Large-format Grocery & General Merchandise Retailer Stocks Q2 In Review: BJ's (NYSE:BJ) Vs Peers

Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q2 now behind us, let’s have a look at BJ's (NYSE:BJ) and its peers.

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

The 4 large-format grocery & general merchandise retailer stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 0.76%, Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but large-format grocery & general merchandise retailer stocks held their ground better than others, with share prices down 2.13% since the previous earnings results, on average.

Weakest Q2: BJ's (NYSE:BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE:BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

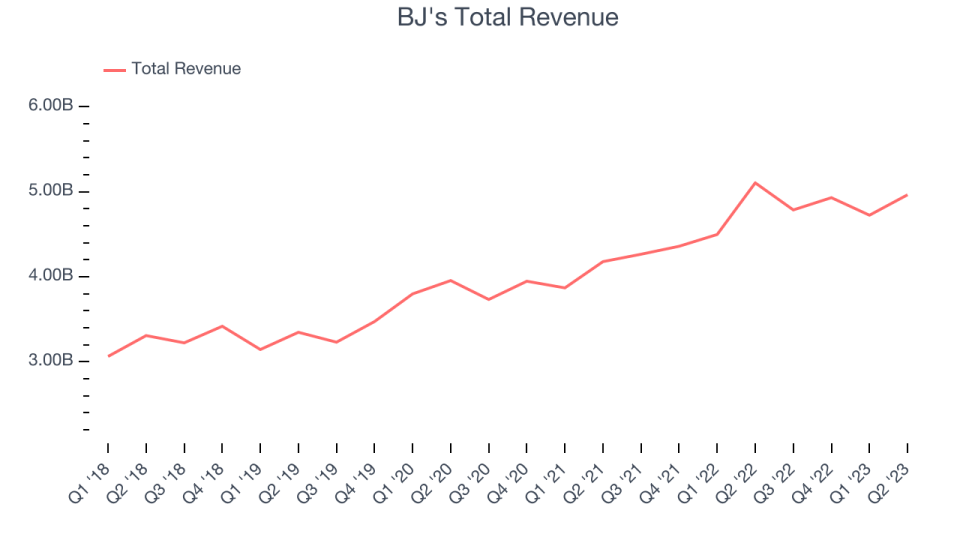

BJ's reported revenues of $4.96 billion, down 2.75% year on year, missing analyst expectations by 4.06%. It was a weak quarter for the company, with a miss of analysts' revenue estimates. On the other hand, EPS and EBITDA beat expectations this quarter.

“Our strong performance in the second quarter reflects our continued gains in membership, traffic and market share, driven by the great value that we provide our members every day,” said Bob Eddy, Chairman and Chief Executive Officer, BJ’s Wholesale Club.

BJ's delivered the weakest performance against analyst estimates of the whole group. The stock is up 0.65% since the results and currently trades at $70.18.

Read our full report on BJ's here, it's free.

Best Q2: Walmart (NYSE:WMT)

Known for its large-format Supercenters, Walmart (NYSE:WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

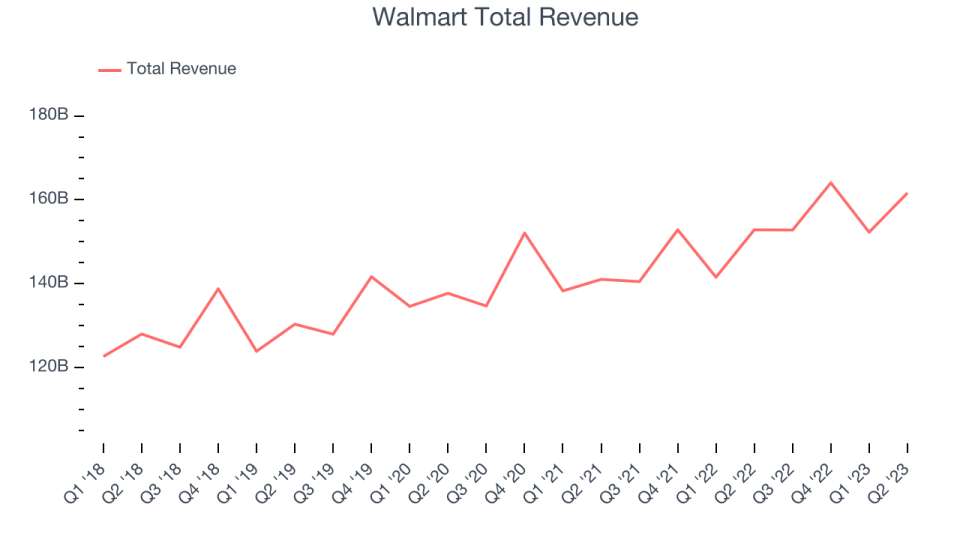

Walmart reported revenues of $162 billion, up 5.74% year on year, beating analyst expectations by 1.58%. It was an ok quarter for the company, with underwhelming earnings guidance for the next quarter. For the full year outlook, revenue was guided slightly below although adjusted EPS was guided above expectations.

Walmart achieved the strongest analyst estimates beat among its peers. The stock is down 0.41% since the results and currently trades at $158.6.

Is now the time to buy Walmart? Access our full analysis of the earnings results here, it's free.

Target (NYSE:TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Target reported revenues of $24.8 billion, down 4.85% year on year, missing analyst expectations by 1.82%. It was a weak quarter for the company, with the company guiding for same-store sales to decline more than expected, causing it to lower its full-year revenue and EPS guidance.

Target had the slowest revenue growth in the group. The stock is down 11% since the results and currently trades at $111.27.

Read our full analysis of Target's results here.

Costco (NASDAQ:COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ:COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $78.9 billion, up 9.5% year on year, beating analyst expectations by 1.25%. It was a decent quarter for the company, with revenue and EPS exceeding Wall Street's expectations.

Costco pulled off the fastest revenue growth among the peers. The stock is up 2.28% since the results and currently trades at $566.15.

Read our full, actionable report on Costco here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned