Lantheus Holdings Is Charting a Path to Sustainable Growth and Value

Lantheus Holdings Inc. (NASDAQ:LNTH) is one of the leading companies in the global medical imaging and radiopharmaceuticals markets, whose products are widely used by health care professionals to detect and characterize cardiovascular diseases and oncology.

Investment thesis

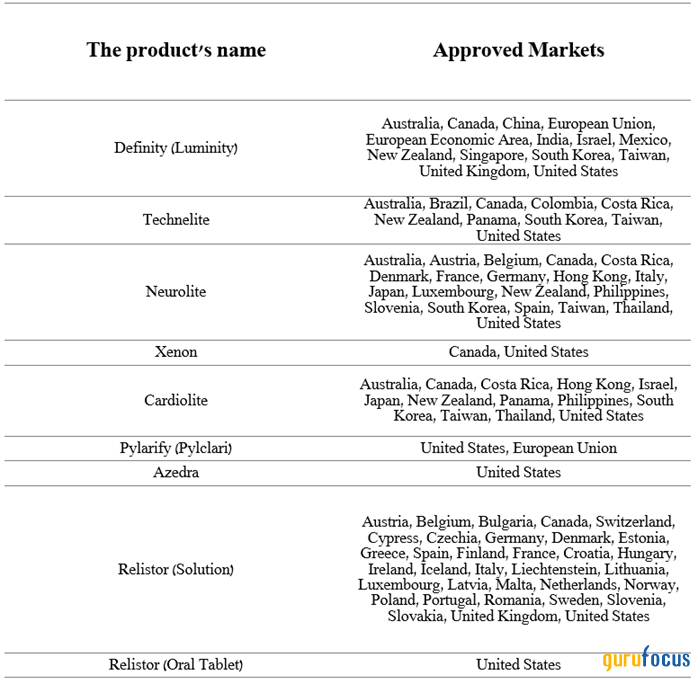

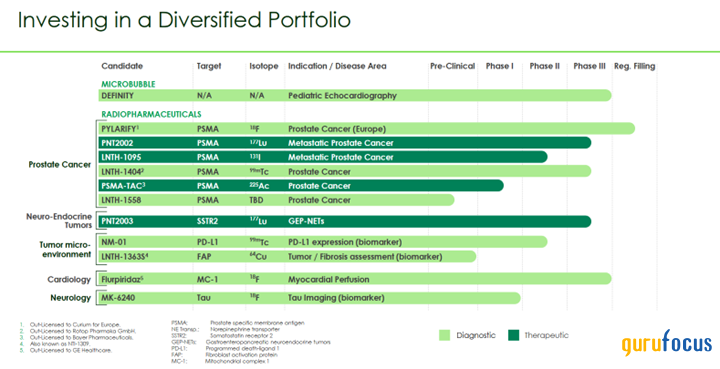

Lantheus Holdings has an extensive portfolio of products, unlike many companies in the pharmaceutical industry, which allows it to diversify its sources of free cash flow and ultimately reduce the negative impact of various challenges.

Author's elaboration, based on 10-K and 10-Q filings.

Thanks to the successful implementation of effective strategies introduced by Mary Anne Heino, the company has improved its ability to adapt to changing market conditions and significantly strengthened its competitiveness on the global stage.

Furthermore, unlike many mid-capitalization stocks, Lantheus Holdings continues to trade at significantly lower multiples, which is one of the factors indicating the potential for growth in the share price in the future, given its revenue growth and the publication of the results of the Phase 3 clinical trial in the fourth quarter of 2023, which assesses the efficacy and safety profile of PNT2002.

PNT2002 is an investigational drug for the treatment of metastatic castration-resistant prostate cancer (mCRPC). It is being developed jointly with POINT Biopharma (NASDAQ:PNT), which was recently acquired by Eli Lilly (NYSE:LLY) for about $1.4 billion.

