Landstar’s Q4 in line; Q1 outlook disappoints

Freight broker Landstar System’s fourth quarter was largely as expected, but its outlook for the first quarter was well below analysts’ expectations.

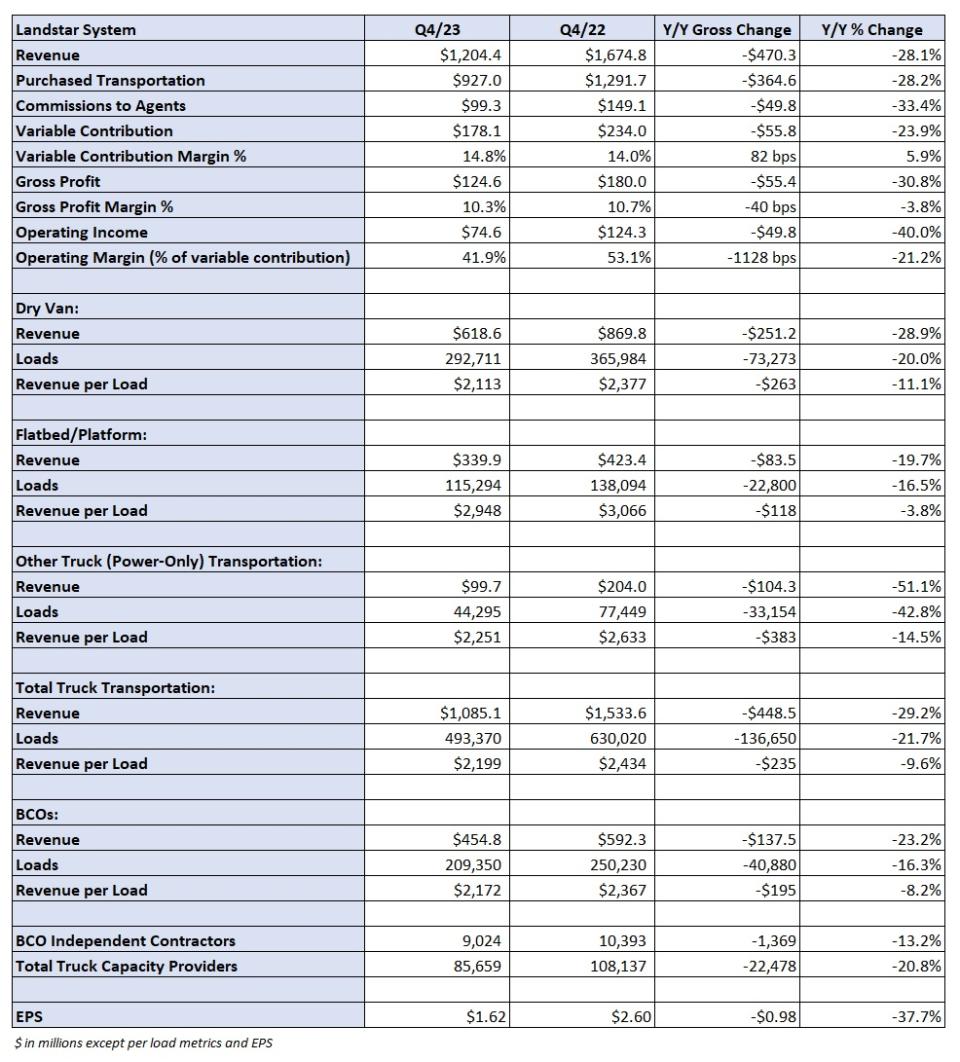

Landstar (NASDAQ: LSTR) reported fourth-quarter earnings per share of $1.62 Wednesday after the market closed. The result was in line with the consensus estimate but nearly $1 lower year over year (y/y). The company closes its books on the last Saturday of the year, which resulted in an extra operating week in the year-ago quarter.

Total revenue of $1.2 billon was 28% lower y/y and worse than management’s guidance. Landstar said the extra week equated to $65 million in revenue last year.

Total loads hauled by trucks were down 22% y/y in the quarter but in line with guidance. Revenue per load was down 9.6%, 260 basis points worse than the midpoint of management’s guidance range.

“The continuation of soft demand, driven by continued weakness in the U.S. manufacturing sector and a weaker than typical peak season, plus the continuation of a loose truck capacity market drove Landstar’s truck revenue per load and volumes in the 2023 fourth quarter below prior year levels,” Jim Gattoni, president and CEO, stated in a news release.

The company is seeing the normal seasonal sequential step-down in demand so far in 2024.

Landstar expects revenue for the first quarter to be in a range of $1.1 billion to $1.15 billion, a 22% y/y decline at the midpoint of the range. Loads hauled by truck are expected to decline between 14% and 16%, with revenue per load down by 8% to 10%. The company is calling for first-quarter EPS of $1.25 to $1.35, well short of the $1.63 estimate at the time of the print.

Variable contribution, or revenue less purchased transportation and commissions, fell 24% y/y to $178 million. The contribution margin improved 80 bps to 14.8% as purchased transportation expenses as a percentage of revenue declined modestly.

The company generated $394 million in cash flow from operations in 2023, a 37% y/y decline.

Landstar will host a call on Thursday at 8 a.m. EST to discuss fourth-quarter results with analysts.

More FreightWaves articles by Todd Maiden

The post Landstar’s Q4 in line; Q1 outlook disappoints appeared first on FreightWaves.