Landstar (LSTR) Q3 Earnings Beat Estimates, Revenues Lag

Landstar System, Inc. (LSTR) third-quarter 2023 earnings per share (EPS) of $1.71 beat the Zacks Consensus Estimate by a penny but fell 38% year over year. Revenues of $1,289.34 million lagged the Zacks Consensus Estimate of $1,296.5 million but declined 29% year over year.

Operating income fell 39.8% from the prior-year quarter’s figure to $80.34 million. Total costs and expenses (on a reported basis) decreased 27.9% to $1,212.01 million.

Total revenues in the truck transportation segment, contributing to 91% of the top line, amounted to $1.17 billion, down 26.5% from the year-ago quarter’s figure. Rail intermodal revenues of $23.06 million decreased 16.5% from the figure recorded in third-quarter 2022.

Revenues in the ocean and air-cargo carrier segments declined 59.9% year over year to $65.82 million. Other revenues increased 4.8% to $26.69 million.

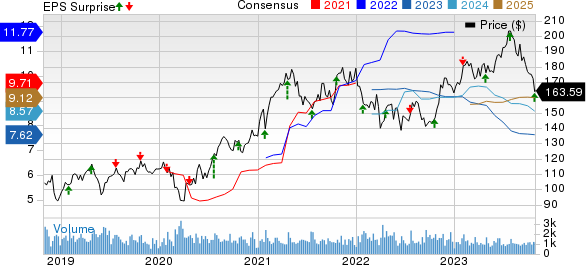

Landstar System, Inc. Price, Consensus and EPS Surprise

Landstar System, Inc. price-consensus-eps-surprise-chart | Landstar System, Inc. Quote

Liquidity, Dividends & Buyback

At the end of third-quarter 2023, Landstar had cash and cash equivalents of $439.66million compared with $360.52million recorded at the prior-quarter end. Additionally, long-term debt (excluding current maturities) totaled $46.17 million at the end of the third quarter compared with $53.14 million at the second-quarter end.

LSTR is currently authorized to purchase up to 2,910,339 shares under its previously announced share purchase programs. LSTR’s board of directors has declared a quarterly dividend of 33 cents per share, payable on Dec 1, 2023, to stockholders of record as of the close of business on Nov 7.

Q4 Outlook

Landstar anticipates fourth-quarter 2023 revenues in the range of $1.225 billion-$1.275 billion. EPS for the fourth quarter is estimated to be between $1.60 and $1.70. LSTR expects fourth-quarter effective income tax rate of 24.5%.

Currently, Landstar carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT third-quarter 2023 EPS of $1.80 missed the Zacks Consensus Estimate of $1.85 and declined 30% year over year.

JBHT’s total operating revenues of $3,163.8 million also lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year.

Delta Air Lines, Inc. (DAL) reported third-quarter 2023 EPS (excluding 31 cents from non-recurring items) of $2.03, which comfortably beat the Zacks Consensus Estimate of $1.92 and improved 35% on a year-over-year basis.

DAL’s revenues of $15,488 million beat the Zacks Consensus Estimate of $15,290.4 million and increased 11% on a year-over-year basis, driven by higher air travel demand.

Alaska Air Group, Inc. ALK reported third-quarter 2023 EPS of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year.

Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line jumped 0.4% year over year, with passenger revenues accounting for 92.2% of the top line and increasing 0.1% owing to continued recovery in air-travel demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report