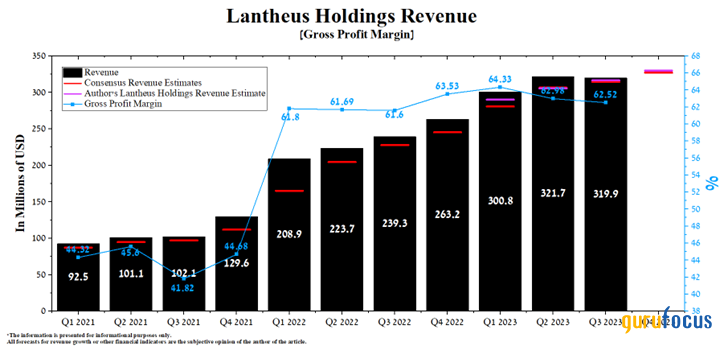

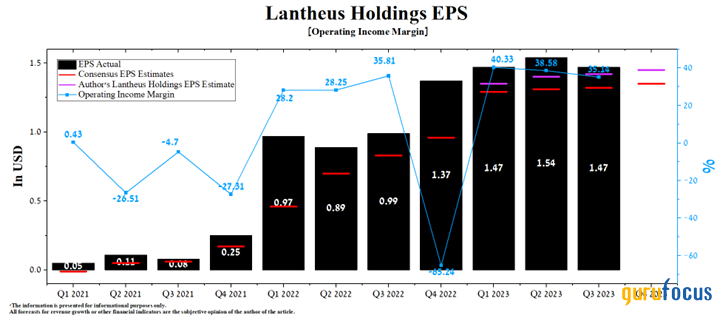

On Nov. 2, the company released financial results for the third quarter of 2023, which continue to surprise positively even as competition in the global nuclear medicine market intensifies. The company's revenue amounted to $319.9 million, an increase of 33.6% compared to the third quarter of 2022. Besides, its non-GAAP earnings of $1.47 per share was 15 cents above analysts' consensus estimates. Meanwhile, Lantheus Holdings' management increased its adjusted diluted earnings guidance for the full year from a range of $5.60 to $5.70 to $5.80 to $5.85 due to growing demand for radiopharmaceutical oncology products.

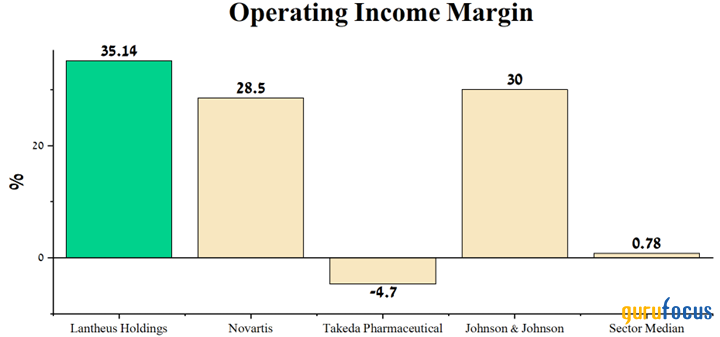

In addition to the company's extensive portfolio of product candidates, another investment thesis is its extremely high operating income margin, which was 35.14% for the third quarter, outperforming its competitors in the health care sector, such as Novartis (NYSE:NVS), Johnson & Johnson (NYSE:JNJ) and Takeda Pharmaceutical (NYSE:TAK).

Author's elaboration, based on Seeking Alpha data.

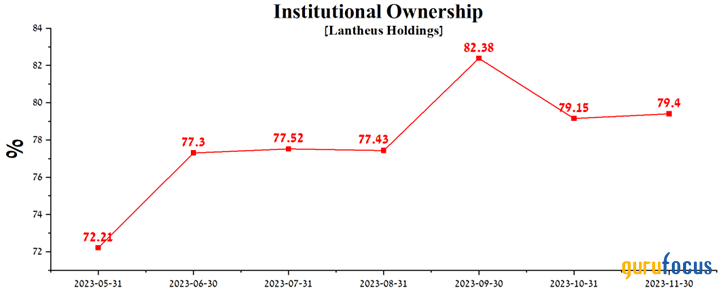

Many of Lantheus Holdings' institutional investors continue to purchase shares, with their stake in the company up 7.19% over the past six months, indicating increased confidence in its development strategy and the commercial prospects of its products, which have the potential to enhance its leading position in the market significantly.

Author's elaboration, based on GuruFocus data.

We initiate our coverage of Lantheus Holdings with an "outperform" rating for the next 12 months.

The current financial position and outlook of Lantheus Holdings

Lantheus Holdings' revenue for the third quarter of 2023 was $319.9 million, exceeding our expectations by about $3.4 million and, more importantly, up 33.6% year over year.

Moreover, the company's actual revenue beat analysts' consensus estimates over the last 10 quarters, which is one factor indicating Mr. Market's continued conservative assessment of the commercial prospects for its precision diagnostics and radiopharmaceutical oncology products, even as demand for them continues to rise year over year.

The radiopharmaceutical-focused company is anticipated to release its fourth-quarter 2023 financial results on Feb. 23. According to Seeking Alpha, Lantheus Holdings' revenue for the quarter is expected to range from $322 million to $335 million, up 24.3% year over year.

Author's elaboration, based on GuruFocus data.

