Latham (NASDAQ:SWIM) Surprises With Q4 Sales But Stock Drops 12.3%

Residential swimming pool manufacturer Latham (NASDAQ:SWIM) reported Q4 FY2023 results topping analysts' expectations , with revenue down 15.8% year on year to $90.87 million. On the other hand, the company's full-year revenue guidance of $505 million at the midpoint came in 6.9% below analysts' estimates.

Is now the time to buy Latham? Find out by accessing our full research report, it's free.

Latham (SWIM) Q4 FY2023 Highlights:

Revenue: $90.87 million vs analyst estimates of $86.95 million (4.5% beat)

EPS: $0 vs analyst estimates of -$0.12 ($0.12 beat)

Management's revenue guidance for the upcoming financial year 2024 is $505 million at the midpoint, missing analyst estimates by 6.9% and implying -10.9% growth (vs -18.3% in FY2023)

Gross Margin (GAAP): 23.3%, up from 17.9% in the same quarter last year

Market Capitalization: $378.7 million

Commenting on the results, Scott Rajeski, President and CEO, said, “Latham navigated a very difficult market environment in 2023. We successfully implemented cost reduction programs and lean manufacturing initiatives that structurally reduced our cost basis, while maintaining our investments in future growth. These cost reduction programs improved margins as the year progressed and we expect they will enable us to considerably expand margins and overall profitability once volumes recover. At the same time, we increased productivity and efficiency for our dealers, developed new fiberglass pool models, and invested in digital tools that have enhanced the consumer’s pool buying experience. As a result of these actions, Latham is positioned for meaningful market share gains as overall industry conditions improve.

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

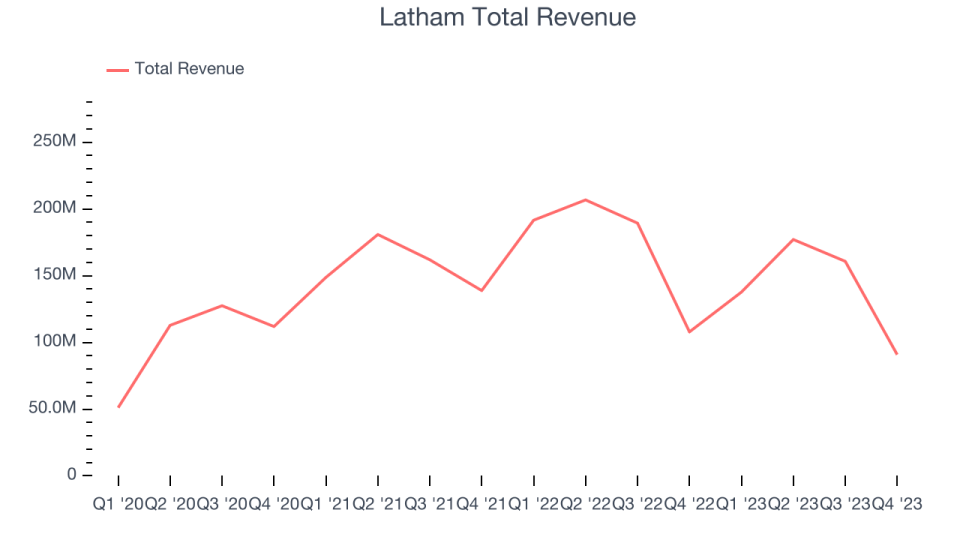

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Latham's annualized revenue growth rate of 12% over the last three years was mediocre for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Latham's recent history shows a reversal from its already weak three-year trend as its revenue has shown annualized declines of 5.2% over the last two years.

This quarter, Latham's revenue fell 15.8% year on year to $90.87 million but beat Wall Street's estimates by 4.5%. Looking ahead, Wall Street expects revenue to decline 4.1% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

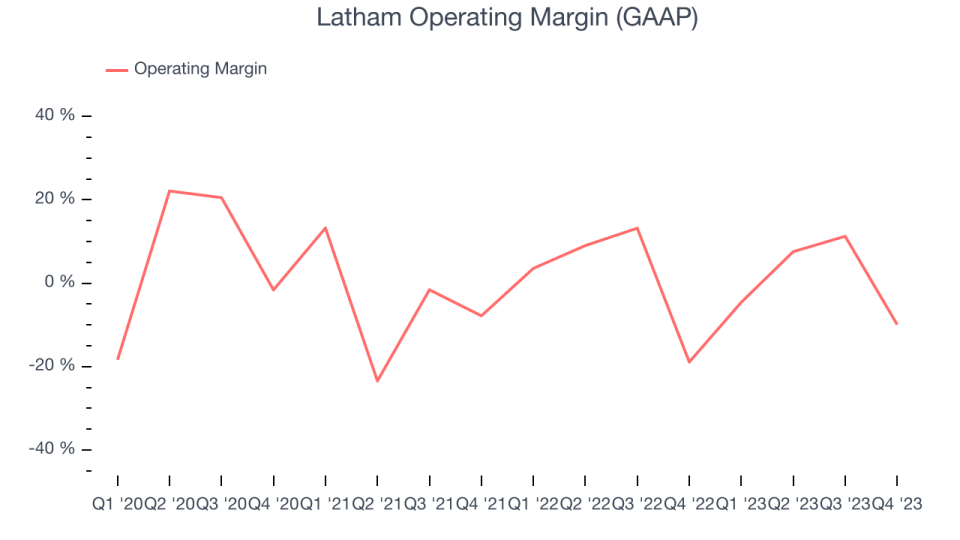

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Latham was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.7% has been paltry for a consumer discretionary business.

In Q4, Latham generated an operating profit margin of negative 9.9%, up 9 percentage points year on year.

Over the next 12 months, Wall Street expects Latham to maintain its LTM operating margin of 2.8%.

Key Takeaways from Latham's Q4 Results

We were impressed by how significantly Latham blew past analysts' operating margin and EPS expectations this quarter. On the other hand, its full-year revenue and EBITDA guidance missed estimates as the company expects more industry softness in 2024, projecting a ~15% decline in new pool installations in its markets. Despite the weakness, management noted it gained market share in 2023, especially with its fiberglass pools (fiberglass products accounted for ~73% of the company's in-ground pool sales in 2023). Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The market was likely frightened by Latham's outlook, and the stock is down 12.3% after reporting, trading at $2.88 per share.

So should you invest in Latham right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.