Lamb Weston (LW) Readies for Q1 Earnings: Things to Consider

Lamb Weston Holdings, Inc. LW is likely to register top-and bottom-line growth when it reports first-quarter fiscal 2024 earnings on Oct 5. The Zacks Consensus Estimate for revenues is pegged at $1.59 billion, suggesting an increase of 41.6% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for the fiscal first-quarter bottom line has moved up by a penny in the past seven days to $1.09 per share. The projection indicates growth of 45.3% from the year-ago quarter’s reported figure.

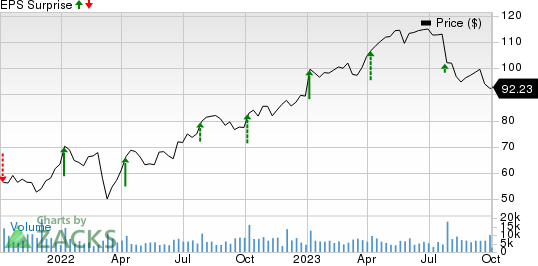

Lamb Weston has a trailing four-quarter earnings surprise of 44.8% on average. This frozen potato product company delivered an earnings surprise of 16.2% in the last reported quarter.

Lamb Weston Price and EPS Surprise

Lamb Weston price-eps-surprise | Lamb Weston Quote

Things To Consider

Lamb Weston’s efforts to boost offerings and expand capacity enable the company to meet rising demand conditions for snacks and fries effectively. The company continues investing to boost supply-chain, commercial and information technology operations. The continuation of such aspects bodes well for the quarter under review.

Yet, Lamb Weston is seeing soft demand owing to dynamic restaurant traffic trends and persistent macro pressures on the consumer. The company is also not immune to a rising inflationary environment.

Nevertheless, Lamb Weston has been benefiting from robust pricing actions that help counter input, manufacturing and transportation cost inflation. We expect price/mix to grow 28.5% in the first quarter of fiscal 2024.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Lamb Weston this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Lamb Weston carries a Zacks Rank #2 and has an Earnings ESP of -5.51%.

Stocks With Favorable Combination

Here are three companies worth considering, as our model shows that these have the right elements to beat on earnings this time.

Flowers Foods FLO currently has an Earnings ESP of +1.54% and carries a Zacks Rank #2. The company will likely register top-line growth when it reports second-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for FLO’s quarterly revenues is pegged at $1.2 billion, indicating a rise of 5.2% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Flowers Foods’ quarterly earnings per share of 28 cents suggests a drop of 6.7% from the year-ago quarter’s levels. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

Conagra Brands CAG currently has an Earnings ESP of +1.73% and a Zacks Rank of 3. The company is likely to register increases in the top and the bottom line when it reports first-quarter fiscal 2024 results. The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the last 30 days at 60 cents per share. The consensus estimate indicates 5.3% earnings growth from the year-ago quarter's reported number.

The Zacks Consensus Estimate for Conagra’s quarterly revenues is pegged at $2.95 billion, suggesting growth of 1.7% from the figure reported in the prior-year quarter. CAG has delivered an earnings surprise of 13.6%, on average, in the trailing four quarters.

Kellanova K has an Earnings ESP of +0.42% and a Zacks Rank of 3. The company is likely to register top-line growth when it reports third-quarter 2023 numbers. The Zacks Consensus Estimate for K’s quarterly revenues is pegged at $4.1 billion, indicating an increase of 2.8% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Kellogg’s quarterly earnings of 94 cents suggests a growth of 6.9% from the year-ago quarter’s levels. K has a trailing four-quarter earnings surprise of 9.7%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands (CAG) : Free Stock Analysis Report

Kellanova (K) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report