Leidos Holdings' (LDOS) Q2 Earnings Beat, 2019 EPS View Up

Leidos Holdings, Inc.’s LDOS second-quarter 2019 adjusted earnings of $1.16 per share surpassed the Zacks Consensus Estimate of $1.10 by 5.5%. The bottom line also increased 3.6% from $1.12 registered a year ago. This uptick can be attributed to solid revenues and operating income growth.

However, the company’s GAAP earnings of 93 cents per share slipped from the year-ago figure of 94 cents.

Total Revenues

Leidos Holdings generated total revenues of $2,728 million in the quarter under consideration, which exceeded the Zacks Consensus Estimate of $2,637 million by 3.5%. The top line also improved 7.9% year over year backed by growth across all its segments.

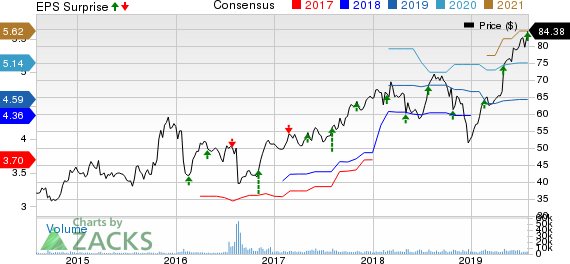

Leidos Holdings, Inc. Price, Consensus and EPS Surprise

Leidos Holdings, Inc. price-consensus-eps-surprise-chart | Leidos Holdings, Inc. Quote

Backlog

At the end of the reported quarter, the company’s total backlog was $21.7 billion compared with $21.5 billion at the end of the first quarter. Of this total backlog, $6.3 billion was funded.

Operational Statistics

Total cost of revenues in the second quarter increased by 9.1% to $2,348 million. Operating income totaled $210 million compared with $199 million in the year-ago period. This upside was driven by decrease in integration and restructuring costs.

As a result, the operating margin contracted to 7.7% from 7.9% in the year-ago quarter.

Interest expenses summed $33 million compared with $35 million in the prior-year quarter.

Segmental Performance

Defense Solutions: Net revenues at this segment increased 6.7% to $1,346 million from the prior-year figure of $1,262 million. This improvement can be primarily attributed to new awards that the segment received in the quarter under review.

Also, the segment’s operating income rose 7.4% to $101 million from the year-ago income of $94 million, with the operating margin having expanded 10 basis points (bps) to 7.5%.

Health: The segment recorded revenues of $501 million in the second quarter, up 11.1% year over year. The uptick was primarily driven by a net increase in program volumes and new awards.

However, operating income declined 10.3% to $61 million, while operating margin contracted 290 bps to 12.2%.

Civil: Revenues at this segment amounted to $881 million, up 8% year over year. New awards and a net increase in program volumes lead to the upside.

While operating income rose 13.3% to $68 million, operating margin expanded 30 bps to 7.7%.

Financials

Cash and cash equivalents as of Jun 28, 2019, were $660 million compared with $327 million as of Dec 28, 2018. Net cash provided by operating activities at the end of second-quarter 2019 amounted to $186 million compared with $271 million a year ago.

2019 Guidance

Leidos Holdings has partially raised its outlook for 2019. The company currently expects its adjusted earnings to be in the $4.50-$4.75 range, up from $4.30-$4.65 anticipated earlier. The Zacks Consensus Estimates for 2019 earnings is pegged at $4.60, below the mid-point of the company’s projected view.

Moreover, the company expects 2019 revenues in the range of $10.65-$10.95 billion compared with the earlier band of $10.5-$10.9 billion. The Zacks Consensus Estimates for revenues stands at $10.73 billion, below the mid-point of the company guided range.

However, the company’s cash flow from operating activities is still anticipated to be around $825 million at 2019 end.

Zacks Rank

Leidos Holdings carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Textron Inc. TXT reported second-quarter 2019 earnings from continuing operations of 93 cents per share, which surpassed the Zacks Consensus Estimate of 85 cents by 9.4%.

Lockheed Martin Corp. LMT reported second-quarter 2019 earnings of $5 per share, which surpassed the Zacks Consensus Estimate of $4.74 by 5.5%.

Hexcel Corporation HXL reported second-quarter 2019 earnings of 94 cents per share, which surpassed the Zacks Consensus Estimate of 88 cents by 6.8%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research