Lear Corp (LEA) Posts Record Sales and Robust Earnings Growth in 2023

Net Sales: Achieved a record $23.5 billion, a 12% increase from the previous year.

Net Income: Grew to $573 million for the full year, up from $328 million in 2022.

Adjusted Earnings Per Share: Increased by 38% to $12.02, reflecting higher earnings and share repurchase benefits.

Free Cash Flow: Improved to $638 million for the full year, compared to $383 million in 2022.

Share Repurchase: $313 million worth of shares repurchased in 2023, with $916 million authorization remaining.

2024 Outlook: Anticipates continued revenue, earnings, and cash flow growth.

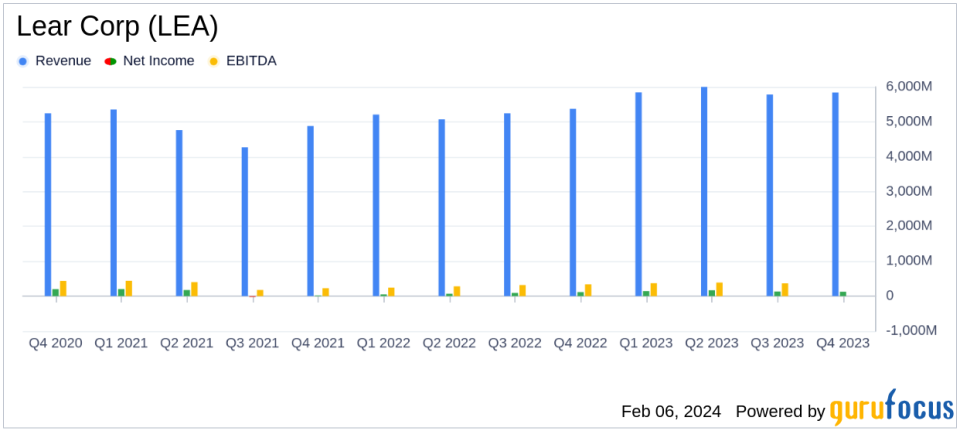

On February 6, 2024, Lear Corp (NYSE:LEA), a global leader in automotive seating and electrical systems, released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which serves every major automaker in the world, reported a 9% increase in fourth-quarter sales to $5.8 billion and a 12% jump in full-year sales to a record $23.5 billion, compared to the previous year.

Lear Corp's largest customer and regional market is GM and North America, accounting for 20% and 44% of 2022 revenue, respectively. The company's comprehensive product offerings include seating components, electrical distribution and connection systems, and electronic systems vital to the automotive industry.

The company's performance reflects a recovering automotive industry and the successful execution of its strategic initiatives, including the acquisition of IGB, which expanded its thermal comfort systems business. Lear's President and CEO, Ray Scott, expressed excitement over the strong customer response to their thermal comfort systems strategy, which is expected to increase market share and margins in the Seating segment.

Financial Highlights and Challenges

Lear Corp's net income for the fourth quarter was $127 million, with adjusted net income at $177 million, marking improvements from the previous year's figures. Core operating earnings also saw a 9% rise to $288 million. The company's earnings per share (EPS) increased to $2.18, and adjusted EPS climbed to $3.03, up from $1.97 and $2.81, respectively, in the fourth quarter of 2022.

For the full year, net income soared to $573 million, with adjusted net income reaching $710 million, compared to $328 million and $523 million, respectively, in 2022. The adjusted EPS surged by 38% to $12.02, reflecting the company's higher earnings and the benefit of its share repurchase program.

Despite these achievements, Lear Corp faces challenges such as higher launch costs and the impact of foreign exchange. Additionally, the company's sales backlog has been affected by launch delays and lower than expected volumes on certain electric vehicle programs.

2024 Outlook and Share Repurchase Program

Lear Corp's outlook for 2024 is optimistic, with expectations of another year of increased revenue, earnings, and cash flow. The company's share repurchase program remains robust, with $175 million worth of shares repurchased in the fourth quarter, the highest level since the fourth quarter of 2018. The remaining authorization stands at approximately $916 million, representing around 12% of the company's total market capitalization at current prices.

The company's 2024 financial outlook anticipates net sales between $24,000 million and $24,600 million, with core operating earnings projected to be between $1,155 million and $1,305 million. Lear Corp also expects adjusted EBITDA to range from $1,795 million to $1,945 million and forecasts free cash flow to be between $600 million and $750 million.

Lear Corp's financial achievements and strategic acquisitions position it well for continued growth in the automotive industry. The company's focus on innovation and operational excellence, along with its strong financial outlook, make it a noteworthy company for value investors and potential GuruFocus.com members seeking reliable and growth-oriented investment opportunities.

Explore the complete 8-K earnings release (here) from Lear Corp for further details.

This article first appeared on GuruFocus.