LCI Industries Inc (LCII) Faces Headwinds but Shows Resilience in Q4 and Full Year 2023 Earnings

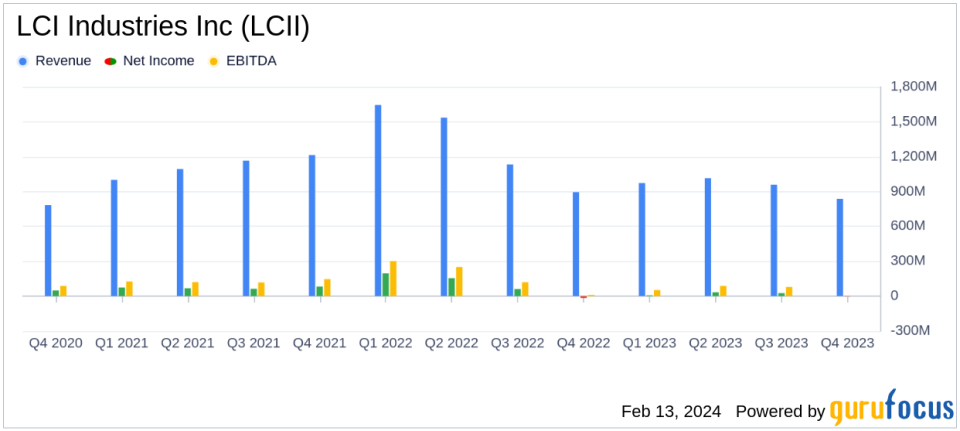

Net Sales: $838 million in Q4, down 6% YOY; $3.8 billion for full year, down 27% YOY.

Net Income: Net loss of $2 million in Q4, an 86% YOY improvement; $64 million for full year, down 84% YOY.

EBITDA: $36 million in Q4, up 248% YOY; $255 million for full year, down 63% YOY.

Aftermarket Segment: Grew 10% YOY in Q4 with a $15 million increase in operating profit.

Inventory Reduction: Decreased by $261 million in 2023.

Cash Flow: Generated $527 million from operating activities in 2023.

Dividends: Returned $106 million to shareholders in 2023.

On February 13, 2024, LCI Industries Inc (NYSE:LCII), a leading supplier of components for the recreational vehicle (RV) industry and adjacent markets, released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which operates through its wholly-owned subsidiary Lippert Components, Inc., faced a challenging environment with a decline in net sales and net income, yet demonstrated resilience through its diversified business model and strong aftermarket segment performance.

Company Overview

LCI Industries Inc supplies a broad array of components for OEMs in the recreational and transportation markets, both domestically and internationally. The company operates through two segments: the OEM Segment, which manufactures or distributes components for RVs and adjacent industries, and the Aftermarket Segment, which focuses on components for the related aftermarkets of these industries. LCI Industries' products are sold to major RV manufacturers such as Thor Industries, Forest River, Winnebago, and other OEMs.

Performance and Challenges

The company's performance in 2023 was marked by a decrease in net sales and net income, primarily due to a significant reduction in North American RV wholesale shipments, decreased selling prices indexed to select commodities, and lower North American marine production levels. Despite these challenges, LCI Industries' diversified business model and operational discipline helped mitigate the impact, with the Aftermarket Segment and Adjacent Industries OEM net sales exceeding 56% of total net sales for the year.

Financial Achievements

LCI Industries' financial achievements in 2023 included a substantial reduction in inventory levels, strong cash flows from operating activities, and significant net repayments of indebtedness. These achievements are crucial for the company's liquidity and financial stability, especially in a volatile industry environment.

Key Financial Metrics

The company's financial statements revealed several important metrics. The net loss for Q4 improved significantly year-over-year, and EBITDA saw a substantial increase in the same period. Inventory reduction and cash flow generation were also notable, with the company making strides in improving its balance sheet and returning value to shareholders through dividends.

"Throughout the year, our consistent execution on diversification priorities and steadfast commitment to operational discipline has supported our performance despite continued softness in the RV and marine markets," commented Jason Lippert, LCI Industries' President and Chief Executive Officer.

Analysis of Performance

LCI Industries' performance in Q4 and the full year of 2023 reflects the company's resilience in the face of industry headwinds. The growth in the Aftermarket Segment and the company's focus on operational improvements and automation position it well for potential recovery in production levels in 2024. The company's commitment to innovation and new product development, as highlighted by its CEO, is expected to drive future growth and market share expansion.

For a more detailed analysis and to stay updated on LCI Industries Inc's financial performance and strategic initiatives, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from LCI Industries Inc for further details.

This article first appeared on GuruFocus.