Las Vegas Sands Corp. Reports Robust Earnings with Net Income Soaring to $469 Million

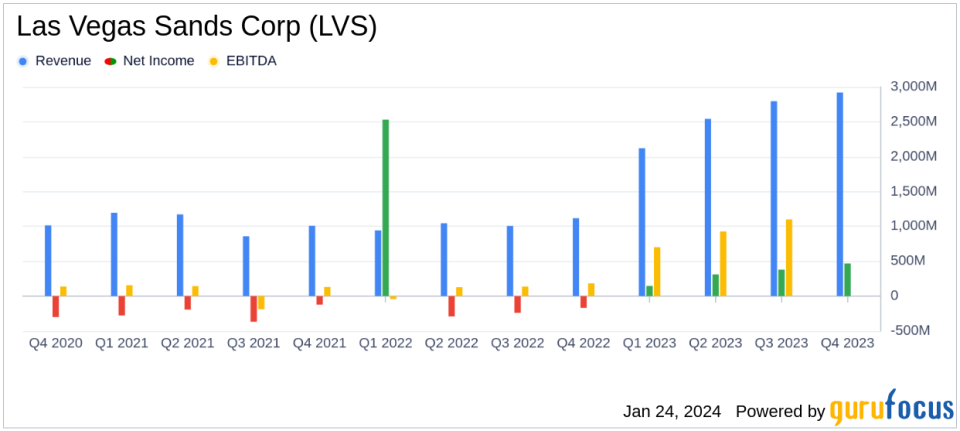

Net Revenue: Increased to $2.92 billion, a 161.0% jump from the previous year.

Net Income: Reported at $469 million, a significant recovery from a net loss of $269 million in Q4 2022.

Adjusted Property EBITDA: Reached $1.20 billion, compared to $222 million in the prior year quarter.

Stock Repurchase: LVS repurchased $505 million of company stock, signaling confidence in its financial health.

Debt Profile: Total debt outstanding at $14.01 billion, with substantial unrestricted cash balances of $5.11 billion.

Dividends: Continued commitment to shareholder returns with a quarterly dividend of $0.20 per common share.

On January 24, 2024, Las Vegas Sands Corp (NYSE:LVS) released its 8-K filing, detailing a substantial turnaround in its financial performance for the fourth quarter of 2023. The world's leading developer and operator of convention-based Integrated Resorts, which includes iconic properties such as Marina Bay Sands in Singapore and several resorts in Macao, reported a net revenue of $2.92 billion, marking a 161.0% increase from the same period in the previous year. The company's net income also reflected a strong recovery, standing at $469 million compared to a net loss from continuing operations of $269 million in the fourth quarter of 2022.

Performance and Challenges

LVS's performance in the fourth quarter is particularly noteworthy given the challenges faced by the travel and leisure industry in recent years. The company's success is attributed to the ongoing recovery in Macao and Singapore, with significant contributions from high hold on rolling play at Marina Bay Sands and continued investment in enhancing the tourism appeal of its properties. However, the company did face a negative impact due to low hold on rolling play in Macao, which reduced adjusted property EBITDA by $40 million. These challenges underscore the volatility in gaming operations and the importance of maintaining a diversified portfolio of offerings to mitigate such risks.

Financial Achievements and Industry Significance

The financial achievements of LVS, particularly the substantial increase in net revenue and net income, are significant for the company and the broader industry. The travel and leisure sector relies heavily on consumer discretionary spending, which has rebounded as global travel restrictions ease and consumer confidence returns. LVS's ability to capitalize on this recovery demonstrates the strength of its brand and the appeal of its integrated resort model. The repurchase of $505 million in company stock and the acquisition of approximately $250 million of Sands China Ltd. (SCL) stock reflect the company's strong financial position and its commitment to delivering value to shareholders.

Key Financial Metrics

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight LVS's robust financial health. The company's consolidated adjusted property EBITDA of $1.20 billion, compared to $222 million in the prior year quarter, is a critical metric that reflects the operational profitability of LVS's properties. This measure is particularly important as it excludes certain expenses that do not relate to the management of specific properties, providing a clearer picture of operational performance.

"We were extremely pleased with our financial and operating results for the quarter, which reflect the ongoing improvement in the operating environment in both Macao and Singapore. We remain deeply enthusiastic about our opportunities for growth in both Macao and Singapore in the years ahead," said Robert G. Goldstein, chairman and chief executive officer.

Analysis of Company's Performance

The company's performance in the fourth quarter of 2023 is a testament to its resilience and strategic focus on growth markets in Asia. With the sale of its Las Vegas assets in 2022, LVS has concentrated its efforts on its Asian operations, which now generate all of its EBITDA. The strong results in Macao and Singapore, coupled with the company's robust balance sheet, position LVS well for future growth and capital returns to shareholders.

For a more detailed analysis of Las Vegas Sands Corp's financial performance and to stay updated on the latest investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Las Vegas Sands Corp for further details.

This article first appeared on GuruFocus.