LendingClub Corp (LC) Reports Q4 and Full Year 2023 Earnings: Sustains Profitability Amid ...

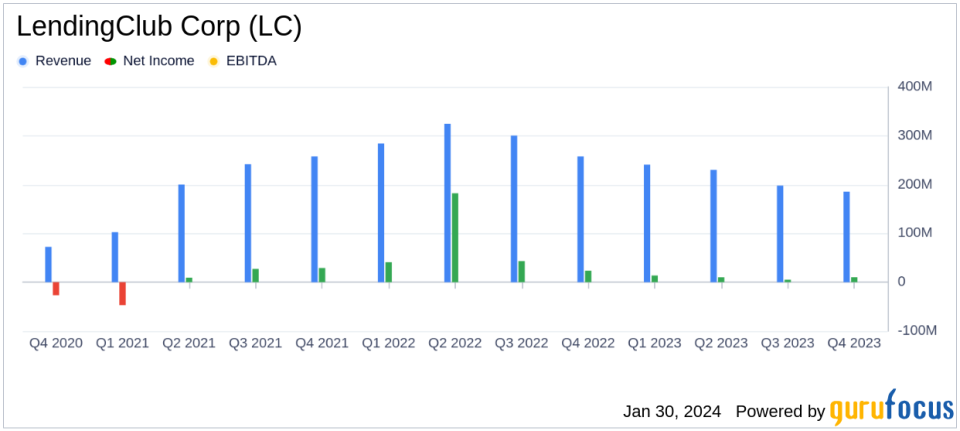

Net Revenue: Q4 total net revenue reached $185.6 million, a decrease from Q3's $200.8 million.

Net Income: Reported a net income of $10.2 million in Q4, with diluted EPS of $0.09.

Loan Originations: Total loan originations increased to $1.6 billion, up from $1.5 billion in Q3.

Balance Sheet Strength: Ended the year with $8.8 billion in total assets and a strong capital position.

Efficiency Ratio: Q4 efficiency ratio worsened to 70.0% from 63.7% in Q3.

Provision for Credit Losses: Decreased to $41.9 million in Q4 from $64.5 million in Q3.

Deposits Growth: Deposits grew to $7.3 billion, with FDIC-insured deposits making up approximately 87% of the total.

LendingClub Corp (NYSE:LC) released its 8-K filing on January 30, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading online lending marketplace platform, reported a dip in net revenue to $185.6 million for Q4 compared to $200.8 million in the previous quarter. However, net income saw an improvement, rising to $10.2 million, or $0.09 per diluted share, from $5.0 million, or $0.05 per diluted share, in Q3.

LendingClub's CEO, Scott Sanborn, highlighted the company's resilience and profitability in a challenging macroeconomic environment. The company's strategic initiatives, including the sale of $1 billion in structured certificates and a focus on a multi-product mobile-first experience, have positioned it to capitalize on a significant refinancing opportunity and drive long-term shareholder value.

Financial Highlights and Performance Analysis

The company's balance sheet showed growth in total assets to $8.8 billion, up from $8.5 billion in the prior quarter, primarily due to growth in securities related to the structured certificate program. Deposits also increased to $7.3 billion, driven by an uptick in customer certificates of deposit. The loan originations rose to $1.6 billion, attributed to increased purchases by loan investors, with marketplace originations growing by 21% compared to the prior quarter.

Despite the positive aspects of the report, the efficiency ratio worsened to 70.0% from 63.7% in the previous quarter, indicating higher costs relative to revenue. The provision for credit losses decreased to $41.9 million from $64.5 million in Q3, reflecting lower volume of retained loans and lower incremental provision on older vintages.

The company's strong capital position is evident with a consolidated Tier 1 leverage ratio of 12.9% and a consolidated Common Equity Tier 1 capital ratio of 17.9%. The tangible book value per common share increased to $10.54 from $10.21 in the prior quarter.

"Thanks to our differentiated business model, strong execution, data advantage, and ongoing innovation, we have remained one of the few fintechs to sustain GAAP profitability throughout this turbulent macro environment, which positions us well for future acceleration," said Scott Sanborn, LendingClub CEO.

LendingClub's performance in Q4 and the full year of 2023 demonstrates its ability to navigate economic headwinds while maintaining a solid financial foundation. The company's focus on innovation and expansion into new product offerings is expected to continue driving growth and profitability in the future.

For investors and potential members of GuruFocus.com, LendingClub's latest earnings report reflects a company that is managing to grow and remain profitable in a challenging environment, making it a potentially attractive option for value investors interested in the credit services industry.

For a detailed analysis of LendingClub Corp's financial results, including income statements and balance sheets, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from LendingClub Corp for further details.

This article first appeared on GuruFocus.