Larry Robbins' Glenview Capital Management Bolsters Stake in DXC Technology Co

Introduction to the Transaction

On December 31, 2023, Glenview Capital Management, led by Larry Robbins (Trades, Portfolio), made a significant addition to its investment portfolio by acquiring 1,972,212 shares of DXC Technology Co (NYSE:DXC). This transaction increased the firm's total holdings in DXC to 13,006,773 shares, marking a substantial vote of confidence in the IT services provider. The trade, executed at a price of $22.87 per share, had a 1.02% impact on the portfolio, bringing the position to 6.7% of the firm's holdings and 6.86% of DXC's outstanding shares.

Profile of Larry Robbins (Trades, Portfolio)

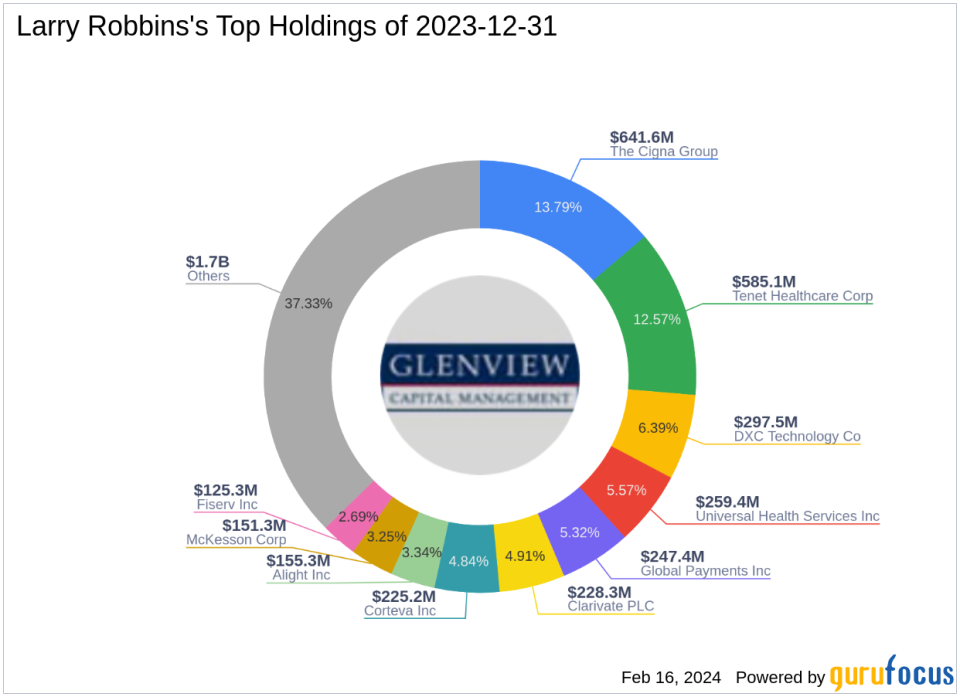

Glenview Capital Management, established in 2000 by Larry Robbins (Trades, Portfolio), is a renowned investment management firm with a reputation for delivering attractive absolute returns. The firm's investment strategy is anchored in rigorous fundamental research and a meticulous security selection process. With a primary focus on the U.S. market and some exposure to Western Europe, Glenview Capital Management has a diverse portfolio, including top holdings such as The Cigna Group (NYSE:CI), DXC Technology Co (NYSE:DXC), and Tenet Healthcare Corp (NYSE:THC). As of the latest data, the firm manages an equity portfolio valued at $4.65 billion, with a strong inclination towards the Healthcare and Technology sectors.

DXC Technology Co at a Glance

DXC Technology Co, headquartered in the USA, has been a prominent player in the IT services industry since its IPO on November 26, 1968. The company operates through two main segments: Global Business Services (GBS) and Global Infrastructure Services (GIS), with GIS being the major revenue generator. With a market capitalization of $4.05 billion and a current stock price of $22.17, DXC Technology Co is considered modestly undervalued according to GuruFocus's GF Value of $30.88.

Analysis of the Trade

The acquisition of DXC shares by Glenview Capital Management reflects a strategic move by Larry Robbins (Trades, Portfolio)' firm. The trade price of $22.87 is currently above the stock's market price of $22.17, indicating a slight decrease in value since the transaction date. However, with a GF Value of $30.88, the stock is still considered modestly undervalued, suggesting potential for growth. The trade has solidified DXC's position as a key holding in Robbins' portfolio, aligning with the firm's investment philosophy of focusing on undervalued opportunities.

