Landstar sees continuation of soft freight market in Q4

Broker Landstar System reported an in-line third-quarter result Wednesday after the market closed. However, its fourth-quarter outlook was light of expectations.

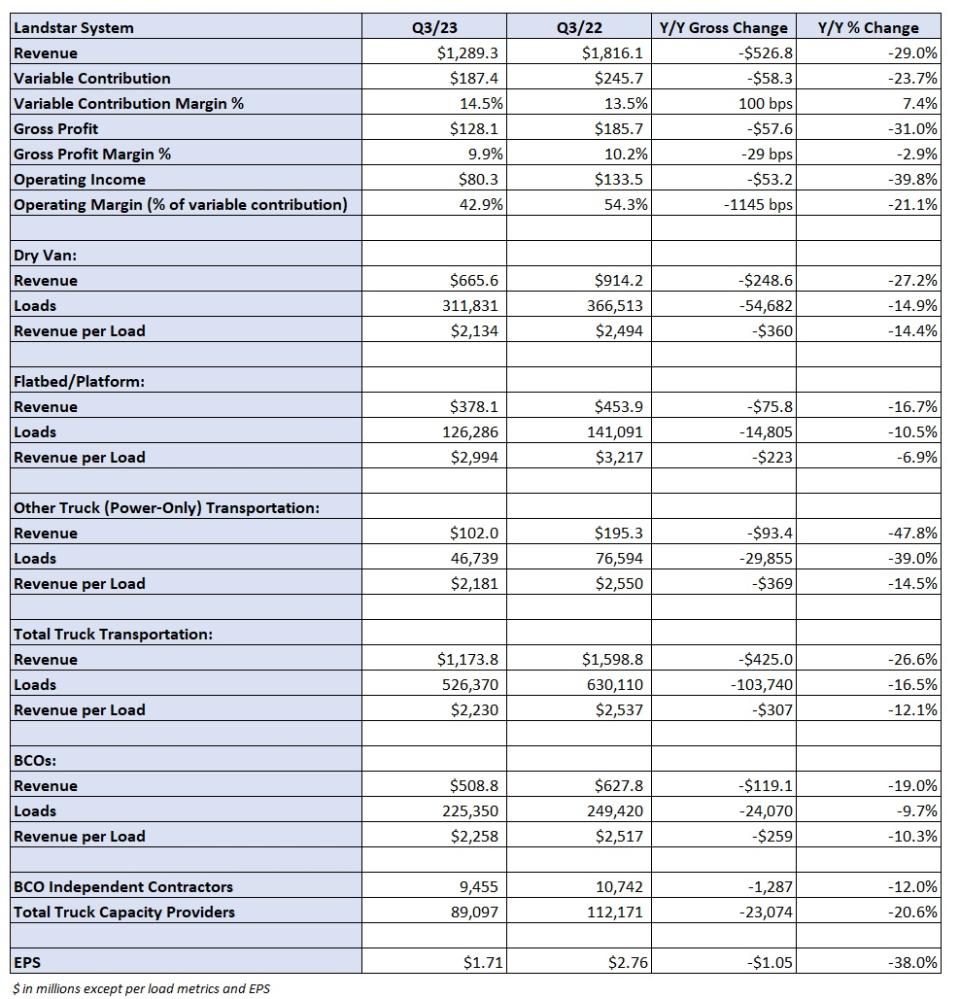

Landstar (NASDAQ: LSTR) reported third-quarter earnings per share of $1.71, in line with the consensus estimate but $1.05 lower year over year (y/y). The company reported a 29% y/y decline in total revenue to $1.289 billion. Both results were near the middle of management’s guidance ranges.

Total truck transportation revenue was off 27% y/y as loads fell 17% and revenue per load was down 12%. Landstar saw modest degradation in trends when compared to the second quarter. Loads were down 6% sequentially and revenue per load was off just slightly.

“Lackluster demand, driven by continued weakness in the U.S. manufacturing sector and the ongoing impact of an inflation-challenged consumer goods sector, plus the continuation of a loose truck capacity market drove Landstar’s truck revenue per load and volumes in the 2023 third quarter below prior year levels,” Jim Gattoni, president and CEO, stated in a news release.

The company’s guidance for the fourth quarter was worse than expected. Loads hauled by truck are underperforming seasonality so far in October, with revenue per load “reasonably in-line with these historical, pre-pandemic sequential patterns,” Gattoni said.

The company is calling for fourth-quarter revenue of $1.225 billion to $1.275 billion, which was lower than the consensus estimate of $1.37 billion at the time of the print. Loads hauled by truck are expected to decline 20% to 22% y/y, and revenue per load is expected to decline 6% to 8%. The guidance assumes a muted peak season and accounts for one fewer operating week in the 2023 fourth quarter than in the same period last year.

At the midpoint of the ranges, the new guidance implies loads will be 5% lower than in the third quarter but revenue per load will increase 1.5% sequentially.

Fourth-quarter EPS is forecast to a range of $1.60 to $1.70, which was below the $1.84 consensus estimate.

Total truck capacity on Landstar’s platform fell 9% from the second quarter to fewer than 90,000 carriers. Trucks provided by the company’s business capacity owners moved 3% lower sequentially.

Variable contribution, or revenue less purchased transportation and commissions, fell 24% y/y to $187 million. The contribution margin improved 100 basis points to 14.5% as purchased transportation expenses as a percentage of revenue declined 150 bps.

The company has generated $304 million in free cash flow year to date, which is 30% lower than the same period last year. It reduced its debt-to-capital ratio 400 bps y/y to 7% in the quarter.

Landstar will host a call on Thursday at 8 a.m. EDT to discuss third-quarter results.

More FreightWaves articles by Todd Maiden

The post Landstar sees continuation of soft freight market in Q4 appeared first on FreightWaves.