Leidos Holdings Inc (LDOS) Reports Strong Revenue Growth Amidst Earnings Challenges

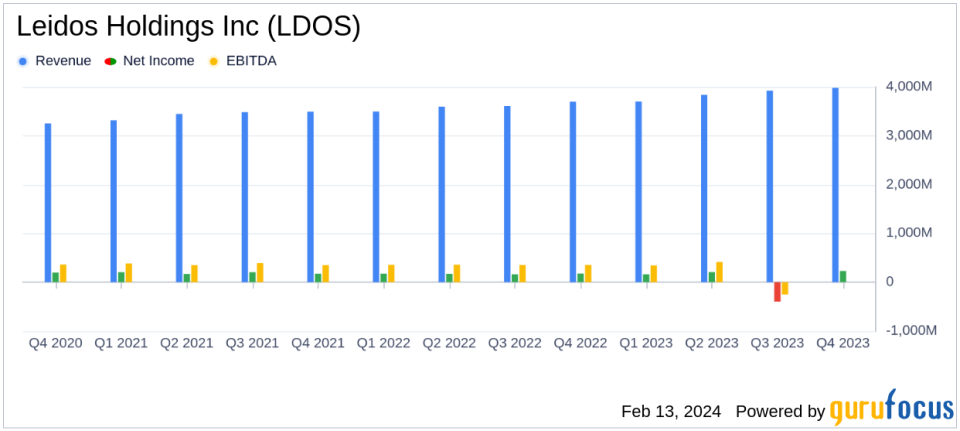

Revenue Growth: Q4 revenues increased by 8% year-over-year to $4.0 billion; FY 2023 revenues rose by 7% to $15.4 billion.

Earnings Per Share (EPS): Q4 diluted EPS up 30% to $1.66; FY 2023 diluted EPS down 71% to $1.44.

Non-GAAP EPS: Q4 non-GAAP diluted EPS increased by 9% to $1.99; FY 2023 non-GAAP diluted EPS up 11% to $7.30.

Cash Flows: Q4 net cash from operations was $304 million; FY 2023 net cash from operations totaled $1.2 billion.

Guidance: Initial FY 2024 guidance reflects consistent financial performance with 2021 Investor Day targets.

Net Income Margin: Q4 net income margin improved to 5.8%; FY 2023 net income margin decreased to 1.3%.

Bookings and Backlog: FY 2023 net bookings totaled $16.5 billion with a backlog of $37.0 billion, of which $8.8 billion was funded.

On February 13, 2024, Leidos Holdings Inc (NYSE:LDOS), a leader in technology, engineering, and science solutions, released its 8-K filing, detailing its financial performance for the fourth quarter and fiscal year 2023. The company, which serves a diverse range of government and civil customers, including the U.S. Department of Defense and the U.S. Intelligence Community, reported a revenue increase across all segments, particularly within the Health segment.

Financial Performance Overview

Leidos Holdings Inc (NYSE:LDOS) concluded the fiscal year with a revenue increase, driven by heightened demand across customer segments. The company's Q4 net income rose to $230 million, with a net income margin of 5.8%, reflecting an improvement from the previous year. Adjusted EBITDA for Q4 was $452 million, translating to an 11.4% margin. However, the full-year picture was less rosy, with net income and diluted EPS experiencing significant declines due to pre-tax impairment and restructuring charges, primarily associated with the Security Enterprise Solutions (SES) reporting unit.

The company's cash flow remained robust, with Q4 net cash from operations at $304 million and free cash flow at $226 million. For the full year, net cash provided by operations was $1.17 billion, and free cash flow was $958 million. Leidos' disciplined approach to working capital management and cost controls contributed to these results.

Segment Performance and Challenges

Leidos' Defense Solutions segment reported revenue growth due to digital modernization efforts and increased task order volume. The Civil segment saw growth from infrastructure spending by the FAA, while the Health segment benefited from higher levels of medical examinations and growth on the SSA ITSSC II contract.

Despite these achievements, the company faced challenges, including a net income margin decrease for the year, primarily due to the aforementioned impairment and restructuring charges. This decline underscores the importance of monitoring segment-specific risks and the potential impact of restructuring on profitability.

Looking Ahead

Leidos provided FY 2024 guidance, anticipating revenues between $15.7 and $16.1 billion, with an adjusted EBITDA margin in the mid-to-high 10% range and non-GAAP diluted EPS between $7.50 and $7.90. The company expects to generate approximately $1.1 billion in cash flows from operations, considering the impact of cash tax payments related to the capitalization and amortization of R&D costs.

CEO Tom Bell expressed confidence in the company's trajectory, citing a "promises made, promises kept" culture and a leaner organizational structure poised for a second decade of growth.

With a strong finish to the year, Leidos delivered on all of its financial commitments. Record top- and bottom-line performance enabled us to exceed the high end of the guidance ranges that we set last quarter for all metrics. Our financial performance over the last three quarters demonstrates how strongly the team has enhanced its focus on cost controls and cash generation and committed to a promises made, promises kept culture. 2024 is going to be another busy and exciting year for Leidos, as we capitalize on our leaner, more focused organizational structure and chart our path to our second decade of growth."

Investors and analysts can expect Leidos to continue leveraging its market position and operational efficiencies to navigate the dynamic defense, intelligence, and health markets. The company's commitment to innovation and customer service, combined with prudent financial management, positions it to meet its FY 2024 targets and beyond.

For a more detailed analysis of Leidos Holdings Inc (NYSE:LDOS)'s financial results and forward-looking guidance, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Leidos Holdings Inc for further details.

This article first appeared on GuruFocus.