Landsea Homes Corp (LSEA) Reports Robust Order Growth and Solid Full Year Earnings for 2023

Net New Home Orders: Increased by 352% in Q4, signaling strong demand.

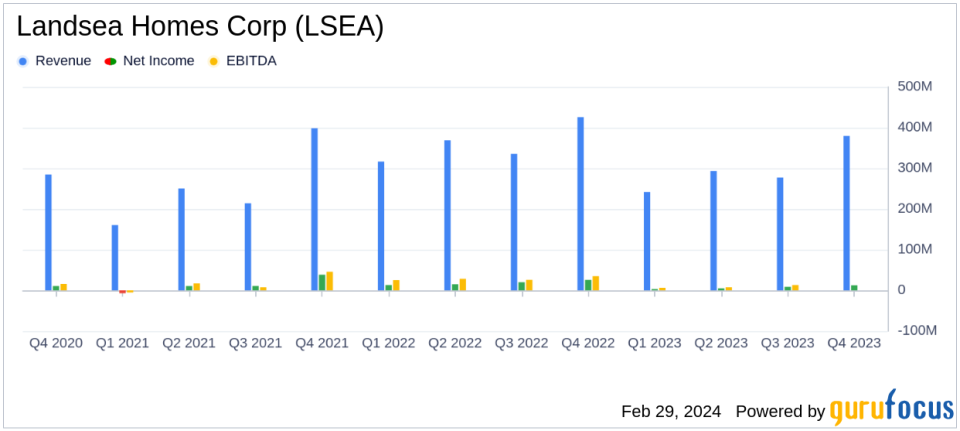

Full Year Revenue: Total revenue of $1.21 billion for the year.

Q4 Home Sales Revenue: $379.7 million, with 664 home closings at an average price of $572,000.

Q4 Net Income: $12.5 million, or $0.33 per diluted share.

Full Year Net Income: $29.2 million, or $0.75 per diluted share.

Book Value Per Share: Increased to $17.88, up 11.4% from year-end 2022.

Market Expansion: Entry into the Colorado market and a definitive agreement to acquire Antares Homes.

On February 29, 2024, Landsea Homes Corp (NASDAQ:LSEA) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The homebuilding company, which operates in several key U.S. markets including Arizona, California, Florida, Metro New York, and Texas, reported a significant increase in net new home orders and a solid net income for the year.

Financial Performance and Challenges

Landsea Homes saw a remarkable 352% increase in net new home orders in Q4, a clear indicator of robust demand for their homes. However, the company faced challenges with a 7% decrease in total revenue to $397.6 million in Q4 compared to the same period in 2022, primarily due to increased financing incentives and geographic mix changes. The full year revenue also saw a decrease of 16% to $1.2 billion compared to the previous year, largely driven by the same factors.

Despite these challenges, the company's net income for Q4 was reported at $12.5 million, or $0.33 per diluted share, and the full year net income was $29.2 million, or $0.75 per diluted share. This performance is critical as it demonstrates the company's ability to maintain profitability in a competitive and changing market landscape.

Financial Achievements and Industry Importance

Landsea Homes' financial achievements, including the growth in net new orders and the expansion into the Colorado market, underscore the company's strategic positioning and operational efficiency. The increase in book value per share to $17.88, representing an 11.4% increase, is particularly important for investors as it reflects the company's growing assets and shareholder value.

These achievements are significant in the real estate industry, where market presence and the ability to adapt to consumer needs are key drivers of success. Landsea Homes' focus on sustainable and high-performance homes aligns with current market trends towards environmentally friendly living spaces.

Key Financial Metrics

Landsea Homes reported a home sales gross margin of 15.9% in Q4 of 2023, a decrease from 19.0% in the prior year period. The adjusted home sales gross margin, a non-GAAP measure, also decreased to 20.8% compared to 23.4% in Q4 of 2022. The company ended the year with 11,176 lots owned and controlled, representing approximately 5 years of supply based on 2023 home closings.

As of December 31, 2023, the company had total liquidity of $431.3 million, with a debt to capital ratio of 44.1% and a net debt to total capital ratio of 30.4%. These metrics are crucial as they provide insights into the company's financial health and its ability to fund future growth.

Management Commentary

"Landsea Homes ended 2023 on a strong note, as the company posted healthy profits and a significant year-over-year increase in net new orders in the fourth quarter," said John Ho, Landsea Homes Chief Executive Officer. "We believe these achievements make us better equipped to succeed as a public homebuilder and will bear fruit well into the future."

2024 Outlook and Strategic Positioning

Looking ahead to 2024, Landsea Homes anticipates new home deliveries to be in the range of 2,500 to 2,900 with delivery ASPs expected to be between $500,000 to $525,000. The company expects home sales gross margins between 17% and 18% on a GAAP basis and between 21% and 23% on an adjusted basis.

With a strong market positioning and the appeal of its High Performance Homes, Landsea Homes is well-positioned to capitalize on favorable homebuilding fundamentals. The company's asset-light land portfolio and entry-level focus are expected to generate improving returns on capital, setting a positive tone for the future.

For more detailed information on Landsea Homes Corp's financial results, including the full balance sheets and statements of operations, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Landsea Homes Corp for further details.

This article first appeared on GuruFocus.