Lancaster Colony Corp (LANC) Posts Record Q2 Sales and Earnings

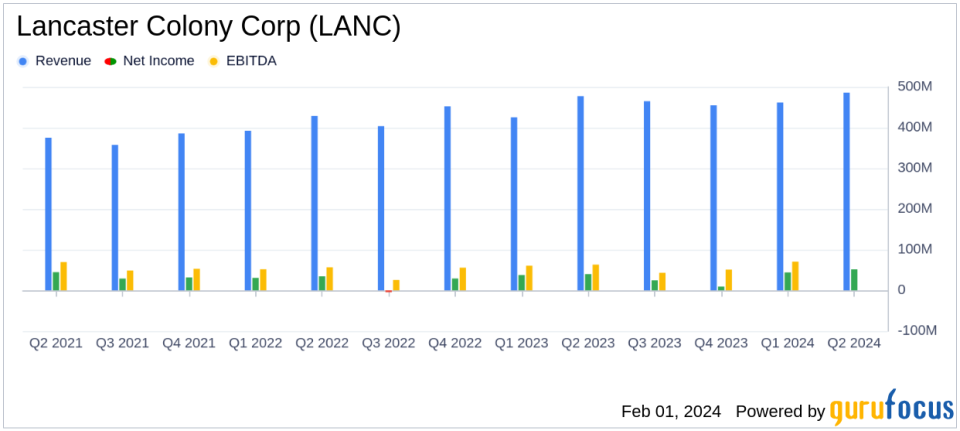

Net Sales: Increased by 1.8% to a record $485.9 million in Q2.

Gross Profit: Rose by 19.0% to a record $121.5 million in Q2.

Operating Income: Grew by 28.1% to a record $65.8 million in Q2.

Net Income: Reported at $1.87 per diluted share, up from $1.45 per diluted share last year.

Retail and Foodservice Segments: Retail net sales grew 2.0%; Foodservice net sales advanced 1.5%.

On February 1, 2024, Lancaster Colony Corp (NASDAQ:LANC) released its 8-K filing, announcing the financial results for the second quarter ended December 31, 2023. The company, a leading manufacturer and marketer of specialty food products, reported a record increase in consolidated net sales, gross profit, and operating income, signaling a strong performance despite the inflationary pressures that have challenged the industry.

Lancaster Colony Corp's Retail and Foodservice segments both contributed to the sales growth, with notable performance in products such as New York BRAND Bakery frozen garlic bread and Reames frozen egg noodles. The company's strategic pricing actions and cost savings initiatives played a significant role in the improved gross profit margin, which reached 25.0%, an increase of 360 basis points from the previous year.

Financial Highlights and Strategic Initiatives

The company's financial achievements, particularly in gross profit and operating income, are critical for sustaining growth in the competitive Consumer Packaged Goods industry. Lancaster Colony Corp's ability to navigate inflationary challenges and still deliver record profits is a testament to its robust pricing strategies and operational efficiencies. The company's focus on expanding its licensing program and driving volume growth through key product segments has also contributed to its strong financial position.

CEO David A. Ciesinski expressed satisfaction with the quarter's results, attributing the success to carryover pricing and volume gains from the company's licensing program. He also noted that deflationary pricing in the Foodservice segment posed a challenge, but the company expects continued volume growth and favorable pricing net of commodity costs in the upcoming quarter.

Comprehensive Financial Review

Analyzing the condensed consolidated statements of income, Lancaster Colony Corp's net sales for the three months ended December 31, 2023, were $485.9 million, a 1.8% increase from the previous year. The gross profit for the same period was $121.5 million, up 19.0%, while operating income rose by 28.1% to $65.8 million. Net income per diluted share increased to $1.87 from $1.45 in the prior year.

For the six months ended December 31, 2023, net sales were up 4.9% to $947.5 million, and net income totaled $95.4 million, or $3.47 per diluted share, compared to $77.6 million, or $2.81 per diluted share, in the previous year. The balance sheet reflects a solid financial position, with total assets amounting to $1.148 billion as of December 31, 2023.

"We were very pleased to complete the quarter with record sales and profit. Our reported gross profit margin improved to 25.0%, an increase of 360 basis points versus last year, which reflects favorable pricing net of commodity costs, or PNOC, following two years of unprecedented inflation, in addition to the positive impacts of our cost savings initiatives," said CEO David A. Ciesinski.

The company's financial performance is a key indicator of its ability to manage costs effectively and leverage its brand strength to maintain profitability. Investors and value-oriented readers of GuruFocus.com will find Lancaster Colony Corp's disciplined approach to cost management and strategic growth initiatives to be of particular interest.

For further details on Lancaster Colony Corp's financial performance, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Lancaster Colony Corp for further details.

This article first appeared on GuruFocus.