LeMaitre Vascular Inc: A Strong Contender in the Medical Devices Industry with a GF Score of 84

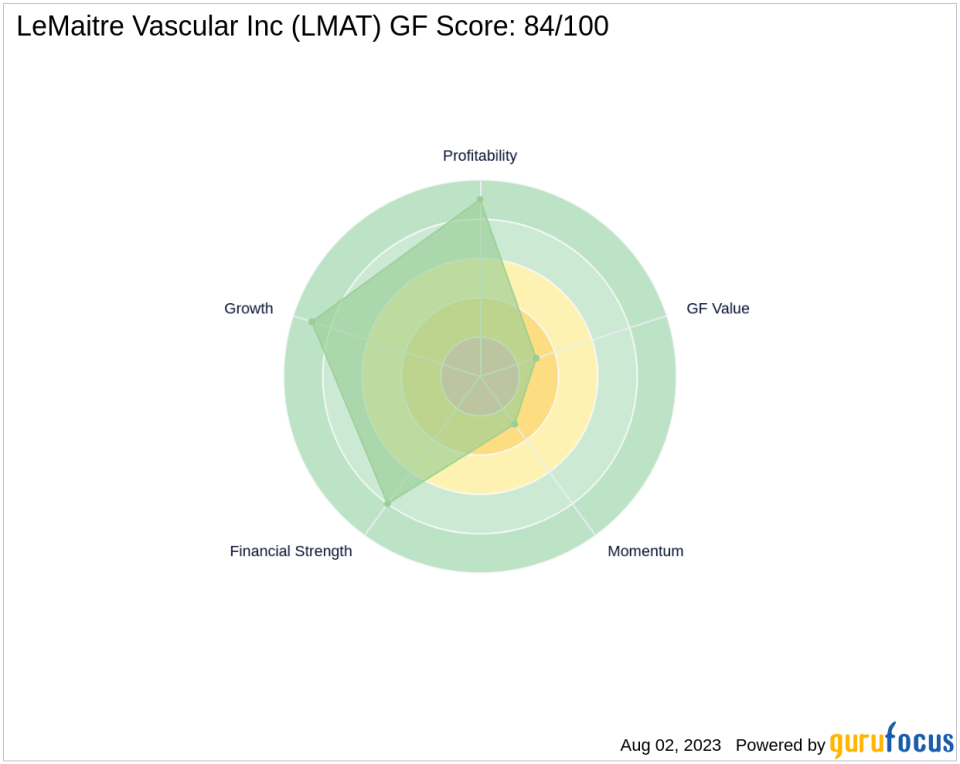

LeMaitre Vascular Inc (NASDAQ:LMAT), a leading player in the Medical Devices & Instruments industry, is currently trading at $65.1 per share. With a market capitalization of $1.44 billion, the company's stock has seen a gain of 3.63% today, despite a slight dip of -3.64% over the past four weeks. The company's GF Score stands at an impressive 84 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which takes into account five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis

LeMaitre Vascular Inc boasts a Financial Strength rank of 8/10. This score is a reflection of the company's robust financial situation, taking into account factors such as its interest coverage and debt to revenue ratio. The company's debt to revenue ratio is a mere 0.10, indicating a low debt burden. Furthermore, its Altman Z-Score, a measure of financial distress, stands at a healthy 22.33.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its strong profitability. This score is based on factors such as its Operating Margin of 17.84%, a Piotroski F-Score of 4 out of 9, and a consistent profitability record over the past 10 years based on a Business Predictability Rank of 3.5 stars out of 5. The company's operating margin has also seen a positive trend with a 5-year average increase of 0.40%.

Growth Rank Analysis

LeMaitre Vascular Inc's Growth Rank is 9/10, indicating strong growth in terms of revenue and profitability. The company has demonstrated a 5-year revenue growth rate of 8.70%, a 3-year revenue growth rate of 8.10%, and a 5-year EBITDA growth rate of 7.90%.

GF Value Rank Analysis

The company's GF Value Rank is 3/10, which is determined by the price-to-GF-Value ratio. This score suggests that the company's stock may be overvalued, and investors should exercise caution.

Momentum Rank Analysis

LeMaitre Vascular Inc's Momentum Rank is 3/10, indicating that the company's stock price performance does not have a strong momentum at present.

Competitor Analysis

When compared to its competitors in the same industry, LeMaitre Vascular Inc holds a strong position. Embecta Corp (NASDAQ:EMBC) has a GF Score of 25, Warby Parker Inc (NYSE:WRBY) has a GF Score of 19, and Atrion Corp (NASDAQ:ATRI) has a GF Score of 88. This comparison can be found on the competitors page.

Conclusion

In conclusion, LeMaitre Vascular Inc's overall GF Score of 84 suggests good outperformance potential. The company's strong financial strength, high profitability, and robust growth make it an attractive investment option. However, its lower GF Value Rank and Momentum Rank indicate that investors should exercise caution. As always, potential investors are advised to conduct their own comprehensive research before making investment decisions.

This article first appeared on GuruFocus.