LendingTree Inc (TREE) Posts Solid Q4 Earnings Amid Economic Headwinds

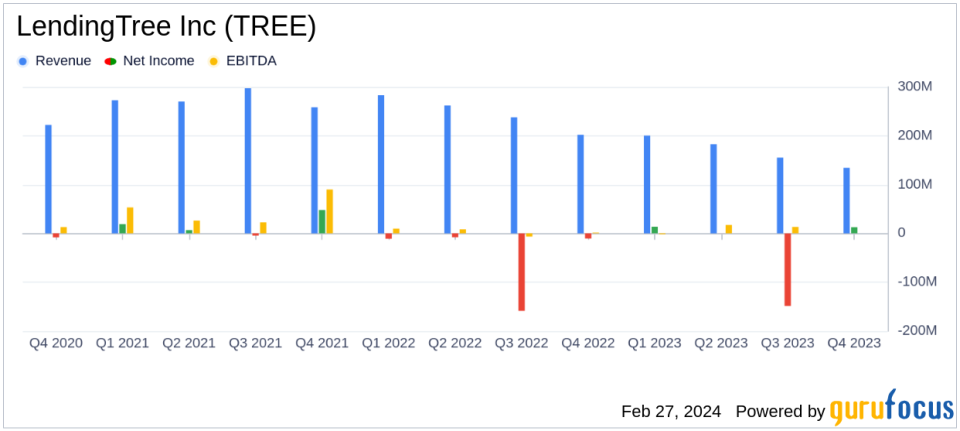

Revenue: Q4 consolidated revenue reached $134.4 million, a 33% decrease year-over-year.

Net Income: GAAP net income was $12.7 million, or $0.98 per diluted share, marking a 222% increase from the prior year.

Adjusted EBITDA: Adjusted EBITDA stood at $15.5 million, a slight 7% decrease year-over-year.

Free Cash Flow: The company generated $55 million in free cash flow for the year.

Segment Performance: Home segment revenue saw a 48% decrease, while the Insurance segment's revenue declined by 11%.

Financial Outlook: For 2024, revenue is projected to be $650 - $690 million, with Adjusted EBITDA expected to increase by 8% to 21%.

LendingTree Inc (NASDAQ:TREE) released its 8-K filing on February 27, 2024, detailing the financial results for the fourth quarter ended December 31, 2023. The company, a leading online loan marketplace in the United States, reported a consolidated revenue of $134.4 million, a 33% decrease from the same quarter in the previous year. Despite the revenue decline, LendingTree achieved a GAAP net income of $12.7 million, or $0.98 per diluted share, which is a significant improvement over the prior year's loss.

LendingTree's business model, which provides consumers with direct access to a broad range of lenders, faced challenges due to higher interest rates and persistent inflation. However, the company's resilience is evident in its solid results, with a variable marketing margin of $60.6 million and an adjusted EBITDA of $15.5 million. The adjusted net income per share was reported at $0.28.

Segment Analysis and Market Adaptation

The Home segment experienced a significant revenue decline of 48% year-over-year, with mortgage revenue falling by 59%. The Consumer segment also saw a 43% decrease in revenue, with credit card and personal loans revenue declining by 57% and 24%, respectively. However, the Insurance segment showed signs of recovery with only an 11% decrease in revenue and a marginal 2% decrease in segment profit.

Chairman and CEO Doug Lebda emphasized the company's durability in adverse economic conditions and highlighted the steps taken to simplify operations, reduce costs, and improve technology and data infrastructure. President and COO Scott Peyree expressed optimism about returning to growth, particularly in the Insurance segment, and stability in the lending businesses.

Financial Strength and Outlook

CFO Trent Ziegler noted the generation of $78.5 million in AEBITDA and $55 million in free cash flow for the year, despite external challenges. The company also repurchased $100 million of its 2025 convertible notes at a discount and maintained $112 million in cash on the balance sheet. The outlook for 2024 is cautiously optimistic, with revenue expected to be between $650 and $690 million and adjusted EBITDA projected to increase by 8% to 21%.

"Our company continues to prove durable to adverse economic conditions, as we generated another quarter of solid results despite ongoing pressure from higher interest rates and persistent inflation," said Doug Lebda, Chairman and CEO.

LendingTree's performance in the fourth quarter of 2023 demonstrates the company's ability to navigate economic headwinds and adapt to market conditions. The company's strategic actions and the anticipated recovery in the Insurance segment position it for potential growth in the coming year. Value investors may find LendingTree's resilience and proactive management approach appealing as the company continues to leverage its online marketplace platform in the diversified financial services industry.

For more detailed information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from LendingTree Inc for further details.

This article first appeared on GuruFocus.