

Lamb Weston’s efforts to boost offerings and expand capacity enable the company to meet rising demand conditions for snacks and fries effectively. The company continues investing to boost commercial and information technology operations. The continuation of such aspects bodes well for the quarter under review.

That being said, soft volumes stemming from volatile restaurant traffic trends in the near term, thanks to high interest rates, inflation and uncertainty impacting consumers, remain a threat. Rising selling, general and administrative (SG&A) expenses are also a concern. We expect SG&A expenses, as a percentage of net sales, to increase 240 basis points year over year to 11% in the fiscal second quarter.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Lamb Weston this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Lamb Weston carries a Zacks Rank #3 and has an Earnings ESP of 0.00%.

Stocks With Favorable Combination

Here are three companies worth considering, as our model shows that these have the right elements to beat on earnings this time.

Colgate-Palmolive CL currently has an Earnings ESP of +2.12% and a Zacks Rank of 3. The company is likely to register top- and bottom-line increases when it reports fourth-quarter 2023 numbers. The Zacks Consensus Estimate for Colgate’s quarterly revenues is pegged at $4.9 billion, indicating a rise of 5.3% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Colgate’s quarterly earnings of 85 cents suggests an increase of 10.4% from the year-ago quarter’s levels. CL has a trailing four-quarter earnings surprise of 3.6%, on average.

Mondelez International MDLZ currently has an Earnings ESP of +1.52% and a Zacks Rank #3. The company is likely to register top-and-bottom-line growth when it reports fourth-quarter 2023 numbers. The Zacks Consensus Estimate for Mondelez’s quarterly revenues is pegged at $9.2 billion, indicating a rise of nearly 6% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Mondelez’s quarterly earnings of 76 cents suggests an increase of 4.1% from the year-ago quarter’s levels. MDLZ has a trailing four-quarter earnings surprise of 7.3%, on average.

Philip Morris PM has an Earnings ESP of +6.25% and a Zacks Rank #3. The company is likely to witness top-and-bottom-line growth when it reports fourth-quarter 2023 results. The Zacks Consensus Estimate for Philip Morris’ quarterly revenues is pegged at $8.9 billion, which suggests a rise of 9.5% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Philip Morris’ quarterly EPS has remained unchanged in the past 30 days at $1.48, calling for an increase of 6.5% from the year-ago quarter’s level. PM has a trailing four-quarter earnings surprise of 5.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report