After Leaping 83% Ondas Holdings Inc. (NASDAQ:ONDS) Shares Are Not Flying Under The Radar

Ondas Holdings Inc. (NASDAQ:ONDS) shareholders are no doubt pleased to see that the share price has bounced 83% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 73% share price decline over the last year.

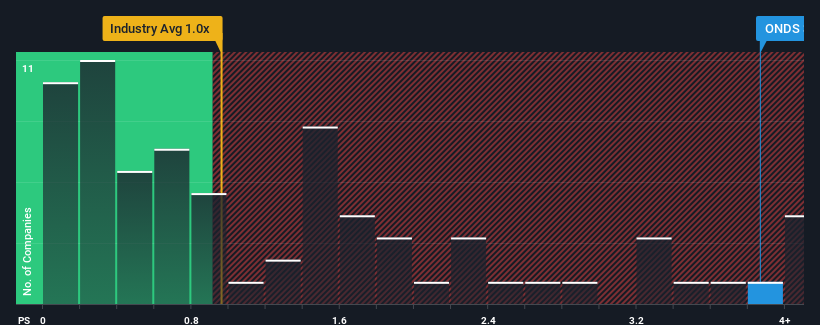

Since its price has surged higher, you could be forgiven for thinking Ondas Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in the United States' Communications industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Ondas Holdings

How Has Ondas Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Ondas Holdings has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Ondas Holdings' future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Revenue Growth Forecasted For Ondas Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Ondas Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 226% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 0.5%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Ondas Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Ondas Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Ondas Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 5 warning signs for Ondas Holdings (1 is a bit unpleasant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.