DXC Technology Co's Financial Health

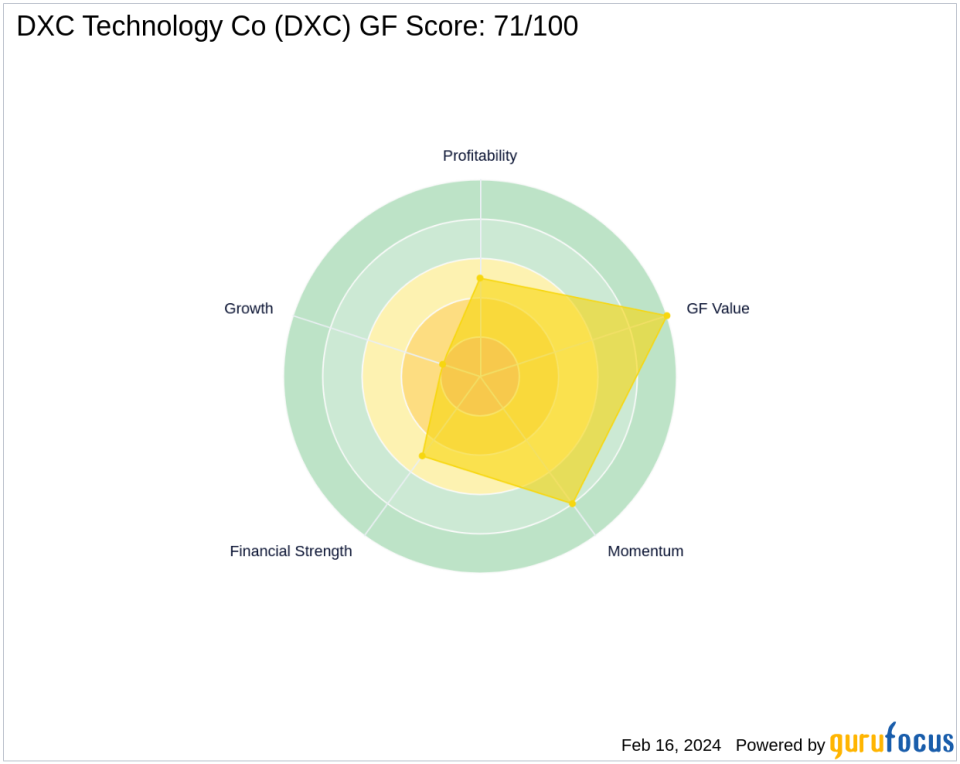

DXC Technology Co's financial metrics and GF Scores paint a mixed picture. The company has a GF Score of 71/100, indicating likely average performance. Its Financial Strength and Profitability Rank both stand at 5/10, while the Growth Rank is at a lower 2/10. However, the stock boasts a perfect GF Value Rank of 10/10 and a strong Momentum Rank of 8/10. The company's Piotroski F-Score is 5, and its Altman Z score is 0.73, indicating some financial stability concerns.

Sector and Market Context

Larry Robbins (Trades, Portfolio)' Glenview Capital Management has a notable exposure to the Technology sector, with DXC Technology Co being a significant investment. This sector allocation complements the firm's largest sector holding, Healthcare, showcasing a diversified approach to value investing. The firm's strategy often involves balancing investments across sectors that offer both growth and stability, with Technology and Healthcare fitting this criterion well.

Broader Market Implications

The investment in DXC Technology Co by Larry Robbins (Trades, Portfolio)' firm is a move that value investors may watch closely. It reflects a belief in the potential of the Technology sector and the specific opportunities within DXC Technology Co. This trade comes at a time when the market is evaluating the intrinsic values and growth prospects of tech companies, making Robbins' decision particularly noteworthy.

Conclusion

In summary, Larry Robbins (Trades, Portfolio)' Glenview Capital Management has increased its stake in DXC Technology Co, aligning with its investment strategy of identifying undervalued opportunities with potential for growth. The firm's significant position in DXC, coupled with the company's modest undervaluation and mixed financial metrics, suggests a calculated bet on the company's future performance. As the market continues to evolve, the performance of DXC Technology Co will be an important indicator of the success of Robbins' investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.