Landmark Bancorp Inc (LARK) Reports Solid Earnings Growth and Declares Dividend

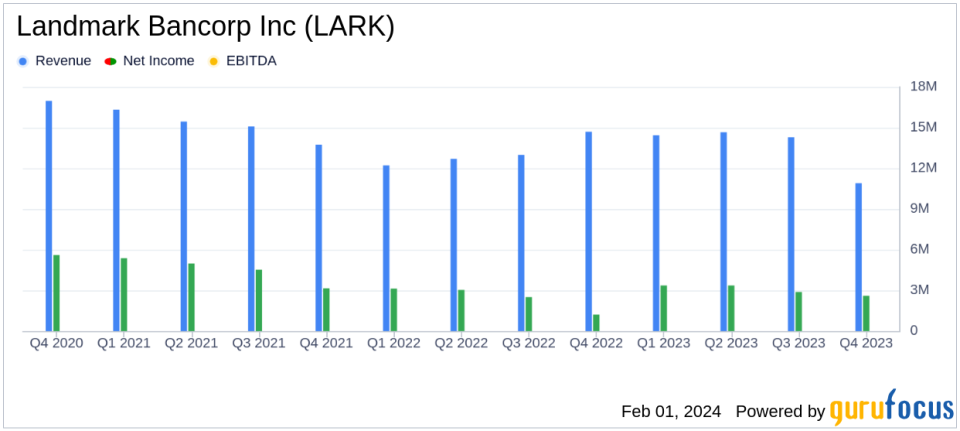

Quarterly Earnings: Landmark Bancorp Inc (NASDAQ:LARK) reported Q4 diluted EPS of $0.48, a decrease from $0.53 in Q3 but an increase from $0.22 in the same quarter last year.

Annual Performance: For the year ended December 31, 2023, diluted EPS totaled $2.23, up from $1.79 in 2022, with net earnings growing by 23.9% to $12.2 million.

Net Interest Income: Q4 net interest income increased by 2.4% to $10.9 million, with a net interest margin of 3.11%.

Dividend Declaration: A cash dividend of $0.21 per share will be paid on February 28, 2024, to shareholders of record as of February 14, 2024.

Balance Sheet Strength: Gross loans increased by 4.8% annualized, with a loan to deposit ratio of 71.3%, indicating ample liquidity for future loan growth.

Asset Quality: The allowance for credit losses stood at 1.12% of period-end gross loans, with solid credit quality maintained.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 31, 2024, Landmark Bancorp Inc (NASDAQ:LARK) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The bank holding company for Landmark National Bank, which operates across 24 communities in Kansas, reported a decrease in quarterly earnings per share (EPS) to $0.48 from $0.53 in the third quarter of 2023, but a significant increase from $0.22 in the same quarter of the previous year. The net earnings for the fourth quarter amounted to $2.6 million, compared to $2.9 million in the prior quarter and $1.2 million in the fourth quarter of 2022.

The company's performance for the full year was notably strong, with diluted EPS totaling $2.23 compared to $1.79 during 2022, and net earnings totaling $12.2 million, up 23.9% from the previous year. This growth was primarily driven by increased net interest income and controlled expenses.

Financial Highlights and Challenges

Landmark Bancorp Inc (NASDAQ:LARK) experienced growth in deposits and loans, particularly in residential mortgage and agriculture loans. The company's net interest income for the quarter was $10.9 million, a 2.4% increase from the prior quarter, with a net interest margin of 3.11%. However, non-interest income decreased by $1.4 million compared to the third quarter of 2023, mainly due to losses on sales of investment securities. Non-interest expense saw a decline, benefiting from the absence of acquisition costs incurred in the previous year.

The bank's credit quality remains robust, with net loan charge-offs of $362,000 in the fourth quarter of 2023 compared to net loan charge-offs of $67,000 in the fourth quarter of 2022 and net loan recoveries of $521,000 in the third quarter of 2023. The ratio of net loan charge-offs to loans totaled 0.15% this quarter, remaining low.

Dividend and Shareholder Value

Reflecting its financial strength and commitment to shareholder value, Landmark's Board of Directors declared a cash dividend of $0.21 per share, to be paid on February 28, 2024, to common stockholders of record as of February 14, 2024. Additionally, the company distributed a 5% stock dividend to common shareholders, marking the 23rd consecutive year for such a dividend.

Balance Sheet and Income Statement Analysis

Landmark Bancorp Inc (NASDAQ:LARK) reported a solid balance sheet with gross loans totaling $948.7 million, an increase from the previous quarter. The loan to deposit ratio was 71.3%, indicating the bank's strong liquidity position. The bank's investment securities portfolio saw a decrease in unrealized net losses, reflecting improved market conditions.

President and CEO Michael E. Scheopner commented on the results, highlighting the bank's ability to grow deposits, reduce investment securities, and fund continued loan growth despite the challenges posed by rapidly rising interest rates earlier in the year.

"While the banking industry has been challenged this year through the third quarter with rapidly rising interest rates, in the fourth quarter the Federal Reserve started to stabilize short-term rates and long-term interest rates declined. This enabled us to grow deposits, reduce investment securities and fund continued loan growth," said Scheopner.

Landmark Bancorp Inc (NASDAQ:LARK) continues to demonstrate its resilience and strategic management in a challenging economic environment. The company's solid financial performance, coupled with its commitment to maintaining a strong balance sheet and credit quality, positions it well for continued success in the future.

Explore the complete 8-K earnings release (here) from Landmark Bancorp Inc for further details.

This article first appeared on GuruFocus.