Lancaster Colony (NASDAQ:LANC) Misses Q2 Sales Targets

Specialty food company Lancaster Colony (NASDAQ:LANC) fell short of analysts' expectations in Q2 FY2024, with revenue up 1.8% year on year to $485.9 million. It made a GAAP profit of $1.87 per share, improving from its profit of $1.45 per share in the same quarter last year.

Is now the time to buy Lancaster Colony? Find out by accessing our full research report, it's free.

Lancaster Colony (LANC) Q2 FY2024 Highlights:

Market Capitalization: $5.06 billion

Revenue: $485.9 million vs analyst estimates of $493.3 million (1.5% miss)

EPS: $1.87 vs analyst estimates of $1.65 (13.1% beat)

Gross Margin (GAAP): 25%, up from 21.4% in the same quarter last year

Sales Volumes were down 1.9% year on year

CEO David A. Ciesinski commented, “We were very pleased to complete the quarter with record sales and profit. In addition to carryover pricing, Retail segment net sales growth of 2.0% was driven by volume gains for our successful licensing program, continued strong performance for our New York BRAND® Bakery frozen garlic bread and increased demand for our Reames® frozen egg noodles. In the Foodservice segment, sales growth of 1.5% was led by higher demand from several of our national chain restaurant accounts along with volume growth for our branded Foodservice products. It is worth noting that, during the period, Foodservice segment sales were adversely impacted by deflationary pricing.”

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ:LANC) sells bread, dressing, and dips to the retail and food service channels.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Lancaster Colony carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Lancaster Colony can still achieve high growth rates because its revenue base is not yet monstrous.

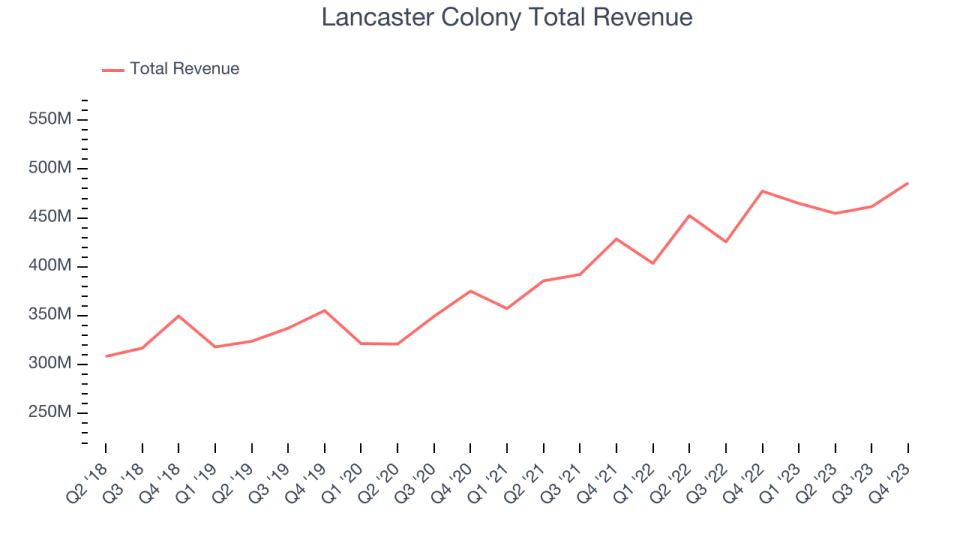

As you can see below, the company's annualized revenue growth rate of 11% over the last three years was decent for a consumer staples business.

This quarter, Lancaster Colony's revenue grew 1.8% year on year to $485.9 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Key Takeaways from Lancaster Colony's Q2 Results

We were impressed by beats on the gross and operating margin lines, leading to a nice EPS beat. On the other hand, its revenue unfortunately missed analysts' expectations. Overall, we think this was a mixed but solid quarter that should satisfy shareholders. The stock is up 1.2% after reporting and currently trades at $185.9 per share.

So should you invest in Lancaster Colony right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.