Lending Tree (TREE) Q2 Earnings Beat, Stock Dips on Revenue Fall

Lending Tree, Inc. TREE reported an adjusted net income per share of $1.14 in the second quarter of 2023, up 97% year over year. The Zacks Consensus Estimate was pegged at 31 cents.

The stock lost 25.2% following the release of the results, reflecting a bearish reaction by investors on the year-over-year decline in revenues. Moreover, management reduced the guidance for 2023.

LendingTree reported a net loss of $1 million compared with a loss of $8 million in the year-ago quarter.

Revenues & Variable Marketing Margin Decline

Total revenues were down 30% year over year to $182.5 million in the second quarter. The downside stemmed from a decline in the Home, Consumer and Insurance segments' revenues. Also, the reported figure missed the Zacks Consensus Estimate of $194 million.

The total cost of revenues was $9.3 million, down 36.2% from the prior-year quarter.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) totaled $26.7 million, down 7% year over year. The variable marketing margin was at $76.5 million, down 16%.

As of Jun 30, 2023, cash and cash equivalents were $162.4 million compared with $298.8 million as of 2022 end. Long-term debt was $625.2 million compared with $813.5 million as of 2022 end.

Outlook

For the third quarter of 2023, total revenues are estimated between $155 million and $170 million. Adjusted EBITDA and the variable marketing margin are anticipated to be $17-$22 million and $65-$75 million, respectively.

For 2023, total revenues are estimated between $680 million and $700 million. Adjusted EBITDA is anticipated to be $70-$80 million. The variable marketing margin is expected between $275 million and $290 million.

Conclusion

The company’s total revenues were affected mainly by the decline in Home and Consumer segment revenues. Nonetheless, TREE has been focused on expense management. Customer demand for new loans and insurance is another positive.

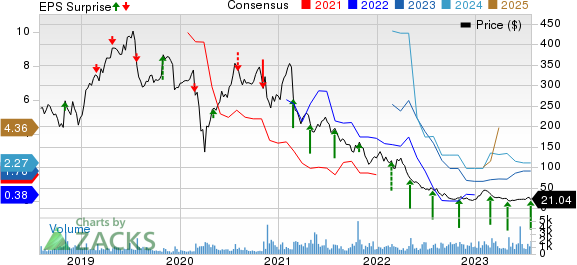

LendingTree, Inc. Price, Consensus and EPS Surprise

LendingTree, Inc. price-consensus-eps-surprise-chart | LendingTree, Inc. Quote

Currently, LendingTree carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Evercore’s EVR second-quarter 2023 adjusted earnings per share of 96 cents missed the Zacks Consensus Estimate of $1.37. Also, the bottom line was down from the prior-year quarter’s $2.46.

A decline in net revenues of Investment Banking & Equities hampered EVR’s overall top line. Nonetheless, lower expenses alleviated the bottom-line pressure. Further, despite a challenging operating environment, EVR saw a rise in assets under management.

Sallie Mae SLM, formally known as SLM Corporation, reported second-quarter 2023 earnings per share of $1.10, missing the Zacks Consensus Estimate of $1.14. The bottom line compared unfavorably with the prior-year quarter’s earnings of $1.29.

A rise in non-interest expenses and lower non-interest income impeded SLM’s results. Nonetheless, lower provisions for credit losses, an increase in the net interest income and robust loan originations were positives.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

Evercore Inc (EVR) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report