Is LendingClub About to Turn a Corner?

- By Nicholas Kitonyi

Shares of San Francisco-based peer-to-peer lending company LendingClub Corp. (LC) have struggled to maintain a steady rally due to inconsistencies in the company's bottom line. The dust finally appears to be settling, however, with the company's stock gaining about 24% since December.

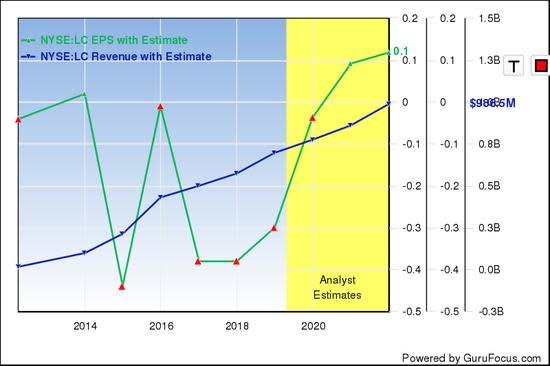

But more telling is the company's bottom line, which after experiencing turbulence over the last several years, now appears to be steadying for consistent growth. LendingClub's revenue and net income are expected to grow steadily for at least the next two years.

Warning! GuruFocus has detected 2 Warning Signs with LC. Click here to check it out.

The intrinsic value of LC

Based on the current revenue and earnings per share estimates, LendingClub is expected to break even next year. Its top line will just miss the $1 billion mark a year later. The expected growth could trigger a major movement in the stock price.

As the first peer-to-peer lending company to go public, LendingClub is what investors look to whenever they want to gain exposure to this disruptive segment of the credit market.

The company has created a platform that connects lenders with borrowers in a leveraged risk model, whereby borrowers who meet certain criteria apply for loans on the online platform, then investors browse through to select which loans to invest in, thereby creating a loan portfolio.

This form of lending has become very popular since the start of the decade due to the improved rates offered to lenders compared to returns on a savings account. On the other hand, the borrowers get loans at competitive rates depending on their credit scores and history on the platform.

Small and medium-sized businesses have embraced this alternative method of financing and, along with individual customers, continue to drive growth in the industry.

One of the main reasons why people choose LendingClub is the speed of loan processing after applying. The flexibility to issue loans to borrowers with lower credit scores also appeals to those whose profiles do not attract mainstream lenders. As such, LendingClub's addressable market is large.

The company faces competition, though, from privately owned peer-to-peer lending platforms like Upstart, which provide same day pay out loans to people looking for emergency funding. This could create bottlenecks for LendingClub's growth prospects.

Nonetheless, LendingClub's reputation and the requirements set for public companies could give it the edge it needs to thrive through the brewing chaos of alternative lending platforms.

The company's price-book ratio of 1.56 could also appeal to investors.

LendingClub has not been profitable for several years. Losses have oscillated from as high as 44 cents per share to as low as 1 cent, but given the projections for the next two years, the company is expected to break even and report earnings of 9 cents per share at the end of 2021.

Last week, the company announced a partnership with Opportunity Fund, the leading nonprofit small business lender in the U.S., and Funding Circle, the country's leading small business loan platform. The deal seeks to harmonize the alternative lending market for small business owners by improving access and transparency.

The deal also keeps the company in a good position to capitalize on the rapidly growing peer-to-peer lending market. Analysts forecast this market will grow at a compound annual rate of 51.5% through 2022.

This illustrates the depth of the opportunity LendingClub could seize in its quest for growth in the foreseeable future.

After several years of turbulence, LendingClub appears to have weathered the storm with some steady growth expected over the next several years. More people and small businesses are now embracing peer-to-peer lending and the business model is clear to investors. Companies like LendingClub will benefit as they position themselves to capitalize on the expected growth.

Disclosure: I have no positions in the stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with LC. Click here to check it out.

The intrinsic value of LC