Larry Robbins' Glenview Capital Management Bolsters Stake in Myriad Genetics Inc

On December 31, 2023, Glenview Capital Management, led by Larry Robbins (Trades, Portfolio), made a significant addition to its investment portfolio by acquiring 1,500,000 shares of Myriad Genetics Inc (NASDAQ:MYGN). This transaction, executed at a trade price of $19.14 per share, increased the firm's total holdings in MYGN to 5,283,982 shares. The trade had a 0.65% impact on the portfolio, bringing the position to 2.29% of the portfolio and 5.97% of the company's shares.

Insight into Larry Robbins (Trades, Portfolio) and Glenview Capital Management

Glenview Capital Management, established in 2000 by Larry Robbins (Trades, Portfolio), is renowned for its intense focus on deep fundamental research and individual security selection. The firm manages assets across the Glenview Funds and the Glenview Opportunity Funds, with a primary focus on the U.S. market and some exposure to Western Europe. With a portfolio of 43 stocks and an equity of $4.65 billion, Glenview's top holdings include The Cigna Group (NYSE:CI), DXC Technology Co (NYSE:DXC), and Global Payments Inc (NYSE:GPN). The healthcare and technology sectors are prominent in the firm's investment strategy.

Myriad Genetics Inc at a Glance

Myriad Genetics, a molecular diagnostics company based in the USA, specializes in testing services that assess the risk of developing diseases. With products like MyRisk and BRACAnalysis CDx, Myriad Genetics plays a crucial role in cancer risk identification and pharmacogenomics. The company, which went public on October 6, 1995, has a market capitalization of $2.11 billion and is currently deemed "Fairly Valued" by GuruFocus metrics with a GF Value of $25.20. Despite a PE Percentage of 0.00 indicating current losses, MYGN's stock price has seen a 23.25% gain since the trade and a 359.84% increase since its IPO.

Trade Impact and Portfolio Positioning

The recent acquisition of MYGN shares by Glenview Capital Management has solidified the firm's position in the healthcare sector, aligning with its top sector preference. MYGN now represents a more significant portion of the firm's portfolio, potentially indicating Robbins' confidence in the company's future performance and strategic fit within the portfolio's overall composition.

Performance and Valuation Metrics of MYGN

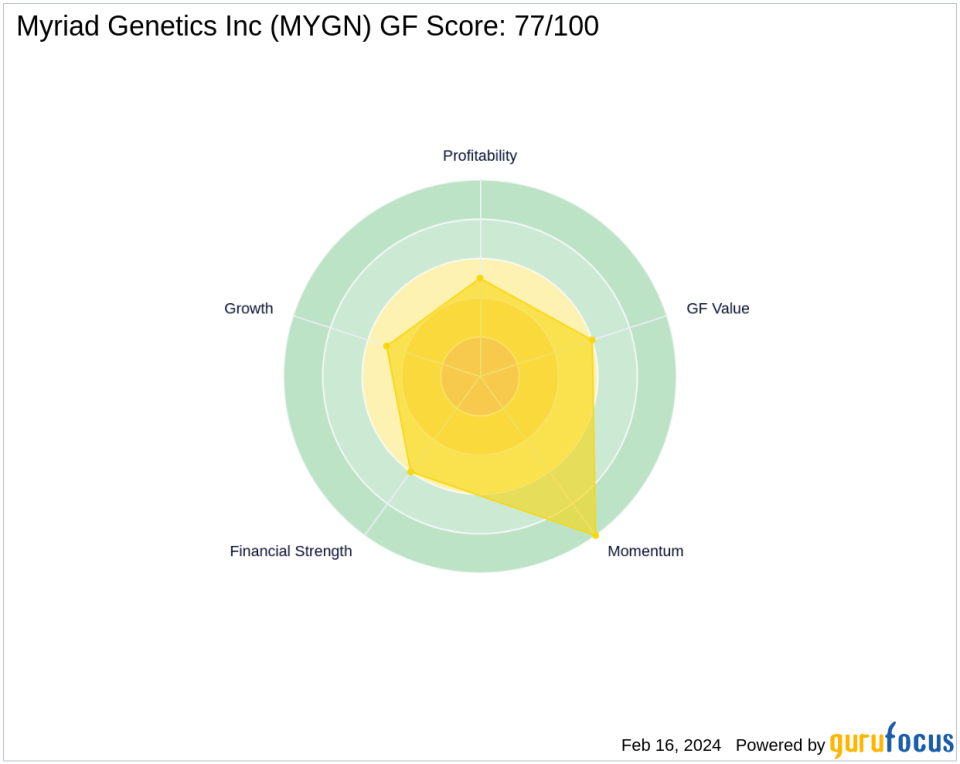

Since the trade, MYGN's stock performance has been positive, with a year-to-date price change ratio of 24.16%. The company's GF Score stands at 77/100, suggesting a strong potential for future performance. The stock's Financial Strength and Profitability Rank are both at a moderate 5/10, while its Growth Rank is also at 5/10. The GF Value Rank and Momentum Rank are higher, at 6/10 and 10/10, respectively, indicating a fair valuation and strong momentum.

Sector and Market Considerations

Larry Robbins (Trades, Portfolio)' Glenview Capital Management has historically shown a preference for the healthcare sector, and the addition of MYGN shares is consistent with this trend. The investment in Myriad Genetics fits within the firm's strategy of selecting companies with strong fundamentals and growth potential within the healthcare and technology sectors.

Comparative Analysis with Largest Guru Holder

While Fisher Asset Management, LLC is the largest guru holder of MYGN, the specific share percentage held by the firm is not disclosed. However, Robbins' recent investment move places Glenview Capital Management as a significant shareholder in Myriad Genetics, reflecting a strategic investment decision that could influence the company's shareholder base and potentially its strategic direction.

Conclusion

The acquisition of additional shares in Myriad Genetics by Larry Robbins (Trades, Portfolio)' Glenview Capital Management is a noteworthy event for value investors. The trade not only reinforces the firm's investment in the healthcare sector but also demonstrates confidence in MYGN's future prospects. As the company continues to innovate in molecular diagnostics, investors will be watching closely to see how this investment decision unfolds and contributes to the performance of Robbins' portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.