Legion Partners Asset Management Reduces Stake in OneSpan Inc

Overview of Legion Partners' Recent Transaction

Legion Partners Asset Management, LLC (Trades, Portfolio) has recently adjusted its investment in OneSpan Inc (NASDAQ:OSPN), a notable player in the information technology security sector. On November 13, 2023, the firm reduced its holdings by 398,898 shares, resulting in an 11.50% decrease in its position. This transaction, executed at a price of $9.97 per share, has decreased the firm's total share count in OneSpan to 3,068,733, which now represents 7.70% of its portfolio, down from 9.05%.

Insight into Legion Partners Asset Management, LLC (Trades, Portfolio)

Legion Partners Asset Management, LLC (Trades, Portfolio), a firm with a keen focus on value investing, operates with a philosophy centered on long-term capital appreciation through active engagement and constructive dialogue with management teams. With an equity portfolio of $342 million, the firm's top holdings include Nutanix Inc (NASDAQ:NTNX), OneSpan Inc (NASDAQ:OSPN), and DigitalBridge Group Inc (NYSE:DBRG), primarily in the technology and communication services sectors.

OneSpan Inc at a Glance

OneSpan Inc, trading under the symbol OSPN, is a USA-based company that went public on March 19, 1998. The company specializes in digital agreements and security solutions, offering products that secure access to digital assets and protect transactions. With a significant presence in the EMEA region and the United States, OneSpan's offerings include multifactor authentication and anti-fraud solutions.

OneSpan Inc's Financial Overview

As of the latest data, OneSpan Inc boasts a market capitalization of $410.84 million, with a current stock price of $10.30. However, the company's PE percentage stands at 0.00, indicating it is not generating profits currently. The GF Value suggests a possible value trap, urging investors to think twice with a price to GF Value ratio of 0.67. Despite this, the stock has seen a gain of 3.31% since the transaction and an 87.27% increase since its IPO, although the year-to-date performance shows a decline of 11.21%.

Portfolio Impact of Legion Partners' Trade

The recent trade by Legion Partners Asset Management, LLC (Trades, Portfolio) has led to a notable reduction in its stake in OneSpan Inc. This move has decreased the firm's exposure to OSPN, which now constitutes a smaller portion of its overall portfolio. The significance of this transaction is underscored by the firm's investment strategy and the potential implications for its performance metrics.

Market Performance and Valuation of OneSpan Inc

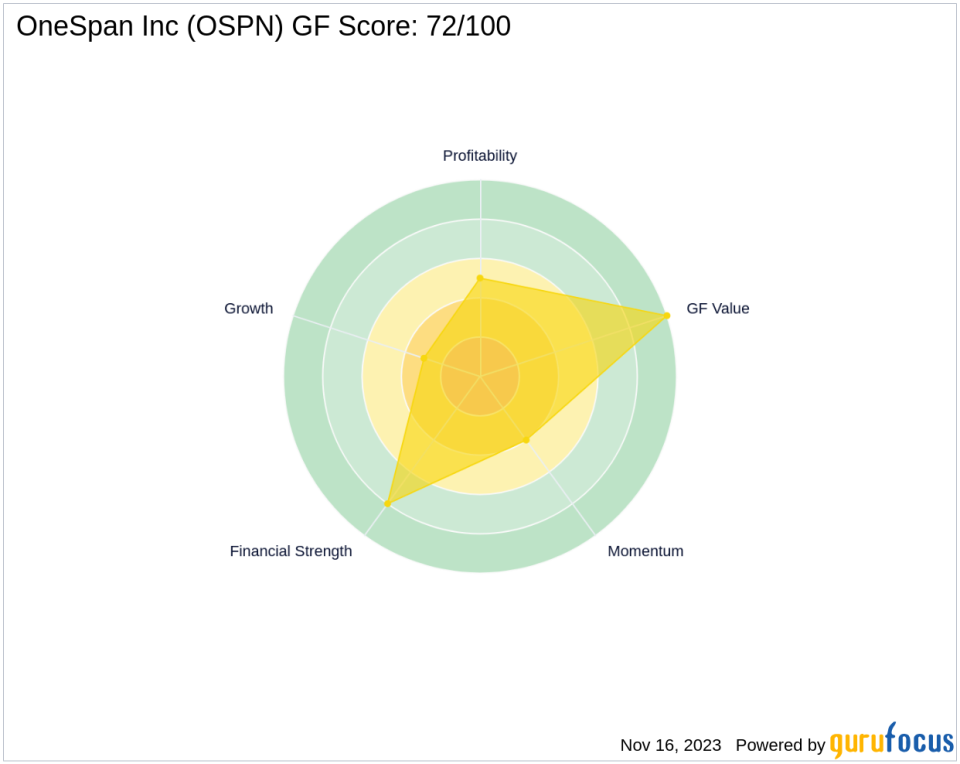

Since the trade date, OneSpan Inc's stock has shown resilience with a modest uptick in its market price. The company's GF Score of 72/100 indicates a likelihood of average performance, with strong points in its Financial Strength and GF Value Rank. However, the stock's Momentum Rank and Growth Rank suggest areas for potential improvement.

Assessing OneSpan Inc's Financial Health

OneSpan Inc's financial health is a mixed bag, with a strong Financial Strength rank of 8/10, bolstered by a cash to debt ratio of 12.94. However, the company's Profitability Rank is moderate at 5/10, and its Growth Rank is low at 3/10. The negative ROE and ROA further reflect challenges in profitability and asset utilization.

Conclusion

In summary, Legion Partners Asset Management, LLC (Trades, Portfolio)'s recent reduction in OneSpan Inc reflects a strategic portfolio adjustment. While OneSpan's market performance post-trade has been positive, the company's financial health indicators and valuation ranks present a nuanced picture for investors. The firm's decision to reduce its stake may have been influenced by these factors, and it will be important for investors to monitor how this transaction influences both OneSpan's trajectory and Legion Partners' portfolio performance moving forward.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.