What You Can Learn From Comstock Holding Companies, Inc.'s (NASDAQ:CHCI) P/E

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

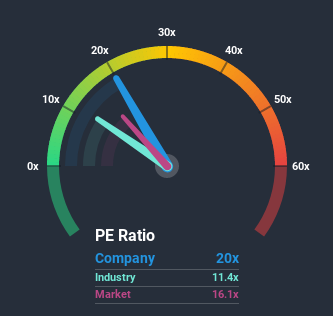

With a price-to-earnings (or "P/E") ratio of 20x Comstock Holding Companies, Inc. (NASDAQ:CHCI) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

For example, consider that Comstock Holding Companies' financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Comstock Holding Companies

Where Does Comstock Holding Companies' P/E Sit Within Its Industry?

An inspection of average P/E's throughout Comstock Holding Companies' industry may help to explain its high P/E ratio. You'll notice in the figure below that P/E ratios in the Consumer Durables industry are lower than the market. So it appears the company's ratio isn't currently influenced by these industry numbers whatsoever. Ordinarily, the majority of companies' P/E's would be compressed by the general conditions within the Consumer Durables industry. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

Although there are no analyst estimates available for Comstock Holding Companies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Comstock Holding Companies would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 12% shows it's a great look while it lasts.

In light of this, it's understandable that Comstock Holding Companies' P/E sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Comstock Holding Companies' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Comstock Holding Companies maintains its high P/E on the strength of its recentthree-year growth beating forecasts for a struggling market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Plus, you should also learn about these 5 warning signs we've spotted with Comstock Holding Companies.

Of course, you might also be able to find a better stock than Comstock Holding Companies. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.