LeMaitre Vascular Inc (LMAT) Reports Robust Q4 2023 Results with Significant Sales and Net ...

Sales: Reported a 19% increase to $48.9 million in Q4 2023 compared to Q4 2022, with organic growth of 14%.

Gross Margin: Improved significantly by 450 basis points to 68.1% in Q4 2023.

Operating Income: Grew by 46% to $10.2 million, with an operating margin of 21%.

Net Income: Increased by 50% to $8.5 million, with earnings per diluted share up by 49% to $0.38.

Dividend: Announced a quarterly dividend of $0.16 per share, payable on March 28, 2024.

Share Repurchase: Authorized a repurchase program of up to $50 million of the companys common stock.

Guidance: Provided Q1 2024 and full-year 2024 guidance, projecting continued growth in sales, gross margin, and EPS.

On February 27, 2024, LeMaitre Vascular Inc (NASDAQ:LMAT) released its 8-K filing, detailing a strong finish to the year with impressive fourth-quarter results. The company, a leading manufacturer and distributor of medical devices for the treatment of peripheral vascular disease, has demonstrated robust growth and financial health in its latest earnings report.

Financial Highlights and Business Performance

LeMaitre Vascular Inc's Q4 2023 sales surged to $48.9 million, marking a 19% increase compared to the same period in the previous year, with organic growth contributing 14%. This sales growth was driven by strong performance across several product lines, including bovine patches, allografts, valvulotomes, and carotid shunts. Geographically, sales in EMEA grew by 21%, the Americas by 20%, and APAC by 11%.

The company's gross margin saw a significant increase to 68.1% in Q4, up from 63.6% in Q4 2022, primarily due to average selling price increases and manufacturing efficiencies. Operating income followed suit, rising by 46% to $10.2 million, with an operating margin reaching 21%. Net income also saw a substantial increase of 50%, resulting in $8.5 million, and earnings per diluted share grew by 49% to $0.38.

Strategic Financial Moves

LeMaitre Vascular Inc's Chairman and CEO, George LeMaitre, commented on the financial results, stating:

Our 19% sales growth and gross margin recovery produced 46% op. income growth in Q4. Full year 2024 guidance implies an operating margin of 21%, up from 19% in 2023.

Alongside the earnings report, LMAT announced a quarterly dividend of $0.16 per share, demonstrating the company's commitment to returning value to shareholders. Additionally, the Board of Directors authorized a share repurchase program of up to $50 million, further underscoring confidence in the company's financial stability and future prospects.

Looking Ahead: 2024 Guidance

Looking forward, LeMaitre Vascular Inc provided guidance for Q1 2024 with sales expected to be between $50.5 million and $52.9 million, and full-year 2024 sales projected to be between $209.7 million and $214.3 million. The company anticipates a gross margin of approximately 68% for Q1 and slightly lower for the full year at 68.0%. Operating income and EPS are also expected to see significant growth in the upcoming year.

LeMaitre Vascular Inc's financial achievements are particularly noteworthy within the Medical Devices & Instruments industry, where innovation, efficiency, and market expansion are critical for success. The company's ability to improve gross margins while expanding sales is indicative of strong operational management and a competitive product portfolio.

Financial Statements and Non-GAAP Measures

The company's balance sheet remains solid, with cash and cash equivalents increasing to $105.1 million. The detailed financial statements also show a healthy uptick in assets and retained earnings, reflecting the company's profitable operations and sound financial planning.

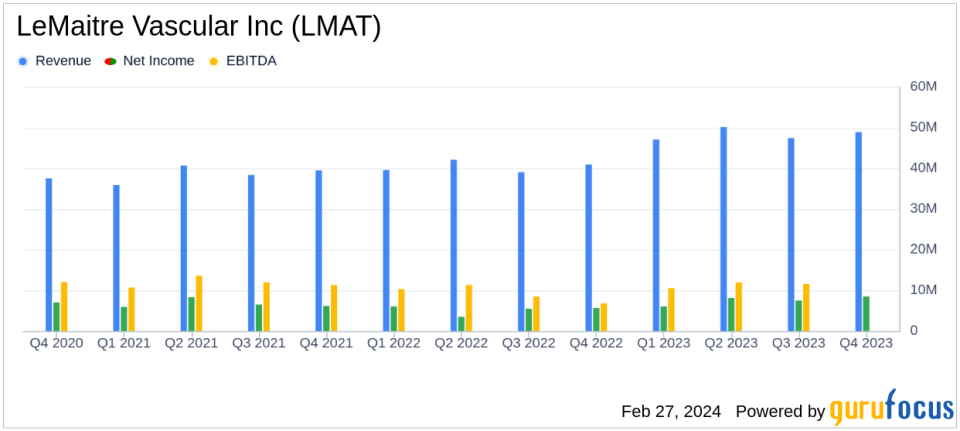

LeMaitre Vascular Inc also provided non-GAAP financial measures, which management believes offer investors a supplemental understanding of the company's financial trends. These measures, which include EBITDA and non-GAAP sales growth percentages, are reconciled with GAAP measures in the attached financial statement tables.

For value investors and potential GuruFocus.com members, LeMaitre Vascular Inc's latest earnings report represents a company with strong financial performance, strategic shareholder initiatives, and positive forward-looking guidance. The company's focus on manufacturing efficiencies, product innovation, and market expansion continues to yield favorable results, positioning LMAT as an attractive investment opportunity within its sector.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and tune into the company's conference call, which will provide further insights into LeMaitre Vascular Inc's financial health and strategic direction.

Explore the complete 8-K earnings release (here) from LeMaitre Vascular Inc for further details.

This article first appeared on GuruFocus.