Lee Ainslie's Q2 2023 13F Filing Update: Top Trades and Portfolio Overview

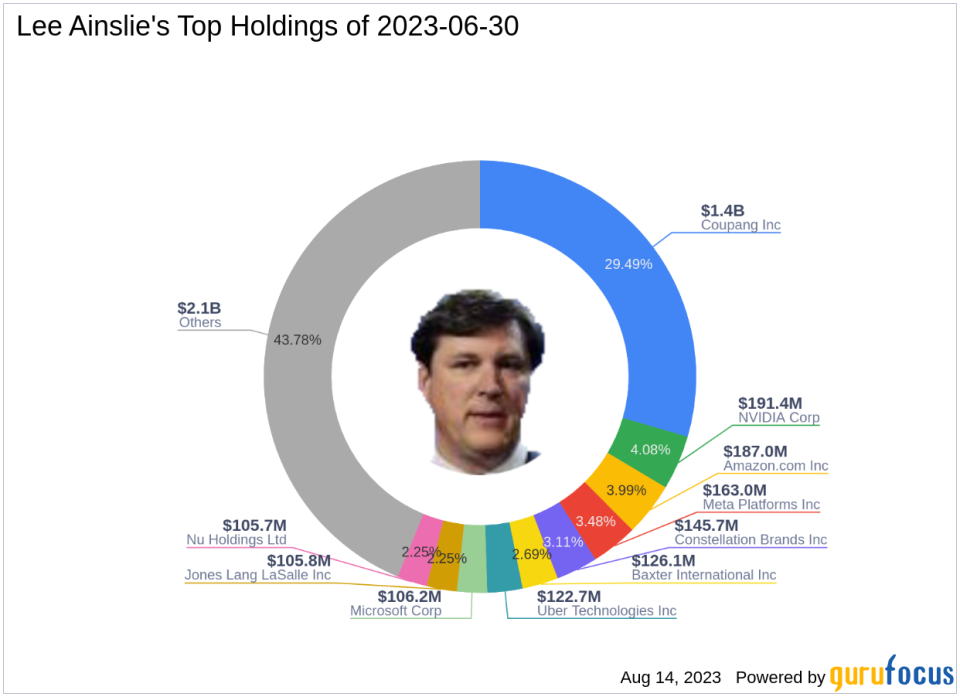

Renowned investment firm, Lee Ainslie, recently disclosed its portfolio updates for the second quarter of 2023, which ended on June 30, 2023. The firm's portfolio contained a total of 393 stocks, with an aggregate value of $4.69 billion. The top holdings for the quarter were CPNG (29.49%), NVDA (4.08%), and AMZN (3.99%).

Top Three Trades of the Quarter

The firm's top three trades for the quarter included new positions in Constellation Brands Inc (NYSE:STZ) and Baxter International Inc (NYSE:BAX), and a reduction in Salesforce Inc (NYSE:CRM).

Constellation Brands Inc (NYSE:STZ)

Lee Ainslie (Trades, Portfolio) established a new position in Constellation Brands Inc, purchasing 592,121 shares. This gave the stock a 3.11% weight in the equity portfolio. The shares were traded at an average price of $233.86 during the quarter. As of August 14, 2023, STZ's price was $267.65, with a market cap of $49.06 billion. The stock has returned 11.28% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, STZ has a price-book ratio of 5.71, a EV-to-Ebitda ratio of 66.98, and a price-sales ratio of 5.42.

Baxter International Inc (NYSE:BAX)

The firm also initiated a new position in Baxter International Inc, acquiring 2,767,081 shares. This gave the stock a 2.69% weight in the equity portfolio. The shares were traded at an average price of $43.5 during the quarter. As of August 14, 2023, BAX's price was $42.81, with a market cap of $21.68 billion. The stock has returned -27.41% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, BAX has a price-book ratio of 3.89, a EV-to-Ebitda ratio of -35.20, and a price-sales ratio of 1.46.

Salesforce Inc (NYSE:CRM)

Lee Ainslie (Trades, Portfolio) reduced their investment in Salesforce Inc by 449,030 shares, impacting the equity portfolio by 2.27%. During the quarter, the stock traded at an average price of $204.06. As of August 14, 2023, CRM's price was $212.06, with a market cap of $206.55 billion. The stock has returned 11.64% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, CRM has a price-earnings ratio of 558.05, a price-book ratio of 3.61, a price-earnings-to-growth (PEG) ratio of 20.82, a EV-to-Ebitda ratio of 28.52, and a price-sales ratio of 6.55.

These trades reflect the firm's investment strategy, which is grounded in a rigorous, fundamental bottom-up research process. The firm seeks to identify companies that are undervalued and have strong growth potential. The firm's portfolio updates provide valuable insights into its investment decisions and strategies.

This article first appeared on GuruFocus.