Leggett & Platt Inc (LEG) Faces Market Headwinds: A Dive into Q4 and Full Year 2023 Financials

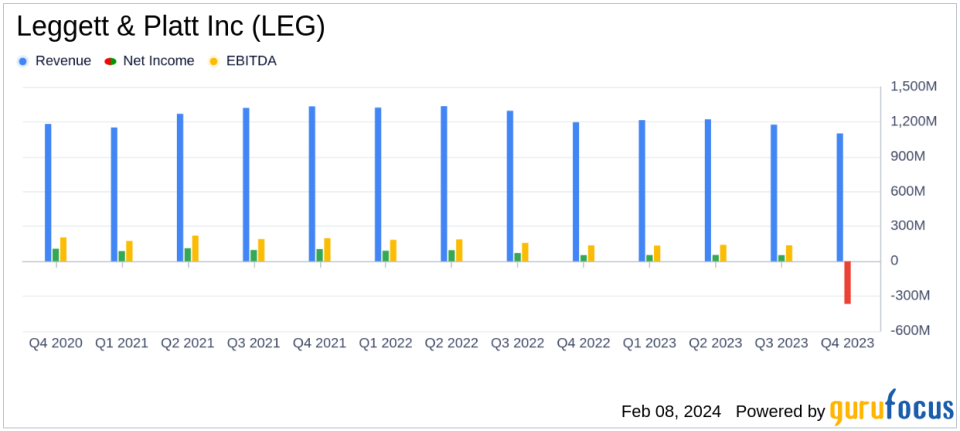

Revenue: Q4 sales dropped by 7% year-over-year to $1.1 billion; full-year sales saw an 8% decrease to $4.7 billion.

Net Income: Reported a Q4 net loss of $297.3 million and a full-year net loss of $136.8 million.

Earnings Per Share (EPS): Q4 adjusted EPS fell to $0.26, down from $0.39 in the prior year; full-year adjusted EPS decreased to $1.39 from $2.27.

Debt and Liquidity: Leggett & Platt maintains a focus on managing debt leverage and liquidity, with restructuring expected to impact financials in 2024 and 2025.

Dividend: Despite financial challenges, the company continues to manage its dividend track record.

Restructuring Plan: Announced on January 16, the plan primarily affects the Bedding Products segment, aiming to improve profitability and product portfolio alignment.

On February 8, 2024, Leggett & Platt Inc (NYSE:LEG) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a leading manufacturer of engineered components and products for homes and automobiles, reported a year of market challenges, particularly in its Bedding Products and Furniture, Flooring & Textile Products segments, which experienced weak market demand.

President and CEO Mitch Dolloff acknowledged the difficulties faced in 2023 and outlined a restructuring plan aimed at creating a more agile organization. The plan is expected to enhance product growth, profitability, and shareholder value. Despite the soft residential end market demand, the company's Specialized Products segment saw sustained demand strength.

Financial Performance Overview

Leggett & Platt's fourth quarter sales declined by 7% to $1.1 billion compared to the same quarter last year. The company reported a significant fourth quarter EBIT loss of $367 million, a stark contrast to the $91.2 million EBIT in the fourth quarter of 2022. Adjusted EBIT for the quarter was $66 million, down $25 million from the previous year. The loss per share for the fourth quarter was $2.18, a decrease from the earnings per share of $0.39 in the fourth quarter of 2022. Adjusted EPS for the quarter was $0.26, reflecting a decrease of $0.13.

For the full year, Leggett & Platt reported sales of $4.7 billion, an 8% decrease from 2022. The full-year EBIT was a loss of $90 million, down from the $485 million EBIT in 2022, with adjusted EBIT at $334 million, a decrease of $151 million. The full-year loss per share was $1.00, a significant drop from the $2.27 earnings per share in 2022. Adjusted EPS for the year was $1.39, down from $2.27.

Challenges and Restructuring Plan

The company's restructuring plan, announced on January 16, primarily impacts the Bedding Products segment. The financial impacts of this plan are expected to be felt in 2024 and 2025, with net cash received from real estate sales estimated between $60-$80 million and total costs projected to be between $65-$85 million. The plan aims to address the ongoing weak market demand and improve the company's operational efficiency.

Looking Ahead

Leggett & Platt's 2024 guidance reflects the anticipation of continued soft residential end market demand. The company remains focused on improving operating efficiency, driving cash flow, and executing its restructuring plan to navigate the near-term challenges and position itself for long-term success.

For more detailed information on Leggett & Platt's financial performance and the restructuring plan's expected financial impacts, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Leggett & Platt Inc for further details.

This article first appeared on GuruFocus.