Legion Partners Asset Management, LLC Reduces Stake in OneSpan Inc

Legion Partners Asset Management, LLC (Trades, Portfolio), a Beverly Hills-based investment firm, has recently made a significant transaction in its portfolio. The firm reduced its stake in OneSpan Inc (NASDAQ:OSPN), a leading provider of information technology security solutions. This article will delve into the details of the transaction, provide an overview of the guru and the traded company, and analyze the potential implications of this move.

Details of the Transaction

The transaction took place on August 14, 2023, with Legion Partners Asset Management, LLC (Trades, Portfolio) reducing its holdings in OneSpan Inc by 9,000 shares. This move resulted in a -0.26% change in the firm's portfolio, with the traded price at $10.735 per share. Following the transaction, the firm holds a total of 3,467,631 shares in OneSpan Inc, representing 10.95% of its portfolio and 8.70% of the company's total shares.

Profile of the Guru: Legion Partners Asset Management, LLC (Trades, Portfolio)

Legion Partners Asset Management, LLC (Trades, Portfolio) is a prominent investment firm located at 9401 Wilshire Blvd., Suite 705, Beverly Hills, CA. The firm currently holds 14 stocks in its portfolio, with a total equity of $340 million. Its top holdings include Nutanix Inc (NASDAQ:NTNX), OneSpan Inc (NASDAQ:OSPN), DigitalBridge Group Inc (NYSE:DBRG), Primo Water Corp (NYSE:PRMW), and Twilio Inc (NYSE:TWLO). The firm's investments are primarily concentrated in the Technology and Communication Services sectors.

Overview of OneSpan Inc

OneSpan Inc, listed under the symbol OSPN, is a US-based company specializing in information technology security solutions. The company, which went public on March 19, 1998, offers multifactor authentication and virtual private network access capabilities, primarily serving the banking and financial services sector. As of August 14, 2023, the company has a market capitalization of $457.358 million and a current stock price of $11.44. However, the company's PE percentage is currently at 0.00, indicating that it is operating at a loss.

Analysis of OneSpan Inc's Stock Performance

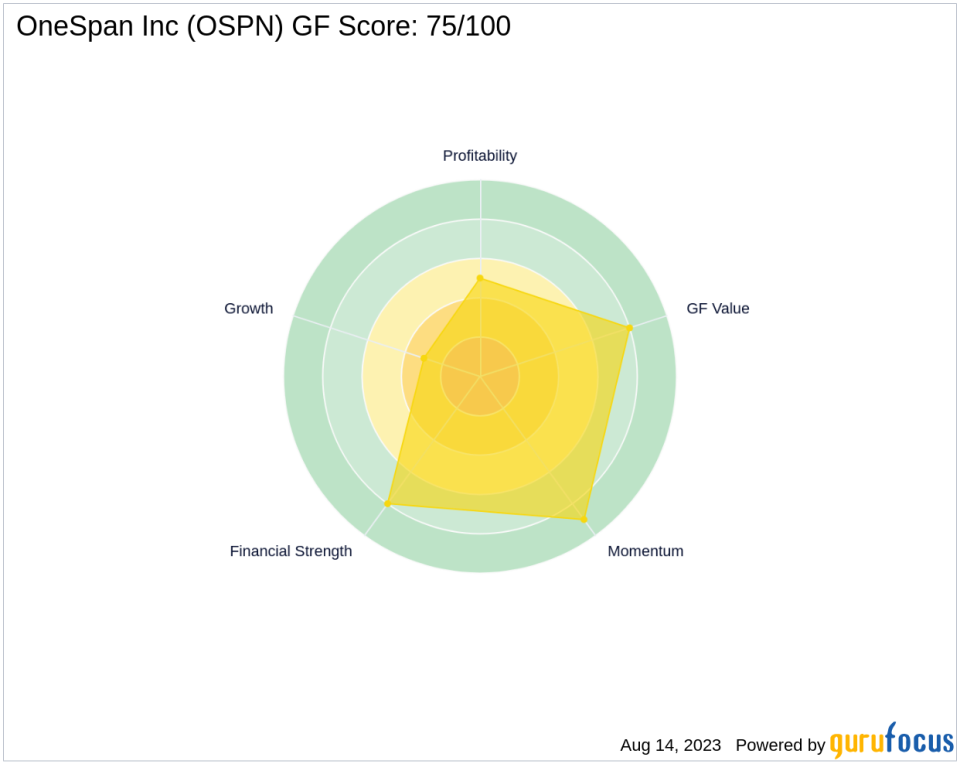

OneSpan Inc's stock performance shows a gain percent of 6.57 since the transaction. Since its IPO, the stock has seen a 108% increase. However, the year-to-date price change ratio stands at -1.38. The company's GF Score is 75/100, indicating a likely average performance in the future. The stock's GF Value is $17.24, with a price to GF Value ratio of 0.66, suggesting that the stock may be undervalued.

Evaluation of OneSpan Inc's Financial Health

OneSpan Inc's financial health, as indicated by its Financial Strength and Profitability Rank, stands at 8/10 and 5/10 respectively. The company's Growth Rank is 3/10, while its GF Value Rank and Momentum Rank are 8/10 and 9/10 respectively. The company's Piotroski F-Score is 3, and its Altman Z score is 3.42, indicating a moderate risk of financial distress. The company's cash to debt ratio is 14.99, ranking it 845th in the industry.

Examination of OneSpan Inc's Industry Performance

OneSpan Inc operates in the Software industry. The company's Return on Equity (ROE) and Return on Assets (ROA) are -18.41 and -11.65 respectively, ranking it 1887th and 1974th in the industry. The company's gross margin growth is -0.60, while its operating margin growth is 0.00. The company's 3-year revenue growth is -4.80, indicating a decline in revenue over the past three years.

Conclusion

In conclusion, Legion Partners Asset Management, LLC (Trades, Portfolio)'s recent transaction in OneSpan Inc reflects a strategic portfolio adjustment. Despite the company's current financial performance and industry standing, the firm's significant stake in OneSpan Inc suggests a long-term investment perspective. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.