Lazard (LAZ) Q4 Earnings Beat Estimates, Stock Rises 5.4%

Lazard Inc.’s LAZ shares jumped 5.36% following the release of its fourth-quarter and full-year 2023 results. Quarterly adjusted earnings per share of 66 cents beat the Zacks Consensus Estimate of 35 cents. However, the bottom line compared unfavorably with the prior-year quarter’s earnings of 69 cents per share.

The results benefited from increased revenues and assets under management (AUM) balances. Nonetheless, higher expenses acted as spoilsports.

Lazard’s net income (GAAP) was $63.6 million, which increased 50% from the prior-year quarter.

In 2023, LAZ’s earnings per share were 77 cents, down 79.4% year over year. However, the figure beat the Zacks Consensus Estimate of 45 cents per share. Net loss (GAAP) was $75.4 million against the net income of $357.5 million in 2022.

Quarterly Revenues

Quarterly operating revenues were $761 million, which increased 13.4% year over year. Also, the top line beat the Zacks Consensus Estimate of $655.4 million.

In 2023, operating revenues were $2.44 billion, down 11.9% from 2022. However, the top line surpassed the Zacks Consensus Estimate of $2.33 billion.

Expenses Rise

Operating expenses were $734.1 million, up 14.8% year over year. Our estimate was pegged at $549.8 million.

The ratio of adjusted compensation expenses to operating revenues was 67.8%, up from the year-earlier quarter’s 62.4%. The ratio of adjusted non-compensation expenses to operating revenues was 19.5%, down from the year-ago quarter’s 21.1%.

Quarterly Segmental Performance Improves

Financial Advisory: The segment’s adjusted operating revenues were $477.4 million, which increased 18.2% from the year-earlier quarter. We had projected the metric to be $353 million.

Asset Management: Segmental adjusted operating revenues of $273.7 million increased 5.8% from the prior-year quarter. Our estimate was pinned at $294.9 million.

Corporate: Adjusted operating revenues from this segment were $9.9 million, up 16.4% from the year-earlier quarter. Our estimate was pegged at $3.3 million.

AUM Rises

As of Dec 31, 2023, total AUM was $246.7 billion, which increased 14.1% from the prior quarter. Our projection for the metric was pinned at $196.2 billion.

The quarter witnessed a market appreciation of $16.9 billion and a foreign exchange appreciation of $5 billion, which was offset by net outflows of $3.6 billion. Our estimate for net outflows was pegged at $1.4 billion.

The average AUM in the reported quarter was $233.9 billion, up 10.7% year over year. Our estimate was $212.2 billion.

Balance Sheet Position Weak

Lazard’s cash and cash equivalents totaled $971.3 million as of Dec 31, 2023, down 21.3% year over year. Stockholders’ equity was $482.2 million, which decreased 28.6% from the previous-year quarter.

Capital Deployment Update

During 2023, Lazard repurchased 2.8 million shares.

As of Dec 31, 2023, the company’s remaining share repurchase authorization was $200 million.

Our Viewpoint

Lazard demonstrates strength in organic growth, a well-managed debt maturity profile and innovative investment strategies. Effective cost controls are expected to support the bottom-line growth, showcasing the company's financial resilience.

Also, a strong AUM balance, along with a quarterly increase in revenues, acts as a tailwind.

However, a challenging operating backdrop and geopolitical concerns, coupled with a lower cash balance, are likely to affect its financials in the near term.

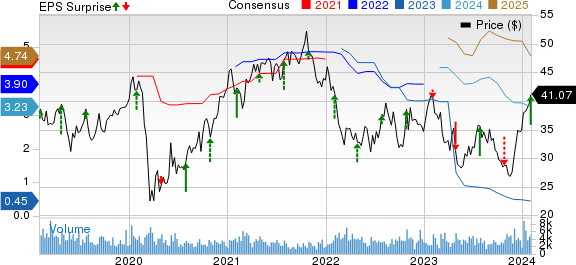

Lazard, Inc. Price, Consensus and EPS Surprise

Lazard, Inc. price-consensus-eps-surprise-chart | Lazard, Inc. Quote

Currently, Lazard carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s BLK fourth-quarter 2023 adjusted earnings of $9.66 per share surpassed the Zacks Consensus Estimate of $8.84. The figure reflects an increase of 8.2% from the year-ago quarter.

BLK’s quarterly results benefited from a rise in revenues and higher non-operating income. Further, the AUM balance witnessed an improvement owing to net inflows. However, higher expenses acted as a dampener.

Invesco’s IVZ fourth-quarter 2023 adjusted earnings of 47 cents per share handily surpassed the Zacks Consensus Estimate of 38 cents. The bottom line grew 20.5% from the prior-year quarter.

IVZ’s results benefited from an increase in AUM balance on decent inflows. However, a rise in operating expenses and lower revenues were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Lazard, Inc. (LAZ) : Free Stock Analysis Report