Latham Group Inc (SWIM) Reports Full Year 2023 Earnings and Provides 2024 Outlook

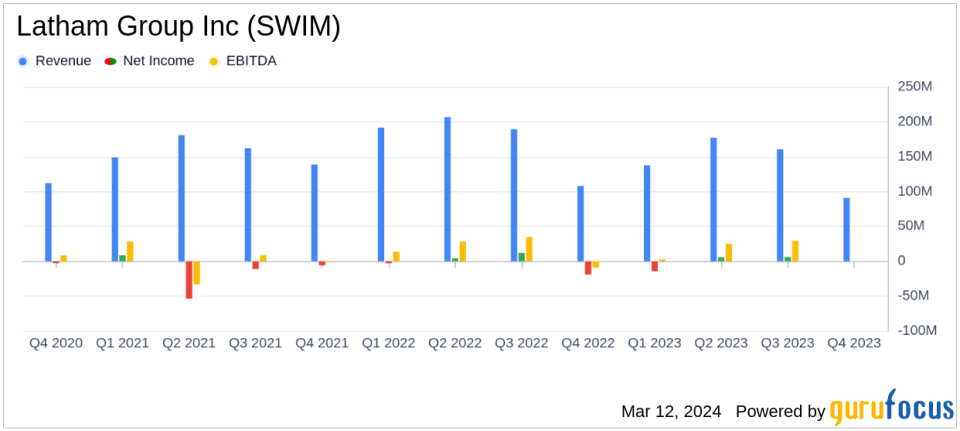

Net Sales: Full year 2023 net sales decreased by 18.6% to $566.5 million compared to the previous year.

Adjusted EBITDA: Adjusted EBITDA for the full year 2023 was $88.0 million, a decrease of 38.6% year-over-year.

Net Income: Net loss for the full year was $2.4 million, an improvement from a net loss of $5.7 million in 2022.

Operating Cash Flow: Generated $116.4 million in operating cash flow, contributing to a record cash position of $102.8 million at year-end.

Cost Reductions: Implemented cost reduction programs and lean manufacturing initiatives, resulting in a substantially reduced cost structure.

Market Share: Fiberglass pool sales outperformed U.S. in-ground pool starts by over 10 percentage points, indicating market share gains.

2024 Guidance: Anticipates continued ability to outperform the industry with net sales guidance ranging from $490 million to $520 million.

On March 12, 2024, Latham Group Inc (NASDAQ:SWIM), a leading designer, manufacturer, and marketer of in-ground residential swimming pools, released its 8-K filing, detailing its financial results for the fourth quarter and full year 2023, and providing guidance for 2024. The company, which garners a majority of its revenue from the United States, faced a challenging market environment but demonstrated resilience through strategic cost reductions and efficiency improvements.

Financial Performance and Challenges

Latham Group Inc (NASDAQ:SWIM) reported a decrease in net sales for the full year 2023, down 18.6% to $566.5 million from $695.7 million in the previous year, primarily due to volume declines from decreased new in-ground pool starts and continued destocking of inventory in the wholesale distribution channel. Despite these challenges, the company's focus on cost reduction and lean manufacturing initiatives led to a gross margin of 27.0% for the year, although this was a decrease from 31.1% in the prior year.

President and CEO Scott Rajeski commented on the company's performance, stating,

Latham navigated a very difficult market environment in 2023. We successfully implemented cost reduction programs and lean manufacturing initiatives that structurally reduced our cost basis, while maintaining our investments in future growth."

He further highlighted the company's strategic initiatives, including the development of new fiberglass pool models and investments in digital tools, which have enhanced the consumer pool buying experience.

Financial Achievements and Industry Impact

The company's fiberglass pool sales, which accounted for approximately 73% of in-ground pool sales, outperformed the decline in U.S. in-ground pool starts by over 10 percentage points. This success is a testament to Latham's leadership in the fiberglass pool market and its effective conversion strategy. The company also saw traction in its automatic safety covers, which offer safety and cost savings, and its AI-powered measurement tool for pool covers and liners, Measure by Latham.

From a financial standpoint, Latham Group Inc (NASDAQ:SWIM) ended the year with a strong cash position of $102.8 million, after generating operating cash flow of over $116 million and repaying $13 million in debt. This financial strength provides the company with substantial flexibility to manage through soft market conditions.

2024 Outlook

Looking ahead to 2024, Latham Group Inc (NASDAQ:SWIM) anticipates continued industry softness but expects to manage a decline of approximately 15% in total pool starts in its markets. The company's guidance for the full year 2024 reflects net sales that are 11% below 2023 levels at the midpoint, with fiberglass products expected to continue increasing penetration in a down market for new in-ground pools in the U.S.

Rajeski remains optimistic about the company's long-term prospects, stating,

The long-term fundamentals of our industry remain compelling, and we are looking ahead to lower interest rates driving pent-up demand for in-ground pools."

He believes that Latham's strategic growth initiatives and reduced cost structure, coupled with a strong balance sheet, position the company well to capture market share and expand profit margins when industry conditions improve.

Investors and analysts are invited to join Latham's conference call to discuss the fourth quarter and full year 2023 financial results, which will be held on March 12, 2024, at 4:30 PM Eastern Time.

For a comprehensive understanding of Latham Group Inc (NASDAQ:SWIM)'s financials and strategic direction, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Latham Group Inc for further details.

This article first appeared on GuruFocus.