Larry Robbins' Glenview Capital Adjusts Portfolio, Cigna Group Sees Notable Reduction

Insights from Glenview Capital's Latest 13F Filing for Q3 2023

Larry Robbins (Trades, Portfolio), the founder of Glenview Capital Management, is renowned for his deep fundamental research and individual security selection. Established in 2000, Glenview Capital is a hedge fund that specializes in delivering attractive absolute returns, focusing primarily on the U.S. market with some exposure to Western Europe. The firm's investment strategy is executed through two main funds: the Glenview Funds, which adopt a long/short equity approach, and the Glenview Opportunity Funds, known for their concentrated and opportunistic investments.

New Additions to the Portfolio

Larry Robbins (Trades, Portfolio)' Glenview Capital Management has expanded its portfolio with 10 new stock positions in the third quarter of 2023. The most significant new additions include:

Teleflex Inc (NYSE:TFX), with 380,711 shares, making up 1.7% of the portfolio and valued at $74.78 million.

Intel Corp (NASDAQ:INTC), comprising 2,088,592 shares, which represents about 1.69% of the portfolio, with a total value of $74.25 million.

Avantor Inc (NYSE:AVTR), with 1,019,890 shares, accounting for 0.49% of the portfolio and a total value of $21.5 million.

Significant Increases in Existing Holdings

Robbins also strategically increased his stakes in 16 existing holdings. Noteworthy increases include:

Amazon.com Inc (NASDAQ:AMZN), with an additional 854,032 shares, bringing the total to 954,049 shares. This represents an 853.89% increase in share count, a 2.47% impact on the current portfolio, and a total value of $121.28 million.

Charter Communications Inc (NASDAQ:CHTR), with an additional 139,721 shares, bringing the total to 171,087 shares. This adjustment marks a 445.45% increase in share count, with a total value of $75.25 million.

Complete Exits from Certain Holdings

In a move to optimize the portfolio, Larry Robbins (Trades, Portfolio) exited 9 positions in the third quarter of 2023, including:

FMC Corp (NYSE:FMC), where Robbins sold all 852,243 shares, resulting in a -2.01% impact on the portfolio.

FedEx Corp (NYSE:FDX), with the liquidation of all 95,628 shares, causing a -0.54% impact on the portfolio.

Notable Reductions in Key Positions

Concurrently, Robbins reduced his positions in 11 stocks. The most significant reductions were observed in:

The Cigna Group (NYSE:CI), with a reduction of 516,732 shares, leading to a -25.02% decrease in shares and a -3.28% impact on the portfolio. The stock traded at an average price of $285.18 during the quarter and has seen a return of 0.53% over the past 3 months and -11.27% year-to-date.

DuPont de Nemours Inc (NYSE:DD), with a reduction of 609,620 shares, resulting in a -58.49% decrease in shares and a -0.99% impact on the portfolio. The stock's average trading price was $74.85 during the quarter, with a return of -8.23% over the past 3 months and 4.09% year-to-date.

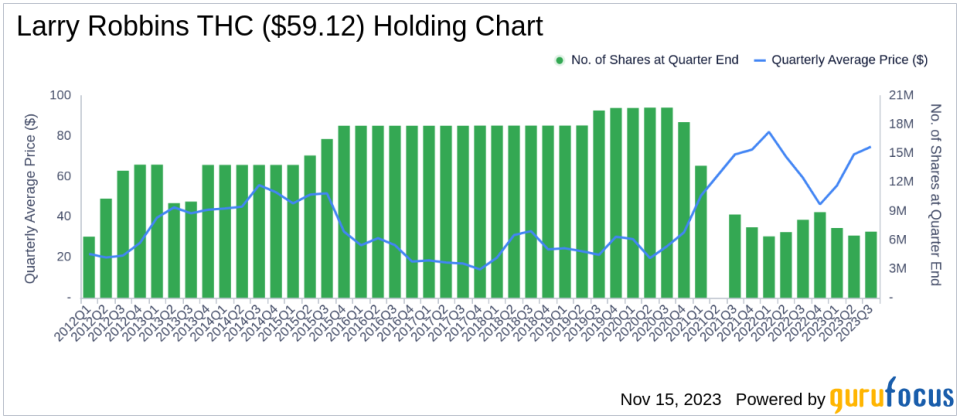

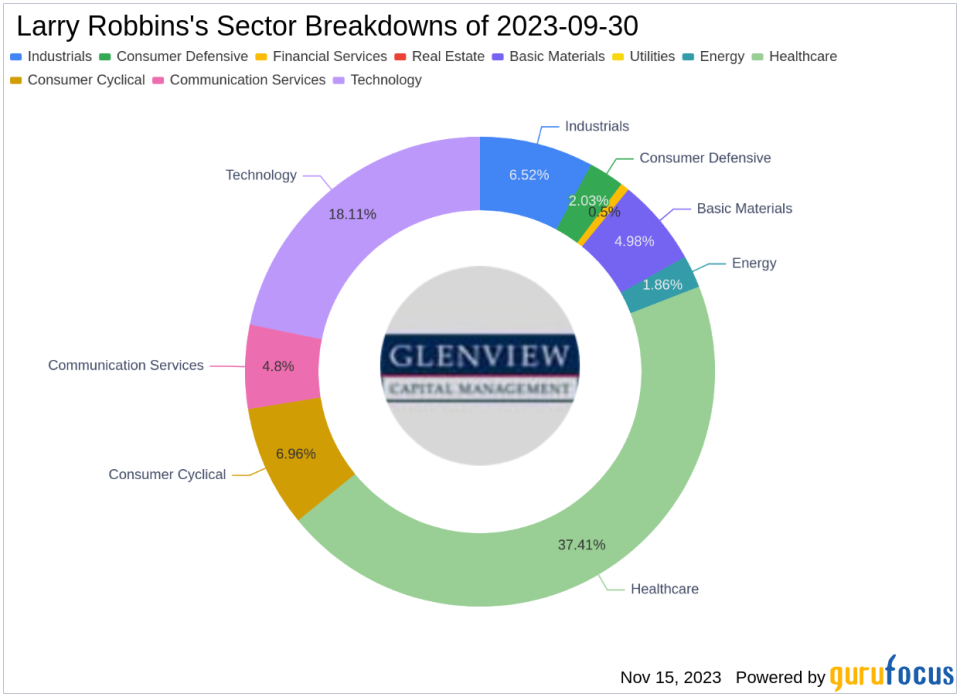

Portfolio Overview and Sector Allocation

As of the third quarter of 2023, Larry Robbins (Trades, Portfolio)' portfolio consisted of 51 stocks. The top holdings included 10.29% in Tenet Healthcare Corp (NYSE:THC), 10.08% in The Cigna Group (NYSE:CI), 5.01% in Universal Health Services Inc (NYSE:UHS), 4.85% in Global Payments Inc (NYSE:GPN), and 4.61% in DXC Technology Co (NYSE:DXC). The investments are predominantly concentrated in 9 industries, with the largest allocations in Healthcare, Technology, Consumer Cyclical, Industrials, Basic Materials, Communication Services, Consumer Defensive, Energy, and Financial Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.