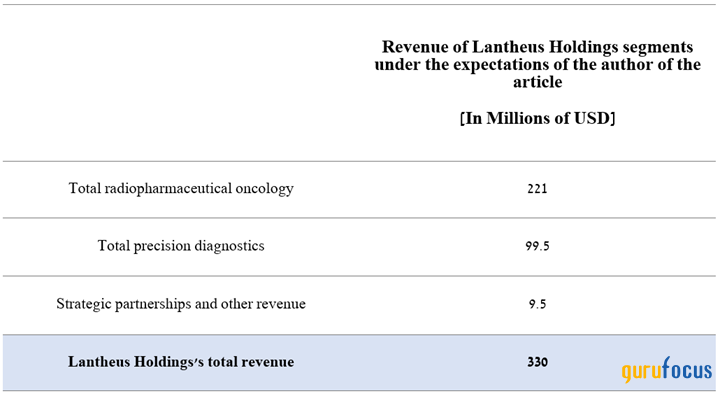

On the other hand, we expect the company's total revenue to reach $330 million for the three months ended Dec. 31, about $3 million above the median of analysts' range, mainly due to growth in sales of its key products such as Pylarify, TechneLite and Definity.

Created by author.

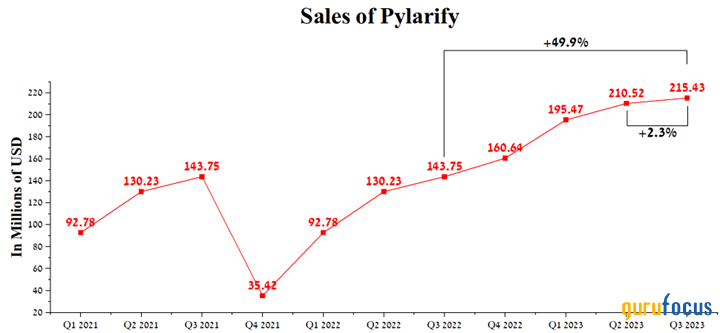

Pylarify has been a crucial product driving Lantheus Holdings' revenue growth in recent quarters. Pylarify (piflufolastat F 18), a radioactive medicine, was approved by the Food and Drug Administration on May 27, 2021 for the detection and imaging of PSMA-positive lesions in men with prostate cancer. Additionally, on July 28, 2023, piflufolastat F18 received the green light from the European Medicines Agency for the detection of prostate cancer cells with prostate-specific membrane antigen (PSMA), which are highly expressed in this part of the body relative to others.

Unlike conventional imaging, the combination of Lantheus Holdings' product with emission tomography/computed tomography (PET/CT) scanners allows a more precise determination of the location of prostate cancer, which ultimately allows the patient's physician to choose the most objective and effective treatment plan.

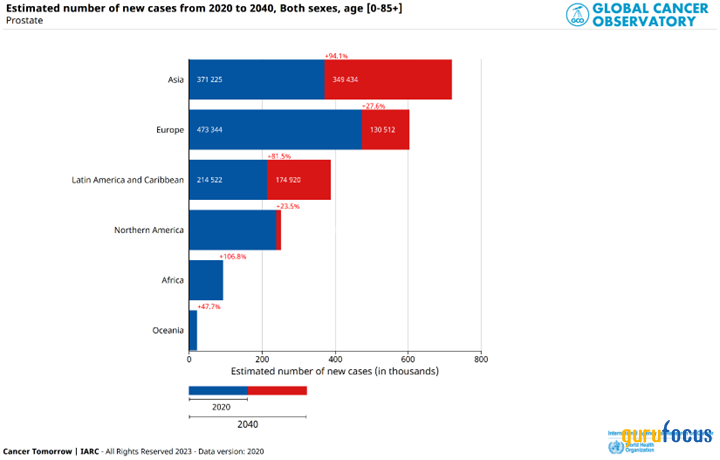

Prostate cancer is one of the most common male malignancies in the world and the second leading cause of cancer death among men in the United States.

According to the Global Cancer Observatory, the number of new cases of prostate cancer will be 603,900 by 2040, an increase of 27.6% compared to 2020. Ultimately, there will be a positive impact on the demand for Pylarify, which dramatically simplifies the visualization of the extent and location of the tumor.

Global Cancer Observatory - IARC

Pylarify sales were approximately $215.4 million for the three months ended Sept. 30, an increase of 49.9% from the prior year, driven by new patient growth in the United States, its recent approval in Europe and its higher specificity and sensitivity relative to competitors in the global prostate cancer diagnostics market.

Author's elaboration, based on quarterly securities reports.

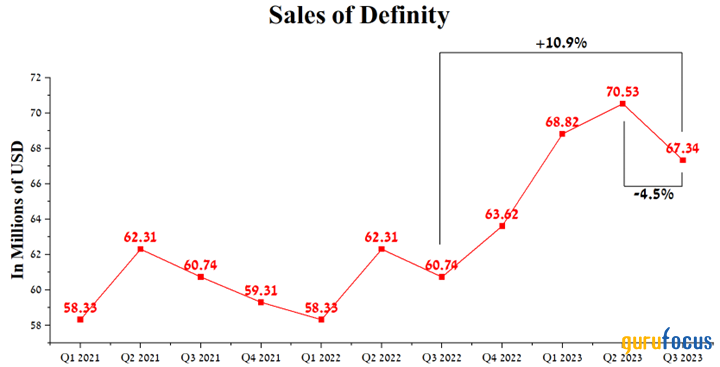

An equally important product for the company's financial position is Definity (perflutren lipid microsphere), approved by regulators to enhance the endocardium during echocardiography, which is an ultrasonic scan to examine the heart and nearby blood vessels. According to the CDC, direct and indirect costs of cardiovascular disease cost the United States hundreds of billions of dollars each year.

Source: Centers for Disease Control and Prevention (CDC)

Definity sales were $67.3 million in the third quarter, an increase of 10.9% year over year. On the other hand, the company's product sales declined quarter on quarter due to increased competition from GE Healthcare and Bracco and the impact of seasonal factors observed in recent years.

Author's elaboration, based on quarterly securities reports.

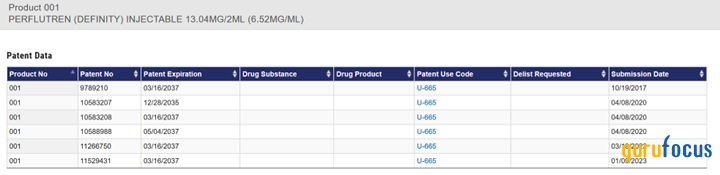

However, Definity's latest method of use patent will remain in effect until 2037, providing continued protection against the launch of its generics and allowing it not to lose its share in the global contrast-enhanced ultrasound market.

Source: U.S. Food and Drug Administration

Lantheus Holdings' operating income margin was 35.14% for the three months ended Sept. 30, 2023, down slightly from the previous year. However, we expect this financial metric to reach 37% for 2023 and increase to 38.2% by 2024, mainly due to the weakening of the U.S. dollar against the euro, increased sales of Pylarify and lower costs of raw materials and components needed to produce its diagnostic imaging products. These factors partially offset the expected increase in the company's research and development expenses caused by the ongoing phase III clinical trials.

Lantheus Holdings presentation

On the other hand, according to Seeking Alpha, the company's fourth-quarter earnings per share are expected to be $1.30 to $1.38, 2.3% higher than analysts' expectations for the previous quarter. Meanwhile, we expect Lantheus Holdings' earnings to reach $1.45 per share, up 5.8% year over year, partly due to management's use of a share repurchase program.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

Lantheus Holdings' trailing 12-month non-GAAP price-earnings ratio is 13, which is 28.61% lower than the sector average and 64.26% lower than the average over the past five years. Simultaneously, its forward non-GAAP price-earnings ratio is 13.03. Given the company's relatively high revenue growth and the beginning of interest rate cuts by the Federal Reserve in 2024, Lantheus Holdings offers an attractive risk-reward opportunity for long-term investors.

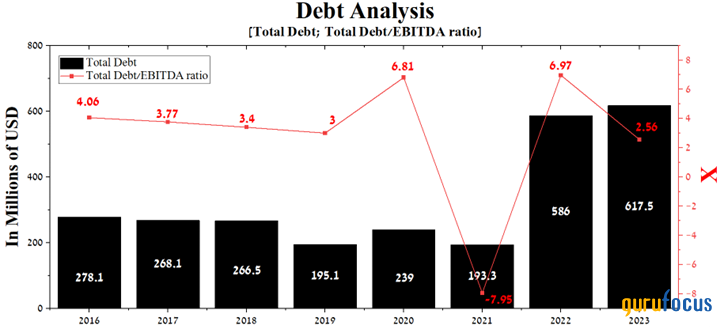

At the end of September, the company's total debt was approximately $617.5 million, a significant increase from 2021 as a result of the issuance of $575 million aggregate amount of senior notes due 2027.

Author's elaboration, based on GuruFocus and Seeking Alpha

At the same time, thanks to the significant growth in the company's free cash flow year over year, we do not expect it to have difficulties servicing its debt.

Conclusion

Lantheus Holdings is one of the leading companies in the global medical imaging and radiopharmaceuticals markets, whose products are widely used by health care professionals to detect and characterize cardiovascular diseases and oncology.

Key risks that could adversely affect the company's financial position include potential failures in developing its innovative experimental medicines, dependence on a limited number of third-party suppliers of Mo-99 used to manufacture TechneLite and the negative impact of the Inflation Reduction Act.

On the other hand, Lantheus Holdings is a leader in the global precision diagnostics market, with a rich pipeline and many partnerships with health care giants such as GE HealthCare, Bayer (XTER:BAYN), Novartis and Regeneron Pharmaceuticals (NASDAQ:REGN). These factors, coupled with the imminent publication of the results of a phase 3 clinical trial evaluating the efficacy and safety profile of PNT2002, are the main investment theses we highlight.

We initiate our coverage of Lantheus Holdings with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.